Together with…

Introduction

Collateralized loan obligations (CLOs) are securities backed by a pool of loans.

These structured financial instruments, often viewed with both fascination and scepticism, have become particularly attractive to institutional investors.

If you want to know more about the general structure and the functioning of CLOs, please refer to the previous articles.

This article aims to shed light on the innovations, the challenges, and the prospects that this financial instrument has faced in the past and is likely to face in the near, economically uncertain, future.

History: from deregulation to the pre-crisis years

CLOs first developed in the early 1990s as a consequence of the wave of deregulation in financial markets, driven by a belief that reducing regulatory constraints would foster innovation, competition, and economic growth. This deregulation touched various sectors of the financial industry, including banking and securities markets.

One of the most transformative outcomes of financial deregulation was the rise of securitization, which involves bundling illiquid financial assets, such as loans, into liquid and tradable securities, which can then be sold to investors. One type of such new products were CLOs, conceived as a way to package and sell pools of corporate senior secured loans to investors. They were designed to provide diversification and risk mitigation benefits. Indeed, by buying a CLO an investor would gain exposure to a wide range of professionally managed portfolios of senior secured loans.

In the early 2000s, there was a significant expansion of the CLO market. As banks were able to reduce risks by pooling together senior secured loans of diverse credit quality, they began to lend money and then transferred the credit risk associated with lending money to suboptimal borrowers via the use of asset-backed securities such as CLOs.

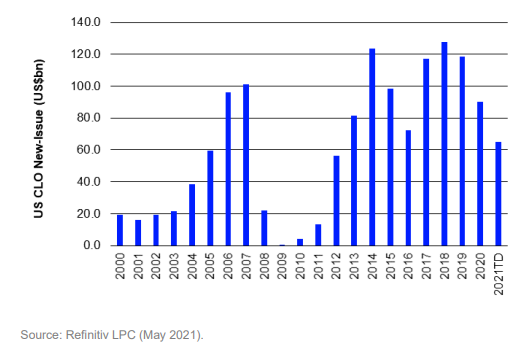

From the year 2000 to 2007, the new issue of US CLOs passed from 20US$bn to 100US$bn.

The 2008 financial crisis

While CLOs were not directly tied to the subprime mortgage market, they were part of the broader securitization landscape.

Some CLOs, which had been rated as safe investments due to their diversified loan portfolios and credit enhancements, experienced some rating downgrades as the underlying loans deteriorated in quality. CLOs, like other asset-backed securities, became illiquid and difficult to trade during the crisis due to the lack of liquidity in the credit market.

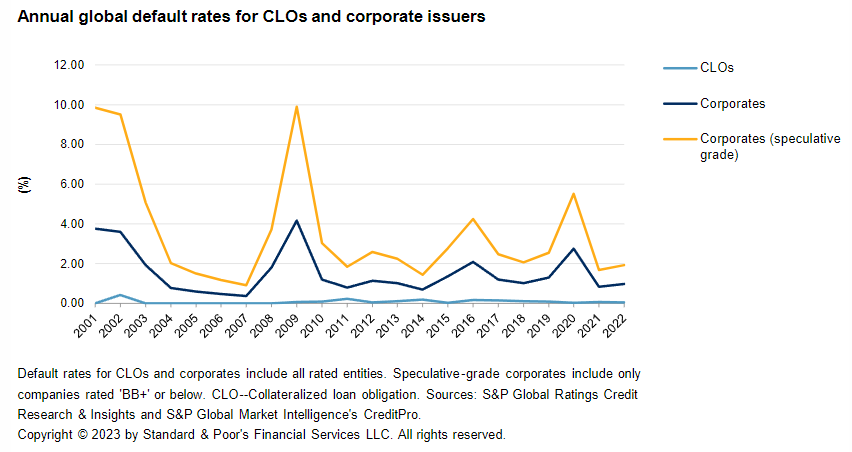

The default rate on leveraged loans within CLOs portfolios peaked above 10% in 2009, while the high-yield market peaked at 20%+, causing concern about the stability of CLOs. However, despite these high default rates, the vast majority of CLOs actually performed well during the crisis. As noted by Credit Suisse Investment Group, “Survival and performance during that period were largely due to the non-mark-to-market structure of CLOs. Managers were not required to liquidate in the face of market price deterioration, and many were able to reinvest into loans at severely depressed prices thanks to the active management of the portfolio”.

Post financial crisis

Like many other structured financial instruments, CLOs have undergone significant changes compared to their pre-crisis counterparts, despite their strong performance during the crisis. These changes are responses to shifts in investor preferences and regulatory requirements. such as tighter restrictions on collateral quality, more robust credit risk management, and improved reporting mechanisms.

Moreover, the development of the regulatory framework now requires the issuer of CLOs to adapt to new risk retention rules and strict disclosure obligations.

Future outlooks and growth prospect

Because of their intrinsic characteristics and the resilience to economic downturns that they have shown both during the Global Financial Crisis and during the Pandemic Crisis, CLOs have increasingly become more and more attractive to investors, especially institutional ones, that aim at diversifying their debt portfolio.

Moreover, the floating-rate nature of these instruments has rendered them extremely appealing in a high inflation, high interest rate environment such as the one we are living in. For instance, according to S&P Global Ratings, the number of CLOs tranches continues to grow.

Conclusion

To sum up, CLOs are interesting instruments with interesting growth prospects that have become increasingly attractive to institutional investors looking to diversify their debt portfolios. CLOs have a strong track record of outperforming equivalent-rated corporate bonds, credit indices, and equities over the medium to long term. They tend to shine during economic slowdowns and when investors reallocate from equities to fixed-income assets in response to rising interest rates.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/