Introduction

In the age of pervasive digitization, where businesses, governments, and individuals increasingly rely on interconnected networks and online platforms, the importance of robust cybersecurity has reached unprecedented heights. The SEC X account hack, which sent shockwaves through the cryptocurrency market on January 9th, serves as a stark reminder of the perils that accompany a lack of cybersecurity in the digital age.

X hacker attack

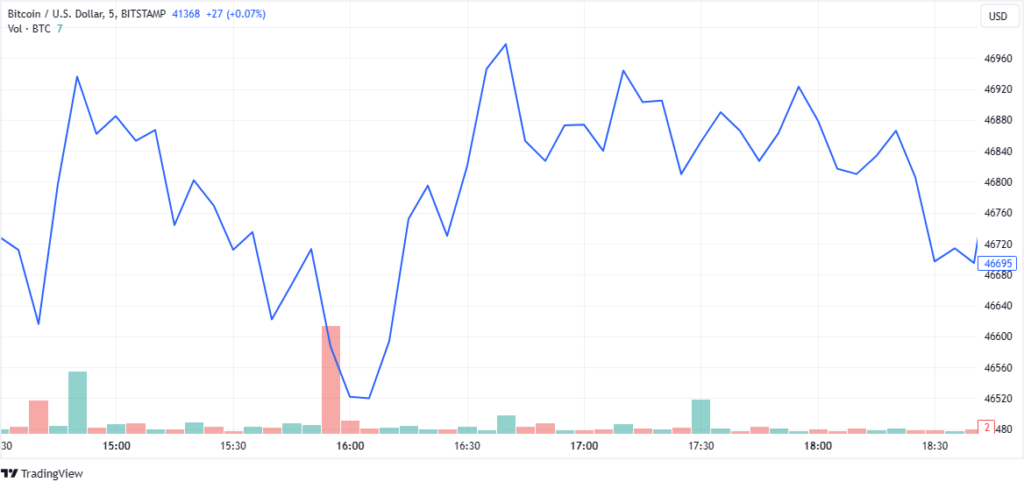

The official X account of the US Securities and Exchange Commission (SEC) was compromised on January 9th. At 4:11 PM, the hackers posted a fraudulent tweet claiming that the SEC had approved a spot Bitcoin exchange-traded fund (ETF), sparking a rapid surge in Bitcoin’s price. However, within 15 minutes, SEC Chair Gary Gensler exposed the hack, clarifying that the tweet was unauthorized and that no such approval had been granted

After the tweet, bitcoin’s price spiked from around $46,000 to $47,680. However, it plunged nearly $45,000 after Gensler’s response.

The incident raised concerns about the SEC’s security system. A review by the agency’s internal watchdog last year revealed that it had not fully complied with federal cybersecurity standards, including the requirement that public-facing systems support multifactor authentication.

While the SEC is not the only federal agency to face criticism for its cybersecurity vulnerabilities, its prominent position as the regulator of companies and markets in the United States has made it an especially tempting target for hackers. In 2016, a group of Eastern European hackers gained unauthorized access to the SEC’s database of corporate filings. By exploiting this breach, the hackers obtained non-public corporate earnings reports and traded on this privileged information, netting over $4.1 million in illicit profits, according to court documents.

Security lack

The SEC X account was compromised at an inconvenient moment for the agency, which had recently implemented new regulations requiring public companies to report cyber incidents within four business days as part of a broader initiative to enhance corporate cybersecurity transparency.

Gensler has emphasized the need for companies to strengthen their cybersecurity measures, particularly by adopting multifactor authentication, a cornerstone of cybersecurity best practices recognized by the White House in 2022.

In 2023, the SEC was forced to dismiss 42 of its enforcement cases due to inadequate data security measures. A review revealed that some SEC employees were able to access confidential memos, prompting the agency to apologize for the lapse and implement stricter safeguards.

Despite these instances, the SEC’s continued focus on cybersecurity best practices is essential to protect sensitive data and maintain the integrity of the markets.

Conclusion

The hacking of the SEC X account serves as a stark reminder of the pervasiveness of cybersecurity vulnerabilities. This incident underscores the urgent need for the SEC, as well as all agencies and companies, to bolster their security measures, particularly by implementing multifactor authentication and adopting stricter safeguards. As evidenced by this incident, even a single security lapse can have a ripple effect across entire markets, underscoring the importance of comprehensive cybersecurity practices to prevent any form of infiltration.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/