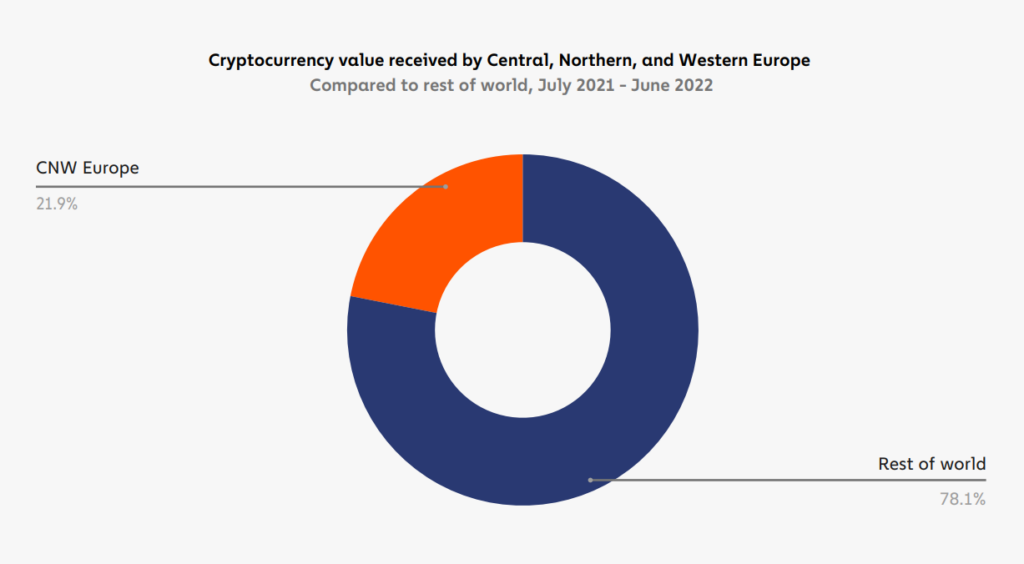

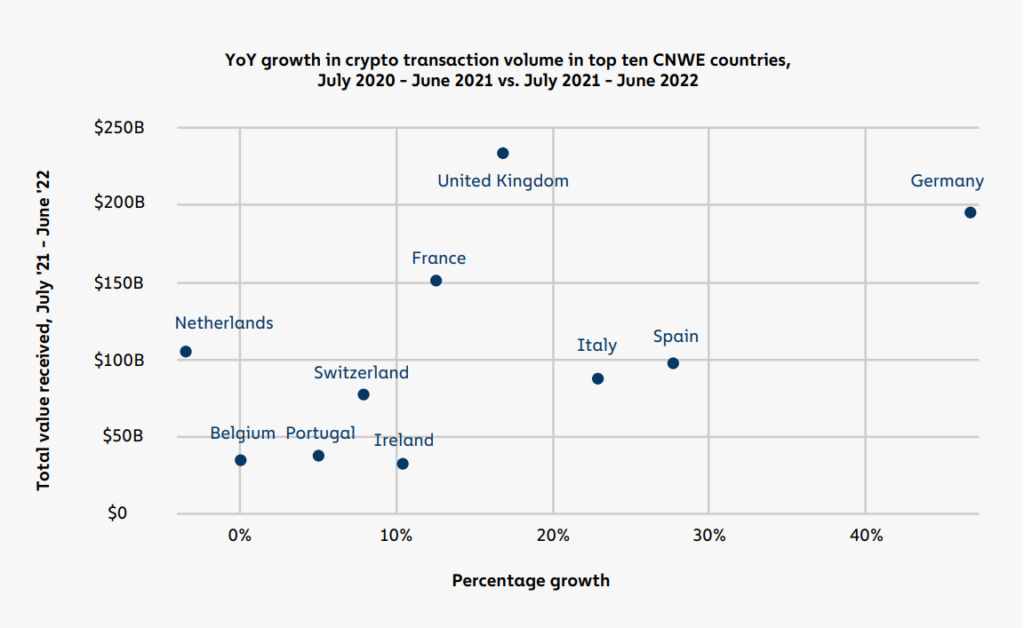

Currently, Central, Northern and Western Europe is the largest crypto economy in the world. In the entire region, users and institutions received USD 1.3 trillion between July 2021 and June 2022. On-chain activity compared to the previous year has grown strongly in the largest markets, reaching rates of around 30 per cent. A special case in point is Germany, where activity grew by 47%. This great success is also due to the fact that more regulatory clarity in the crypto market has recently been established in the European Union.

Germany has had such high growth for two reasons:

- A long-term capital gains tax of 0% was applied

- Many types of asset managers were allowed to invest in cryptocurrencies.

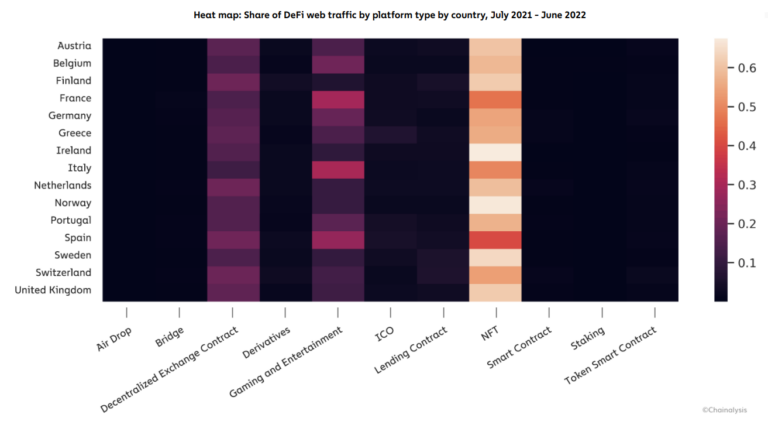

It is interesting to note which are the main platforms through which the share of DeFi web traffic occurred.

In all CNWE countries, NFTs had the highest popularity.

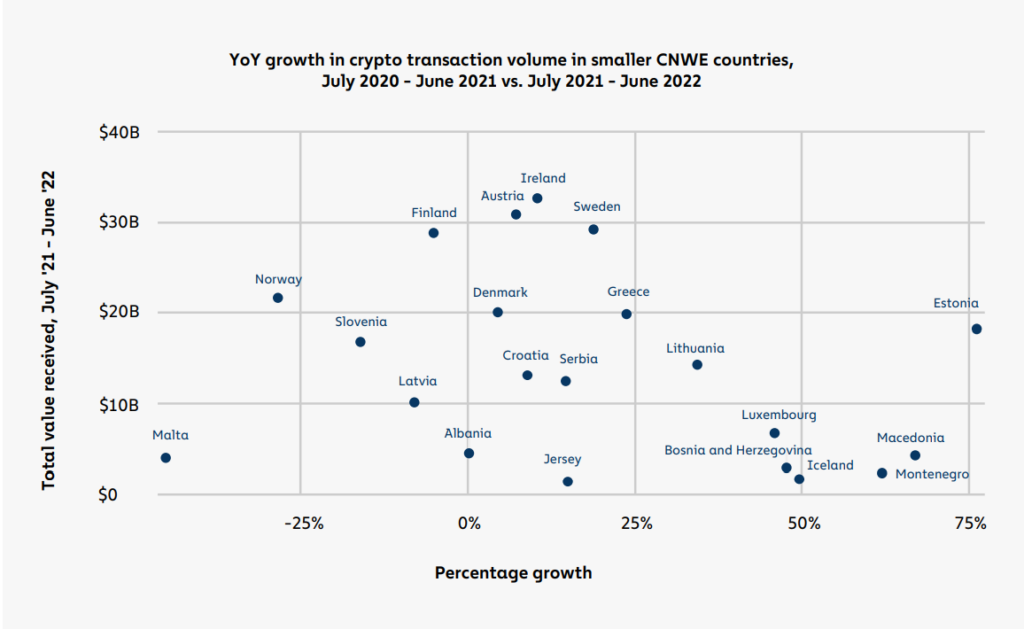

Here is a graph showing the annual growth in crypto transaction volumes in the top ten countries of Central, Northern and Western Europe and another showing the situation in smaller countries.

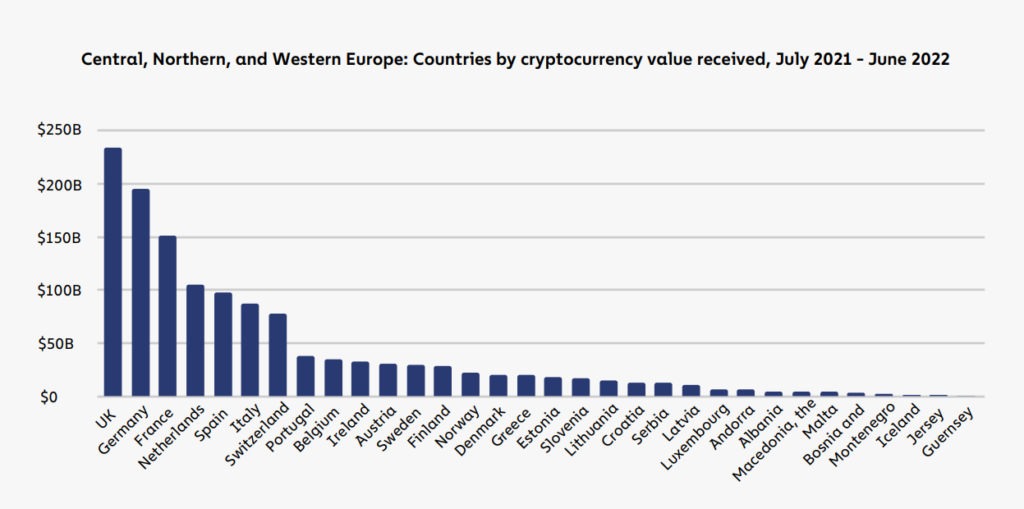

Here is a chart showing the ranking of the CNWE countries based on the cryptocurrency value received in the period between July 2021 and June 2022.

It can be seen that the UK is clearly in first place, with a value approaching $250 billion, followed by Germany.

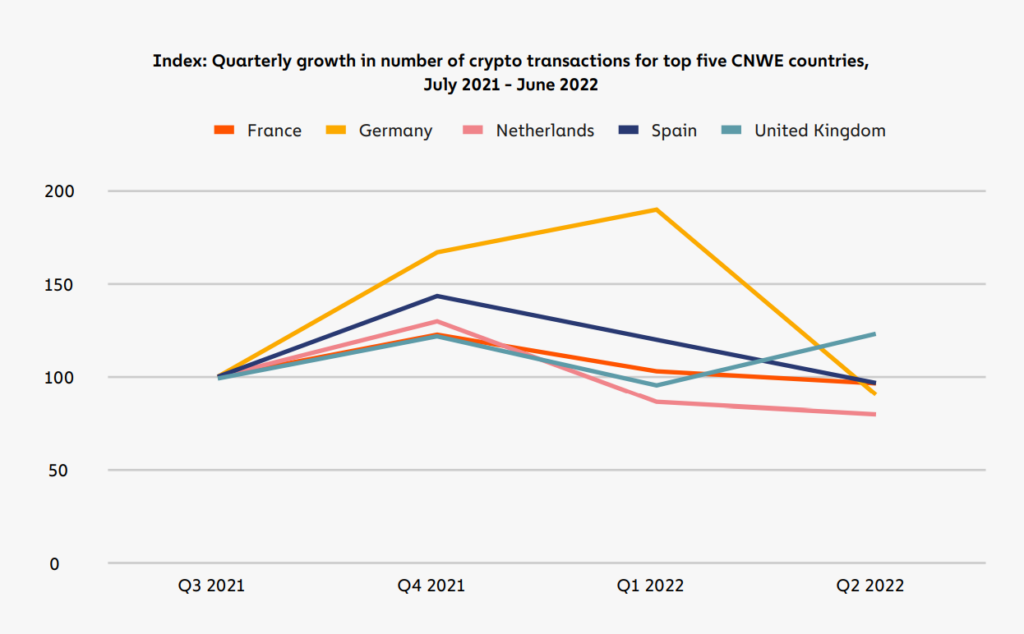

Germany among all CNWE countries qualifies as having the highest quarterly growth in number of crypto transactions in the period between July 2021 and June 2022.

The United Kingdom Situation

The UK has seen considerable growth within the crypto market this year. It is ranked 17th in the Global Crypto Adoption Index and last year was ranked 21st. In terms of raw transaction volume, the UK received $233 billion worth of cryptocurrency in the period between July 2021 and June 2022, ranking 6th in the world and 1st in Northern, Central and Western Europe.

In the opinion of Dion Seymour, technical director for cryptocurrencies and digital assets at Andersen LLP and former policy advisor to HMRC, this growth is due to the certainty that has been given to the regulation and taxation of cryptocurrencies in the UK. Seymour argues that the UK needs to provide more and more consumer protection so that DeFi becomes increasingly popular.

As of 2022, 1.9 million people, corresponding to 4 per cent of the adult population) hold cryptocurrencies in the UK.

The current Prime Minister of the United Kingdom, Rishi Sunakera, has introduced a new bill legitimising cryptocurrencies as regulated financial instruments, with Bitcoin recognised as a commodity.

What are Sunak’s reasons for introducing this proposal?

- There is a widespread need for more regulation in the crypto world lately. Companies are looking for more regulatory clarity.

- The Prime Minister’s aim is not only to make the crypto market more practical and easier, but also to make the UK a global crypto hub. This is a particularly difficult challenge given the need to contain the economic crisis in the meantime. Overall, the bill proposes: “A range of measures to maintain and enhance the U.K.’s position as a global leader in financial services, ensuring the sector continues to deliver for individuals and businesses across the country.”

So, if this project in fact contains even more ambitious proposals than simply popularising crypto, what are Sunak’s long-term goals?

- Sunak’s great ambition is the change in leadership he wanted, which led to the appointment of John Glen as Chief Secretary to the Treasury. Glen’s is a political profile that has always been particularly sensitive to digital asset management. It will be this new leadership, according to Sunak, that will lead the UK into a prominent position in the global crypto market.

- Sunak plans to regulate stablecoins as a form of payment. These new rules will be part of the ‘Financial Services and Markets Bill’, a post-Brexit reform aimed at strengthening the competitiveness of the City of London that still awaits approval by lawmakers.

- A major aim of these radical changes is to introduce a digital pound. This is a proposal that is still under consideration but would represent the most innovative event in this whole series of changes.

Our team created a paper synthesising and integrating with other content the concepts expressed in the report 2022 Report Geography of Cryptocurrency

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/