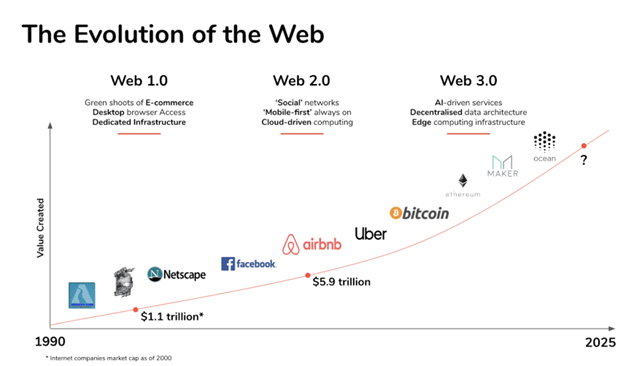

The Evolution of the Internet. Could Web3 be a new investment opportunity for qualified investors?

Web 3.0 is considered the third phase in the evolution of the internet, characterized by decentralization, ubiquity, and artificial intelligence.

The World Wide Web is the main instrument used by people to reach information and communicate through the Internet. It has changed drastically over the years going through 3 phases: Web 1.0, Web 2.0, and now we’re joining Web 3.0.

Web 1.0 was the first version of the internet that lasted from the beginning of the internet era, from 1989 to the early 2000s. Using a computer allowed people to access content uploaded by web developers. Interaction between Web pages was minimal.

The first Web1 upgrade was Web 2.0, also known as “Interactive Read-Write Web” or “Social Web” started in 2004, the innovation consisted in allowing users to create content using apps. At the same time, users had no control over their data since the information was stored and tracked without permission.

Then there comes Web 3.0 (Web3), also known as “Semantic Web” or “Read-Write-Execute”. The implementation of this new technology is due to the birth and development of the blockchain and with it to a series of decentralized services that are giving life to the OnChain Economy.

This last evolution will allow users to monetize their own data, content creators will be able to receive crypto payments directly from their post views, and online services and platforms, ranging from e-commerce to social media to gaming, to be provided and controlled by democratic groups of developers. Decentralization, openness, and greater user utility are the features on which Web 3 is breaking new ground from the past.

The aim of removing the “middleman” has massive implications: it would be replaced by a decentralized app, or a dApp. These apps run on peer-to-peer networks and use code-based smart contracts to facilitate agreements between parties without the need for pre-established trust. In theory, these apps wouldn’t be owned by any single person or company.

To be considered decentralized, an app must be fully open source, with data stored on an open blockchain, it must generate tokens, required for the app usage, and awarded to users in exchange for their contributions; it adopts protocol changes only upon the majority consensus of most of its users.

Web3 apps and communities will be governed by decentralized autonomous organizations (DAOs), blockchain-based structures that run online platforms and embody collective ownership. Dao’s role is to replace companies that manage online platforms, the rules are written into smart contracts and the current evidence is that many Web3 startups have already begun the transition to becoming a DAO structure.

Thanks to the use of dApps Web 3.0 technically gives greater protection to the user. Additionally, a decentralized identifier (DID) has been implemented with the task to verify and track the identity of users. It takes the form of a series of numbers and letters at the base of applications called “identity wallets.”. the latter grants their owner access to their portfolio since it contains verified credentials and other data that a user creates on the blockchain.

Web3 adoption is still in its infancy. The last few years have seen an incredible evolution of many dApps (which will form the basis of the future Web3) capable of making financial services more efficient and revolutionizing them. Decentralized finance DeFi is a great example of the innovative power of these technologies. some of the main types of Defi protocols are:

- Decentralized exchanges (DEX) which are used to trade cryptocurrencies.

- Asset management services and yield where depositors are rewarded for staking tokens, contributing to liquidity pools, or cultivating yield.

- Payments in cryptocurrency tokens.

In addition to tokens, Web 3.0 counts also on non-fungible tokens (NFTs). NFT stands for Non-Fungible Token. It is a type of cryptographic token that is unique and non-interchangeable, meaning it cannot be replaced by another token of the same type and its value cannot be exchanged for another token of the same type. NFTs are typically used to represent digital assets such as artwork, collectibles, video game items, and other digital assets.

This is possible because NFTs provide a blockchain-based record of ownership of digital assets and each NFT represents a unique and immutable entry in a ledger. As a result, the exchange of NFTs allows the “ownership” of digital assets recorded in the ledger to be exchanged.

In addition, Web3 allows users to interact with the Metaverse blockchain, enabling them to securely transfer assets and build customised dApps.

The metaverse is the idea of shared worlds driven by virtual products and digital experiences that are highly immersive and interactive. A Web3 metaverse is blockchain-based and built on open standards and is sometimes called an “open metaverse.” It is an independent collective virtual space that offers virtual products and highly engaging and interactive digital experiences; it has its independent virtual economy using digital currencies and non-fungible tokens (NFT). It is an open ecosystem where no single entity is meant to exercise control. Most important companies of Gaming and Fashion industry, are early adopted on Metaverse, because it could be an ecosystem populated by young users, perfect targets for their products, and it is expected that tech giants are also mobilizing to this “new land”. One example is meta, which is investing heavily in building 3d reality, accessible with VR headsets and AR glasses.

Summing up, one of the major promises of Web3 is the possibility of giving content creators control over the way their online content is used, distributed, and paid for. The management of such online content would then become direct, without going through a publisher or social media site.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/