ESG criteria

Environmental, Social and Governance (ESG) criteria have emerged as pivotal metrics for evaluating the commitment of companies to advancing sustainability objectives. Moreover, the changing world and economy have made it necessary for regulators around the world to impose ESG reporting for public companies, in line with the United Nations’ Agenda 2030 goals of ensuring a fast economic transition towards an equitable, sustainable, and ecologically responsible society.

The growing consideration of ESG standards is manifested also by the increasing number of companies that are now voluntarily disclosing their ESG performance through sustainability reports and integrated annual reports to provide stakeholders with transparency about ESG’s initiatives and progress towards sustainability goals.

What emerges is that Environmental, Social and Governance factors are gaining significance not only because of the regulatory framework, but also as a response to shifting social priorities. This trend is intricately linked to the development of sustainable finance, where ESG considerations serve as the guiding principles for allocating capital. As society places greater emphasis on environmental protection, social equity, and ethical governance, the financial sector is adapting by directing investments toward businesses that align with these values, creating a symbiotic relationship between sustainable finance and evolving social consciousness.

Sustainable Finance: The Rise of ESG Integration and the Need for Standardization

Investors and asset managers use Environmental, Social and Governance (ESG) information for a variety of reasons, driven by both financial and ethical considerations.

Indeed, ESG information provides valuable insights into a company’s sustainability records, which can impact its long-term financial performance and reputation: ESG investing has now become a factor to measure the resiliency of portfolios to long term ESG risks and opportunities. Indeed, recent experiences during the COVID-19 pandemic highlight that businesses that incorporate ESG factors into their models are more resilient to technological risks and better equipped to face challenges posed by unexpected crises.

As noted by the Organisation for Economic Cooperation and Development – the OECD- “growing concerns over the impact of climate change and the consequences of pandemics have drawn greater attention to environmental and social risks, combined with policy signals that the financial sector should be a driving force in advancing global sustainability”.

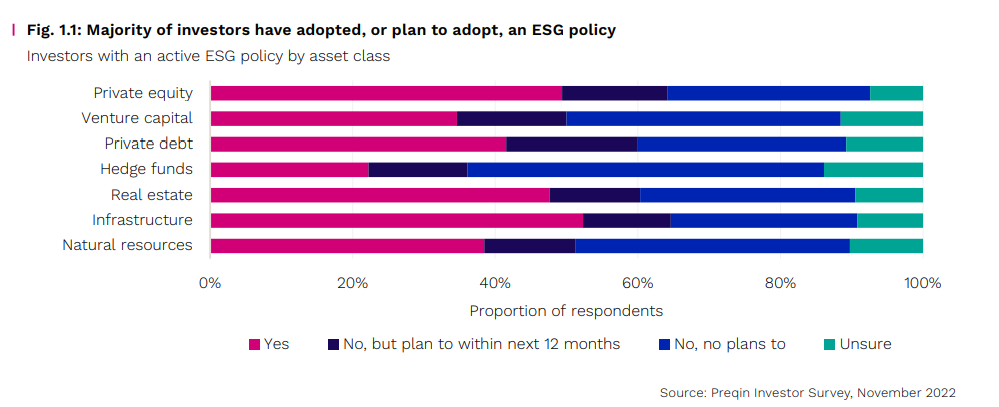

To manifest the increasing attention in sustainable finance, we report the results of a survey carried out by Preqin Investor Survey, which goes to show how the majority of investors have adopted or plan to adopt active ESG policies.

As demand for ESG assets increases, the need for harmonized methods for ESG rating assessment becomes crucial for various reasons.

Firstly, standardized ESG assessment methods would allow investors and stakeholders to compare the ESG performance of different companies or investment products more effectively.

Secondly, an harmonized method would ensure more transparency in the way ESG scores are drafted. Increases in transparency would enhance the credibility of both rating agencies and companies, as it would mitigate the inherent conflict of interest that can arise from the fact that rating agencies may have financial ties to the companies they assess or could aspire to secure future business relationships with these firms.

Finally, a reliable method to assess a company’s effort in ESG practices, would strengthen the role of ESG disclosures and ratings, reducing the asymmetry of information that intercurs between companies and both financial and social investors.

Conclusion

In conclusion, the integration of ESG criteria into finance signifies a monumental shift toward sustainable and responsible investment practices, driven by both financial incentives and ethical imperatives. This shift reflects a global consensus on the profound influence of ESG factors on long-term financial performance and societal well-being.

The burgeoning demand for ESG investments underscores the necessity of standardized ESG rating methodologies, as they serve as indispensable tools fostering transparency, credibility, and accountability. Ultimately, these standardized methods play a pivotal role in bridging the informational divide between corporations and investors.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/