Together with…

Introduction

The concept of microcredit was first introduced in the 1950s by economist Muhammad Yunus, referring to the provision of small loans to artisans in Bangladesh. In 1976, Yunus founded Grameen Bank, which became the world’s first microfinance institution (MFI). Grameen Bank’s innovative group lending model, in which borrowers form small groups that are responsible for each other’s loans, helped to make microcredit a sustainable and scalable financial service.

The microcredit industry began to grow rapidly in the 1980s and 1990s, as international organizations and governments recognized its potential to alleviate poverty and promote economic development. MFIs began to emerge in countries around the world, providing small loans to entrepreneurs and individuals who were unable to access traditional forms of credit. Today, microcredit is a global industry with over 120 million active borrowers and over US$90 billion in loans disbursed.

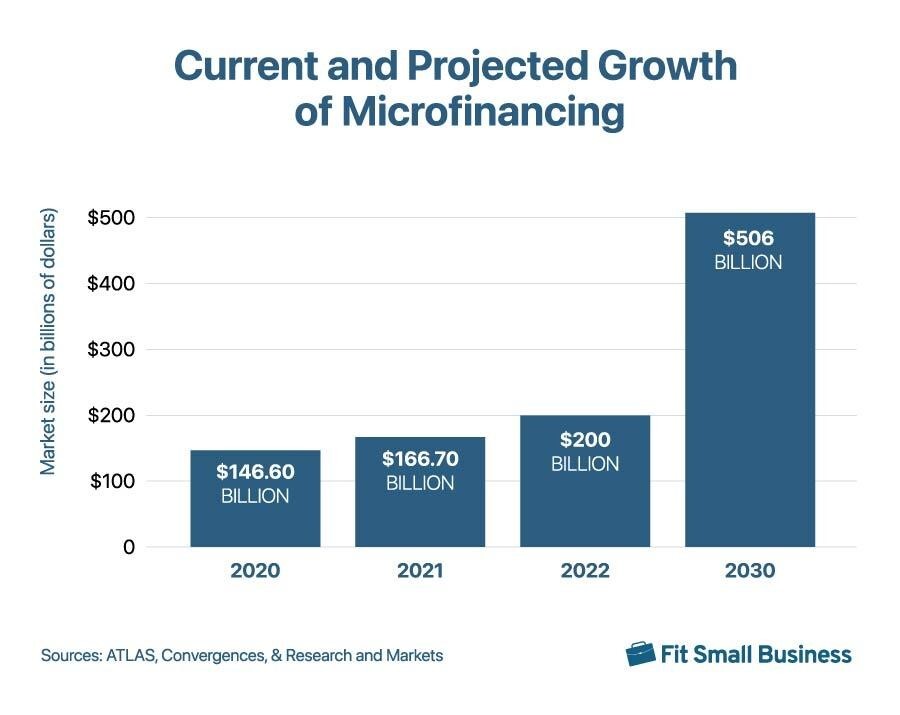

Global Microcredit Market Size

The market has experienced important growth in the last ten years; according to the Global Microfinance Industry report, the global microcredit market size was estimated to be US$200 Billion in the year 2022 and is projected to reach a size of US$506 Billion by 2030, this marks a significant increase with a CAGR of 12.3% over the period 2022-2030.

The growth of the microcredit market is driven by several factors, including:

- Increasing demand for financial services: The underserved segments of the population, often living in rural or low-income areas, increasingly seek access to financial services to support their businesses, households, and overall economic well-being.

- Rising awareness of microcredit’s impact: The effectiveness of microcredit in poverty alleviation and promoting entrepreneurship has gained global recognition, leading to increased awareness and support for microfinance institutions (MFIs).

- Expansion into new markets: MFIs are expanding their reach into underserved regions and countries, particularly in Africa and Asia, where the demand for microcredit is high.

By considering the microcredit market development per geographical area, the Asia Pacific region leads the microfinance market and is expected to reach a size of US$236.4 billion by 2030, with a CAGR of 14.3% over the analysis period 2022 to 2030. This sharp predominance is mainly due to government initiatives aimed at contrasting poverty and vast rural populations with limited access to traditional banking services.

The Microfinance market in Europe is estimated at US$13.4 Billion in the year 2022 and shows strong growth: microfinance is a way for financial inclusion and Germany, UK, and France are at the forefront. Diverse institutions provide services focused on social impact.

North America has established institutions: community organizations offer microloans, training, and resources. The US and Canada drive the demand, with a focus beyond just credit, including empowerment programs and financial education.

Empowering Entrepreneurs: a Look at Microcredit Providers

Microcredit providers, a diverse group encompassing non-profits, for-profits, foundations, and donor organizations, empower entrepreneurs who struggle with traditional banking access. These small loans fuel business growth, with each provider offering a unique approach.

Non-profits, focused on social impact, prioritize flexible terms and rely on grants, while for-profit institutions, accountable to shareholders, prioritize financial returns often reflected in stricter terms and capital raised through investments. Foundations and donor organizations, driven by philanthropic goals, bridge the gap by providing grants and funding to microfinance initiatives, further expanding the reach of microcredit. This spectrum, with non-profits holding a 42% market share in 2023 compared to for-profit’s 36% and 4% for foundations and donor organizations, allows investors to balance financial returns with social impact. In particular, the profit MFIs segment has witnessed significant growth in recent years; it presents a win-win solution for both investors and entrepreneurs because investors gain access to a new asset class with social impact, while entrepreneurs benefit from increased access to capital and potentially more efficient lending models.

Microcredit providers typically assess the borrower’s creditworthiness based on factors such as their business plan, income stability, and, if any, past financial performance. They may also include in the loan contract the obligation for borrowers to attend financial literacy training, created and provided by the lender, to ensure they can manage their loans responsibly. A strict selection process often includes collateral, such as a business asset or personal guarantee, and group lending for accountability and reduced risk.

How do investors get involved in microcredit?

Investors can support microcredit by providing funding to MFIs or for-profit microlenders. This funding can help MFIs expand their reach and offer more loans to entrepreneurs. Investors can also provide non-financial support, such as expertise in business development or financial management. Microcredit has demonstrated its effectiveness in promoting entrepreneurship, poverty alleviation, and economic development. By providing access to capital, microcredit can help small businesses grow, create jobs, and improve the lives of individuals and communities.

With the development of financial markets, some major investment companies have made microcredit-related opportunities more accessible and democratic, especially for accredited and sophisticated investors. There are investment funds on the market that specialize in supporting and developing microfinance, which have been generating significant returns for years, contributing substantially to the development of ESG investment opportunities. This acronym refers to three main areas: Environmental, Social, and Governance. Each ESG pillar refers to a specific set of criteria, such as environmental commitment, respect for corporate values, and transparency.

Thanks to the development of the activity of important financial players, investors can participate in the microfinance market in different ways:

- By acquiring shares in the aforementioned investment funds and providing pure risk capital.

- By subscribing to bonds or notes issued by the same investment funds involved in microcredit or by MFIs.

In the latter case, the investor holds a debt security that can recognize an annual return, typically in the form of well-remunerated quarterly or annual coupons, and generally higher than the average interest rates perceived by the most common treasury and corporate bonds. At the same time, the bond issuing companies secure the cash flows necessary to provide microcredit loans that are used to fuel the micro-loan system and contribute concretely and significantly to the development of new economies in different parts of the world.

Conclusion

Microcredit has emerged as a transformative tool for poverty alleviation, economic development, and financial inclusion, empowering millions to break the cycle of poverty and improve their livelihoods. As the industry continues to evolve, striking a balance between social impact and financial sustainability will be crucial for non-profit and profit microfinance institutions (MFIs) to play their distinct yet complementary roles in bridging the financial gap for underserved communities.

By fostering partnerships and adopting innovative strategies, the microcredit sector can continue to empower individuals, businesses, and communities worldwide, contributing to a more equitable and prosperous world.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/