Together with…

Introduction

Collateralized Loan Obligations (CLOs) can play a pivotal role in the management of a portfolio, offering an avenue for risk diversification and credit risk management.

This insight delves into the significance of CLOs in enhancing portfolio diversification, their historical performance, and their attractiveness relative to other fixed-income asset classes.

Diversification through CLOs

One of the key advantages of CLOs lies in their diversification characteristics. Specifically, CLOs offer investors access to a diversified pool of senior secured loans due to their structure; they include an average of 250 issuers spanning approximately 40 different sectors. This characteristic significantly reduces the idiosyncratic risk investors face, thereby enhancing portfolio security and mitigating concentration risk.

CLOs are backed by portfolios of senior secured leveraged loans, which means they offer exposure to a credit profile distinct from that of traditional investment-grade corporate borrowers. This diversification aids investors in navigating market fluctuations more effectively.

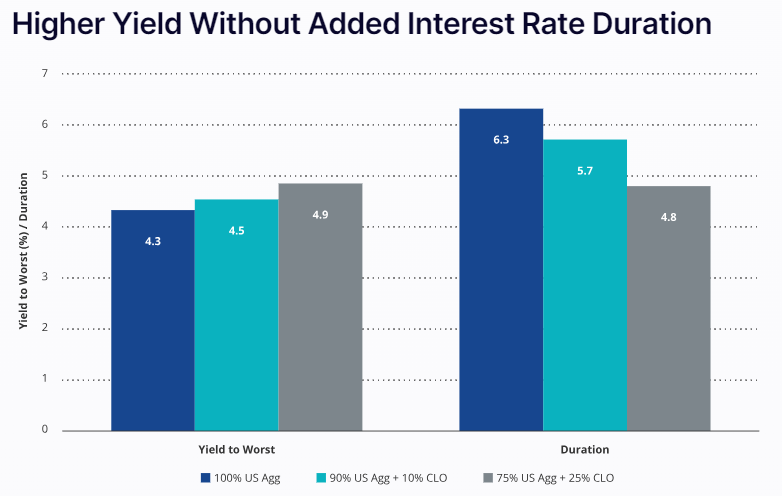

By investing in CLOs, investors can diversify a traditional fixed-income portfolio, potentially benefiting from lower volatility, higher credit quality, reduced sensitivity to interest rate changes and lower correlations with other fixed-income categories.

Floating-Rate Advantages

Unlike certain other structured financial products, CLOs benefit from match funding. This means that the assets they hold (primarily leveraged loans) and their liabilities (debt tranches) are both floating-rate instruments. The floating-rate coupons feature akin to leveraged loans but bolstered by additional risk protections inherent in the CLO structure. The floating rate is typically quoted as a spread over a base rate (historically LIBOR, but now SOFR), which renders the loans and CLO tranches relatively resistant to interest rate fluctuations with low-interest rate duration.

In contrast, historically, other structured products such as CBOs held fixed-rate assets while carrying floating-rate liabilities. This structure exposed the portfolio to heightened interest rate risk and jeopardized consistent arbitrage, as the interest rates on liabilities and assets did not necessarily move together. With both assets and liabilities featuring floating rates, CLO cash flows and payments tend to align more closely, resulting in reduced sensitivity to interest rate changes.

Superior Yields: CLOs Compared to Fixed Income

One of the primary attractions of CLOs is their attractive yields, which historically have exceeded those of other asset classes such as corporate debt categories, including bank loans, high-yield bonds, and investment-grade bonds within the same rating bracket. Also, during two major market downturns—the Global Financial Crisis and the COVID-19 drawdown—the CLO asset class demonstrated fewer defaults than corporate bonds of equivalent ratings. This resilience, coupled with the potential for higher yields and spreads, positions CLOs as an attractive option for long-term investors.

From a quality perspective, investment-grade CLOs offer investors the opportunity to gain exposure to higher yields without taking on additional credit risk. The risk of default in senior CLO tranches is remarkably low due to built-in risk protections, such as high levels of subordination. This ensures that even lower-rated investment-grade CLO tranches remain resilient to defaults in the underlying portfolios.

Taking into consideration some data, CLOs (BBB tranche) current yields are SOFR (5.3%) + 3.5% spread; about 8.8% in USD, significantly surpassing yields on aggregate bonds and U.S. corporate bonds. This high yield is driven by factors such as rising short-term rates and the spread over the risk-free rate that CLOs provide.

Most benchmark indexes, such as the Bloomberg U.S. Aggregate Bond Index, the Bloomberg U.S. Corporate High Yield Index, and the Bloomberg Global Aggregate Bond Index, consist entirely of fixed-rate bonds. Consequently, portfolios exclusively invested in these indexes tend to exhibit negative correlations with changes in interest rates, experiencing declines in value when interest rates rise.

The Compelling Case for CLOs in Fixed Income Portfolios

In conclusion, Collateralized Loan Obligations (CLOs) offer investors an opportunity to enhance diversification and manage risk effectively in their fixed-income allocations. With their low correlations to other asset classes, such as equities and fixed-rate bonds, CLOs provide an effective hedge against market volatility and concentration risk.

Moreover, CLOs’ attractive yields, historically resilient performance during market downturns, and structural features like coverage tests and floating-rate coupons make them an appealing option for long-term investors seeking stable income streams and capital preservation. As investors continue to navigate evolving market conditions and seek to optimize their investment strategies, the inclusion of CLOs could serve as a potentially valuable component.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/