Together with…

Introduction

Collateralized Loan Obligations, commonly referred to as CLOs, are structured financial instruments that have gained notoriety and popularity in recent years, particularly for their intrinsic characteristics of generating higher yields and allowing for more risk diversification than traditional fixed income instruments, such as government and corporate bonds.

These instruments are essentially actively managed securitization vehicles that pool together a diverse range of corporate loans. As for every other securitized financial product, CLOs are structured into various tranches, each carrying different levels of risk and return. The most senior debt tranche holds the highest priority in receiving cash flows generated by the CLO portfolio. This top-ranking position provides the strongest safeguard against defaults when compared to other tranches. However, this added protection comes at the cost of offering a relatively lower yield. Conversely, the most junior (equity) tranche exposes investors to higher credit risk, but also entails higher expected returns. The interested reader can find more about the general functioning of CLOs here.

As for every financial instrument, CLOs are influenced by general market conditions and their performance is affected by the macroeconomic environment of the economy.

This article will be devoted to the analysis of the effects of interest rates on CLOs and to the comparison of such effects with those that interest rate changes stem in other fixed income instruments.

Why do changes in interest rates happen and how do they affect financial products?

Central banks use monetary policy to manage the supply of money in a country’s economy. With monetary policies, a central bank increases or decreases the amount of currency and credit in circulation, in a continuing effort to keep inflation, growth and employment on track.

In periods of high consumption, robust growth or high inflation, central banks typically raise interest rates in an attempt to control these conditions and favor a smooth economic development. Conversely, they lower rates during economic downturns to stimulate borrowing and spending, which can boost economic activity.

In other words the tightening or loosening of credit conditions impacts the cost of borrowing, a crucial factor in determining the attractiveness of debt instruments. For instance, the high inflation environment in which we have been living in since the beginning of 2022, has led central banks to fiercely and repeatedly raise interest rates. The debt market has since gained significant appeal, as newly issued bonds now offer yields higher than any seen in the past two decades of flat, close to 0, interest rates.

At the same time, higher interest rates may lead to higher credit risk, the risk of defaulting on financial obligations that any lender, bondholder, bank, or credit institution faces when lending money to a person, business, or government.

CLOs and bonds: differences in a period of rising interest rates

Despite being debt instruments, both CLOs and bonds react in different ways to changes in interest rates. The first difference we notice is that CLOs do not exhibit the inverse relationship between their prices and yields that traditional bonds do exhibit. Indeed, traditional fixed-rate bonds offer a stable stream of fixed coupon payments, which do not change over the bond’s life. This inherent rigidity means that when market interest rates rise, these fixed coupon payments become less attractive compared to new bonds issued with higher coupons. In other words, demand for fixed rate bonds decreases whenever the central bank raises interest rates, leading to a decrease in bond price and exposing bondholders to the so-called interest rate risk, the probability of a decline in the value of an asset resulting from unexpected fluctuations in interest rates.

On the other hand, CLOs are floating rate instruments. The interest payment that the borrowers (those companies whose loans are inserted in the CLO portfolio) have to pay is indexed and hence continuously adjusted taking into account current market conditions and changes in interest rates. This entails that CLOs become more attractive than traditional bonds that share a similar level of risk when the interest rate increases. Conversely, when the interest rate decreases, bonds tend to outperform CLOs.

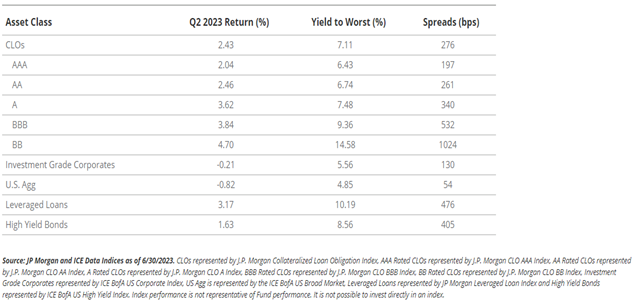

As a reference, the second quarter of 2023 (Q2 2023) reflects the general trend mentioned above: CLOs outperformed Investment Grade Corporate bonds, U.S Aggregate bonds and High Yield Bonds, whilst being outperformed only by leveraged loans, those extended to companies known to have considerable amounts of debt.

Conclusion

In conclusion, in periods of high inflation and economic uncertainty, CLOs can offer a hedge against rising interest rates due to their floating-rate nature and potentially capture higher yields than traditional fixed-rate bonds.

Diversification across various asset classes, including a mix of fixed-income securities like traditional bonds and alternative investments like CLOs, can help mitigate risk and capture opportunities in a dynamic market environment such as the one we are living in.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/