Together with…

Introduction

Collateralized Loan Obligations (CLOs) are complex financial instruments structured as debt securities. They are typically backed by a diversified pool of secured loans, mainly corporate loans, and opportunistically bonds. On the other hand, bonds are debt securities issued by governments, municipalities, corporations, or other entities to raise capital.

When purchasing a Collateralized Loan Obligation (CLO), essentially it is the investment in a structured financial product backed by a pool of loans, with the potential for receiving periodic interest payments and a return on the investment based on the performance of the underlying loan portfolio, over a specified investment horizon.

When investing in a bond, it means lending money to the issuer in exchange for periodic interest payments (coupon payments) and the return of the bond’s face value (the principal) at a specified maturity date.

Despite appearing very similar at a glance, these instruments diverge in various key characteristics.

This article will focus on what makes CLOs different from traditional bonds.

Risk Diversification

CLOs provide a more comprehensive risk mitigation strategy than traditional bonds. This is because, by nature, CLOs excel in spreading risk through their diversified portfolio of loans, which encompasses various industries, credit ratings, and geographic sectors. In contrast, traditional bonds are issued by a single entity which exposes the investor to a higher credit risk. Of course, if a company defaults on its debt, the bondholder loses all or part of the initial investment. On the contrary, if that same company’s bond is included in a CLO, the investor may not experience significant losses, since the portfolio comprises around 200-300 similar bonds and loans.

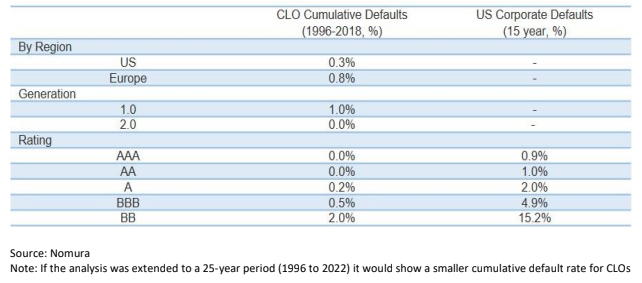

This difference in credit risk can be seen through the analysis of the cumulative default rates suffered by CLO debt notes and by equivalent-rated senior corporate bonds. What emerges is that all CLO tranches are much more resilient than their comparable high-yield and investment-grade bonds.

Interest Rate Sensitivity

CLOs and traditional bonds differ in one important element: the interest rate. CLOs typically, in 99% of cases, have a floating interest rate, while traditional bonds have a fixed interest rate.

The floating interest rate of a CLO is linked to a benchmark interest rate, such as the USD 3 months SOFR for USD CLOs or EURIBOR 3 months for EURO CLOs. This makes CLOs advantageous to investors in a rising interest rate environment, as the coupon generated will also rise, protecting the value of the investment.

Traditional bonds, on the other hand, typically have fixed-rate interest rates, which means that the interest rate on the bond will remain the same for its whole life, regardless of changes in interest rates. This can make traditional bonds more attractive to investors mainly in an environment where rates decrease.

Risk-adjusted Returns

Risk-adjusted returns are a critical metric in evaluating the performance and attractiveness of investment opportunities. These returns take into account both the potential return on investment and the level of risk associated with that investment. The key idea behind this indicator is to assess whether the potential reward justifies the level of risk undertaken.

In the context of CLOs and traditional comparable bonds, CLOs tend to outperform similar comparable bonds.

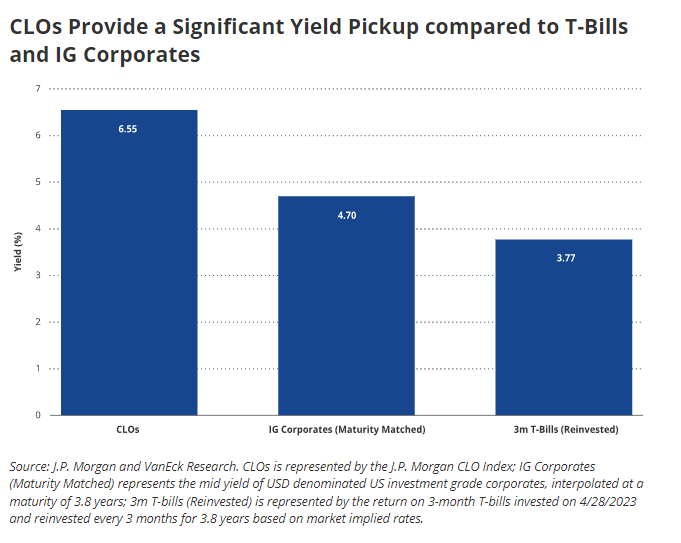

This year, CLOs have performed very well when compared to other fixed-income asset classes, because of the increase in short-term rates and credit spread levels that are above the historical average. CLOs historically have higher credit spreads than bonds of the same rating, and this premium contributes to their outperformance over the medium term.

CLO Managers and Market Liquidity

Another advantage that CLOs have over traditional bonds is the active management of their loan portfolio. This characteristic renders CLOs dynamic products since CLO Managers can opportunistically trade positions to enhance returns, mitigate risk or, generally speaking, exploit market opportunities. The loan trading activity for CLO Managers is facilitated by the size of the market which has reached a total outstanding over $1 trillion in the US and Europe.

Furthermore, at times of market volatility and price compression or credit spreads widening, CLO Managers have a greater possibility to generate trading profits as more switching opportunities arise: CLOs are instruments that tend to benefit from credit volatility.

Conclusion

In conclusion, Collateralized Loan Obligations (CLOs) and traditional bonds represent distinct investment vehicles with notable differences in risk diversification, risk-adjusted, interest rate sensitivity (duration risks), returns, and active management.

CLOs offer enhanced risk mitigation through their diversified loan portfolios, reducing exposure to credit risk compared to traditional bonds. Moreover, even in periods of economic uncertainty and rising rates, they offer higher risk-adjusted returns. Finally, active management makes them a dynamic instrument suitable for those investors seeking diversification and potentially risk-adjusted returns within the realm of debt instruments.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/