Together with…

Introduction

Poverty alleviation has been a central challenge throughout history. Microfinance, with its focus on extending small loans and financial services to the poor, has emerged as a powerful tool for economic empowerment.

This article explores the historical development of microfinance and its journey from charity-driven beginnings to a more sustainable and market-oriented approach. We’ll delve into the evolution of microcredit, its core principles, and how individuals can participate in supporting this impactful movement.

Early Roots and the Charity Model

The seeds of microfinance were sown in the 19th century with initiatives like the Schulze-Delitzsch cooperatives in Germany and the credit unions pioneered by Friedrich Wilhelm Raiffeisen. However, the modern concept gained traction in the mid-20th century. Pioneering figures like Muhammad Yunus, founder of Grameen Bank in Bangladesh, recognized the limitations of traditional charity in breaking the cycle of poverty.

Microcredit, a core component of microfinance, offered small, unsecured loans to the poor, primarily women, to help them start or expand micro-businesses. This approach empowered individuals to become self-sufficient rather than reliant on handouts.

The Shift Towards Sustainability

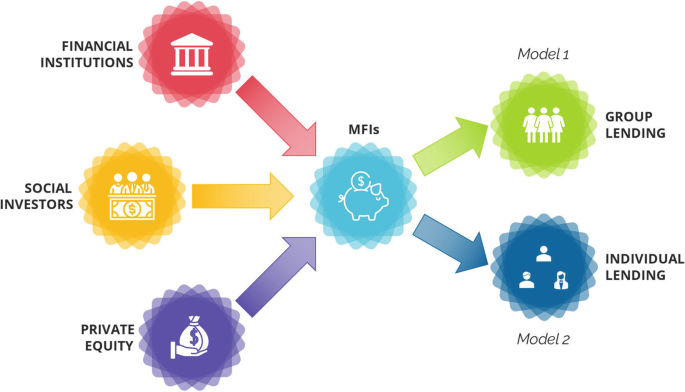

While microcredit proved successful initially, concerns emerged about high-interest rates and repayment burdens. Critics argued that the model resembled micro-debt rather than micro-finance. This led to a shift towards a more sustainable approach in the 1990s. Microfinance institutions (MFIs) began focusing on:

- Financial self-sufficiency: Lower interest rates, group lending for peer support, and savings products encouraged responsible borrowing and long-term financial health.

- Mission and impact: While profitability was important, MFIs remained committed to social impact by targeting the underbanked and promoting financial inclusion.

- Regulation and transparency: Regulatory frameworks were established to ensure fair practices and protect borrowers.

The Debate: Charity vs. Empowerment

The evolution of microfinance has sparked debate. Proponents of the charity model argue that microloans can trap borrowers in debt, and that grants or subsidized credit would be more beneficial. However, supporters of the current model highlight the importance of financial discipline, ownership, and building a credit history.

The reality lies somewhere in between. Microfinance is most effective when combined with other poverty alleviation strategies such as financial literacy training, business development services, and access to markets.

The Impact of Technology

The rise of mobile banking and fintech solutions has significantly impacted microfinance. These technologies allow MFIs to reach remote communities more efficiently, reduce transaction costs, and offer new financial products like mobile wallets and digital payments. This fosters financial inclusion by bringing formal financial services to those previously excluded from traditional banking systems.

Digital platforms are empowering sustainable micro-credit groups and MFIs around the world by streamlining financial transactions. Mobile payments are making financial services faster and cheaper, while online peer-to-peer lending platforms are expanding access to credit for those who need it most.

Different Ways to Participate

In the previous insight, An introduction to the Microcredit Industry, we started talking about how investors can participate in microcredit and the existence of different channels of access. We saw how, depending on the different providers that exist, there are different options. Let us now see what they are.

- Direct Investment in MFIs or Microlenders: Some MFIs offer equity investment opportunities, allowing investors to support their mission and potentially earn a return. This approach provides capital for MFIs to expand their reach and offer more loans to entrepreneurs. Investors can also consider for-profit microlenders with strong social impact commitments.

- Non-Financial Support: Investors can contribute valuable expertise beyond capital. This could include business development skills, financial management knowledge, or marketing experience that can be instrumental in helping MFIs grow and operate more efficiently.

- Microfinance Investment Funds: The development of financial markets has opened doors for broader investor participation. Specialized investment funds focus on supporting and developing microfinance institutions. These funds have a history of generating competitive returns while contributing to Environmental, Social, and Governance (ESG) goals. Investors seeking ESG-aligned investments can participate in these funds through:

- Purchasing Shares: This allows investors to provide risk capital and benefit from the fund’s overall performance.

- Microfinance Bonds or Notes: Investors can also subscribe to debt securities issued by microfinance investment funds or directly by MFIs. These bonds offer fixed-income returns, typically distributed as quarterly or annual coupons. Interest rates on microfinance bonds can be higher than those of traditional bonds, reflecting the inherent risk involved. By investing in these bonds, individuals contribute directly to the microloan system, fueling economic development in underserved regions.

Conclusion

Microfinance has undergone a significant transformation, evolving from a charity-driven model to a more sustainable and empowering approach. While challenges remain, it continues to be a powerful tool for poverty alleviation and financial inclusion.

Understanding the historical context, the different models, the impact of technology and the various modes of participation provide a way to analyse the microcredit market in its functioning and the impact of investments in this context.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/