Introduction

In an increasingly sustainability-focused world, finance also plays a significant role in this domain, thanks to the attention given to ESG concepts and the growing prevalence of green instruments, which are increasingly assuming a fundamental role in the financial landscape. In this article, we will explore the latest developments in this area.

Finance Embraces Climate Action

In 2003, the Prime Minister of the United Kingdom, Tony Blair, asserted that the responsibility for reducing emissions extends beyond the government, international agencies, and the public to include companies and investors. Over the course of about two decades, the corporate sector has exhibited a strong commitment to participating in emission reduction and climate action. The incorporation of sustainability measures into financial processes has emerged as a crucial focal point for both corporate boardrooms and political deliberations.

Recent research indicates a growing interest among investors in contributing to a more sustainable world. This interest encompasses not only funds governed by the Sustainable Finance Disclosure Regulation (SFDR) but also includes managers actively working to reduce carbon footprints. Climate action is recognized as a valuable tool for creating economic value.

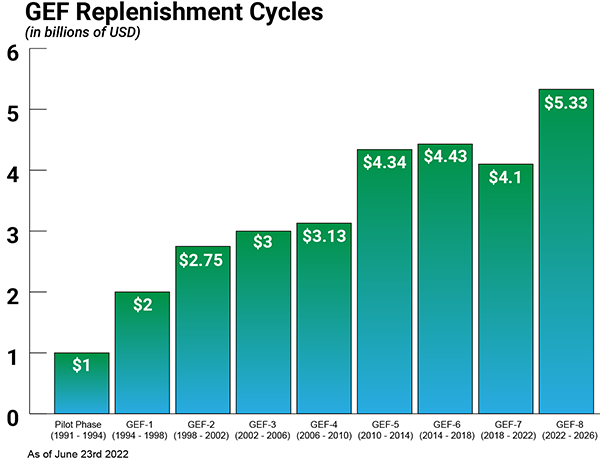

As an illustration, the Global Environmental Facility (GEF), a consortium of funds supported by governments, agencies, and private entities with the objective of addressing critical global environmental challenges, holds a value of $5.3 billion. The GEF council has recently approved funding amounting to $918 million for 45 projects.

This underscores the escalating significance of financial institutions in driving positive environmental outcomes and signifies an evolving scenario wherein financial interests are becoming more intricately connected with environmental considerations.

Goldman Sachs Goes Green: Launches First Passive Green Bond ETF

Goldman Sachs has launched a new ETF, specifically the Green Bond UCITS ETF. This ETF tracks an index developed in partnership with Solactive. The Goldman Sachs Green Bond UCITS ETF aims to be the first passively managed green bond fund that explicitly targets enhanced disclosure and transparency in line with the requirements of Article 9 of the SFDR.

Goldman Sachs Asset Management operates in various financial services sectors, including investment management, asset management, and liquidity solutions. However, it has a strong commitment to sustainable investments, becoming the largest active Green Bond open-ended fund manager in the UCITS space.

This move by Goldman Sachs Asset Management to introduce a sustainable ETF could be a strategic step to expand its offering of sustainable bonds, signalling the finance industry’s commitment to shifting towards environmental stewardship.

The introduction of this new product aims to attract new investors, allowing them to adjust their portfolios with sustainable investment criteria. This fund is part of a much larger fixed-income and liquidity portfolio, managing approximately $822 million in assets. Goldman Sachs is a leader in sustainable investments, with over $10 billion in assets in the green, social, and impact bonds sector. This fund is available on various European exchanges, making it easier for investors to participate in these projects.

Hillary Lopez, Head of EMEA Third-Party Wealth, commented: “Green bonds are a significant investment source driving the climate transition, as evidenced by last year’s record issuances. The expanding pool of issuers includes companies and governments globally, seeking investments to support their plans for reducing greenhouse gas emissions and mitigating physical climate risks.”

Japan Issues World’s First Sovereign Climate Transition Bond

Japan plans to issue the first government bond on climate transition, specifically aiming to issue 20 trillion yen of climate transition bonds over the next 10 years. This issuance is intended to support initial investments in the green transition of its energy and industrial sectors, while also attracting private investor funds in low-carbon technologies.

In 2033, the revenue generated from auctioning emission allowances for power generators will be utilized to repay the transition bonds. Furthermore, debt repayment will also be supported by a levy on fossil fuel imports, which is set to be implemented starting in 2028.

Given Japan’s experience in sustainability-linked bonds, the country is well-positioned for success. Transparency will be maintained through regular reporting on proceeds allocation and project impact. Japan’s climate transition bond represents a promising development.

JPMorgan, State Street Exit Climate Action 100+

JPMorgan and State Street both withdrew from a global investor coalition advocating for companies to reduce climate-damaging emissions. BlackRock transferred its membership in this coalition to its International arm, thereby limiting its involvement. Collectively, these decisions resulted in the removal of approximately $14 trillion in assets from Climate Action 100+.

The companies making these decisions appear to have various motivations. It may be attributed to the fact that the new priorities set by CA100+ threaten their ability to act independently. Specifically, these new priorities would require CA100+ signatories to engage with policymakers and publish details of their discussions with companies to achieve zero emissions by 2050. According to Randall Jensell, spokesperson for State Street, these priorities were “not consistent with our independent approach to proxy voting and portfolio company engagement.”

As for JPMorgan, the justification for this decision is that the company has developed its own investment stewardship capabilities. On the other hand, BlackRock shifted its CA100+ membership to BlackRock International. When initially joining CA100+, BlackRock had stated that the company would maintain its independence while acting on behalf of clients. BlackRock’s move resulted in the removal of approximately two-thirds of its assets from CA100+, equivalent to around $6.6 trillion.

Conclusion

The financial sector is demonstrably undergoing a significant shift towards embracing sustainability. While challenges remain, these developments paint a promising picture of the financial sector’s evolving role in supporting a sustainable future. It is evident that financial institutions are increasingly acknowledging their responsibility and recognizing the potential benefits of integrating environmental considerations into their operations.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/