Together with…

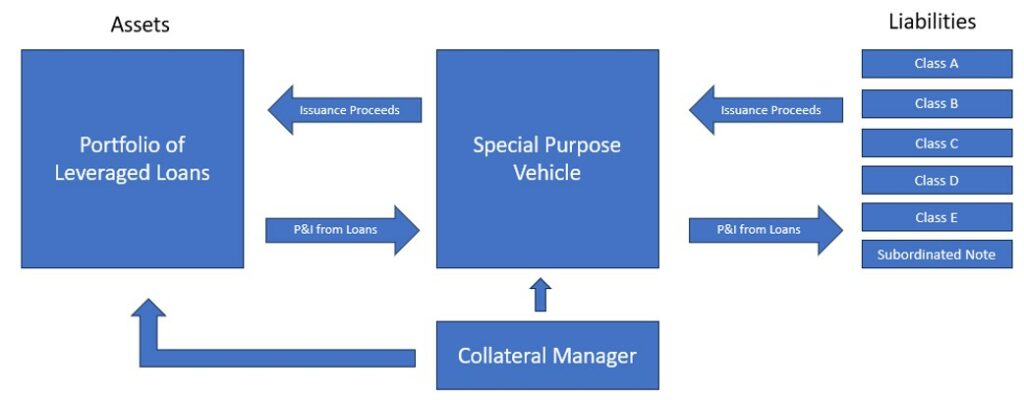

What are CLOs?

Collateralized Loan Obligations (CLOs) are a type of structured credit product that repackages a pool of leveraged loans, typically corporate loans, into tranches with varying degrees of risk and return. Here’s an introduction to the key aspects of CLOs.

Structure

Loan Pooling: CLOs pool together a collection of loans, senior secured loans issued by corporations. These loans are typically syndicated loans, meaning they are offered by a group of lenders.

Tranches: The pooled loans are then sliced into different tranches. Each tranche has a different risk profile and priority in the repayment structure. The main tranches are:

- Senior Tranches (AAA-rated): These have the highest credit rating and are the first to be paid out, making them the least risky but also offering the lowest returns.

- Mezzanine Tranches: These are riskier than senior tranches and offer higher returns.

- Equity Tranches: These are the riskiest and are the last to receive payments. They offer the highest potential returns but also the highest risk of loss.

CLICK HERE TO GET MORE INFORMATION

Creation Process

Loan Origination: Banks and other financial institutions originate loans to corporations.

CLO Manager: An asset management firm, known as a CLO manager, selects and purchases loans to include in the CLO.

Securitization: The CLO manager then packages these loans into tranches and issues securities to investors.

A portfolio or fund of CLOs is a more efficient way to:

- Diversify away from traditional unsecured corporate bond investments.

- Reduce credit concentration because of the selection of a very highly diversified portfolio.

- Mitigate corporate credit risk through active portfolio management by established credit managers such as Blackstone, Apollo, Prudential, Neuberger, KKR, Carlyle, Ares.

- Avoid interest rate risk of fixed rate investments; all CLOs are FRN instruments.

- Take advantage of market dislocation and volatility.

- Choose the range of return and risk: from investment grade rated securities to subordinated notes.

CLOs should not be confused with CDOs or CBOs or structured products. CLOs are the only credit products that outperformed through the Great Financial Crisis: investors that bought subordinated CLO bonds before the GFC had 15-20% annual return (IRR).

Avenida Funds: Investment Philosophy and Objectives

Avenida Funds operates with a clear objective to maximize investor returns while managing risk through diversified and well-structured CLO portfolios. The firm employs a strategic asset allocation approach, carefully selecting securities that offer the best risk-reward ratio. By integrating rigorous risk assessment and market analysis, Avenida Funds aims to capitalize on market inefficiencies and generate consistent returns across various market cycles.

The Avenida Management Team

The success of Avenida Funds is driven by its seasoned management team, comprising industry veterans with over two decades of experience in the CLO market. This team brings together a wealth of expertise from top financial institutions and credit management firms, offering deep insights into credit analysis, portfolio management, and risk control. Their extensive experience is pivotal in navigating complex market dynamics and making informed investment decisions that align with the strategic goals of the funds.

Experience and track record of the Avenida CLO Funds Team

- Experienced Team: Each key professional at Avenida CLOs Team has more than 20 years of experience in the asset class and the team has been working together as a CLO Fund management group since 2016.

- Team’s track record of +13% IRR in selecting CLOs subordinated notes dated back to 2001.

- CLO focus only: Avenida funds invest exclusively in CLO products with no use of leverage.

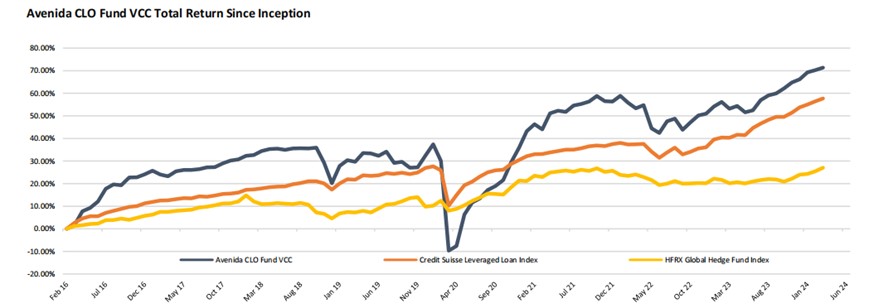

- Outperformance: Avenida CLO Funds provide professional access to invest in the asset class and have been outperforming their peer groups since their inception in 2016 and 2018.

- The team holds a strong belief that CLOs subordinated and debt notes will continue to provide a better medium-long term performance than other credit indices and most equity markets.

Avenida Team Key Members’ Biographies

- Massimo Paschetto, Partner and Senior Fund Manager at Mindful Wealth, has over 21 years of experience in CLO structuring and management. He holds a Business Administration degree from Bocconi University and has held senior positions at Goldman Sachs, DLJ, and Credit Suisse.

- Alberto de Micheli, Partner and Senior Investment Manager at Mindful Wealth, brings over 21 years of experience in CLO equity distribution and management. He has a strong background in economics and has held senior roles at Credit Suisse, specializing in structured products and derivatives.

- Stefano Paschetto, Senior Fund Manager at Mindful Wealth, has over 30 years of experience in finance and wealth management, including 11 years in CLO management. He graduated from Bocconi University with a degree in Business Administration and has held senior roles at BNP Paribas and Generation Asset Management.

CLICK HERE TO GET MORE INFORMATION

Investment Strategies of Avenida Funds

Diversification through Senior Secured Loans

Avenida Funds strategically focuses on senior secured loans, which form the backbone of its investment approach. These loans are secured against the assets of borrowing companies, providing a layer of protection against defaults. By investing primarily in these types of loans, Avenida Funds ensures a stable foundation for its CLO portfolios. The inherent security of these loans, combined with stringent selection criteria employed by the fund’s management, aims to mitigate risk while targeting competitive returns.

Emphasis on High-Quality CLO Debt Tranches

The Avenida CLO Bond Fund specifically targets investment-grade tranches, primarily those rated BBB. This approach is designed to balance yield with risk, as higher-rated tranches typically offer lower risk relative to equity or lower-rated debt tranches. By focusing on these safer tranches, Avenida Funds can offer investors a more secure investment option within the volatile credit markets, making it an attractive choice for conservative investors seeking exposure to the leveraged loan market.

Active Portfolio Management

Avenida Funds employs a hands-on management style that involves continuous monitoring and active trading within its CLO portfolios. The management team’s deep market knowledge and experience allow them to identify and act on trading opportunities that can enhance portfolio value. This active management approach is crucial in navigating the complexities of the CLO market, where changes in credit quality, interest rates, and economic conditions can significantly impact performance.

Utilization of Warehousing Strategies

Investing in CLO warehouses is a key strategy used by Avenida Funds, particularly in the early stages of CLO formation. Warehousing involves accumulating loans that will later be securitized into a CLO. This strategy allows the fund to secure attractive assets at potentially lower prices, thereby positioning the portfolio to benefit from future securitizations. It also provides the fund with the flexibility to shape the final composition of the CLO, aligning it more closely with the fund’s investment objectives.

Focus on Risk Mitigation

Risk management is integral to the investment strategy of Avenida Funds. The fund utilizes a variety of tools and approaches to assess and manage risk, including diversification across different issuers, industries, and geographic regions. Additionally, the fund regularly performs stress tests and scenario analyses to prepare for various market conditions. This proactive approach to risk management helps to protect the portfolio against unforeseen market shifts and to maintain stability in returns.

Strategic Refinancing and Reinvestment

Avenida Funds actively engages in the refinancing and reinvestment of its CLO holdings. This strategy involves replacing older loans with newer ones at more favourable terms or refinancing existing CLO tranches to take advantage of lower interest rates or improved credit terms. Such manoeuvres not only improve the fund’s yield but also extend the duration of income generation, which is vital for maintaining long-term portfolio health and investor satisfaction.

Overview of Avenida Funds

Avenida is a distinguished investment management firm specializing in Collateralized Loan Obligations. Established with the goal of delivering superior risk-adjusted returns, Avenida Funds has developed a robust portfolio focused on senior secured loans. The firm manages two primary investment vehicles: Avenida CLO Fund VCC and AOV Avenida CLO Bond Fund.

Avenida Management believes that to generate value when managing a portfolio of CLO notes, the following aspects are crucial:

- Understanding when the market is undervalued,

- Recognising securities and warehouse investment timing,

- Managing call and refinancing of Sub notes,

- Early involvement in new issuance discussions and negotiations

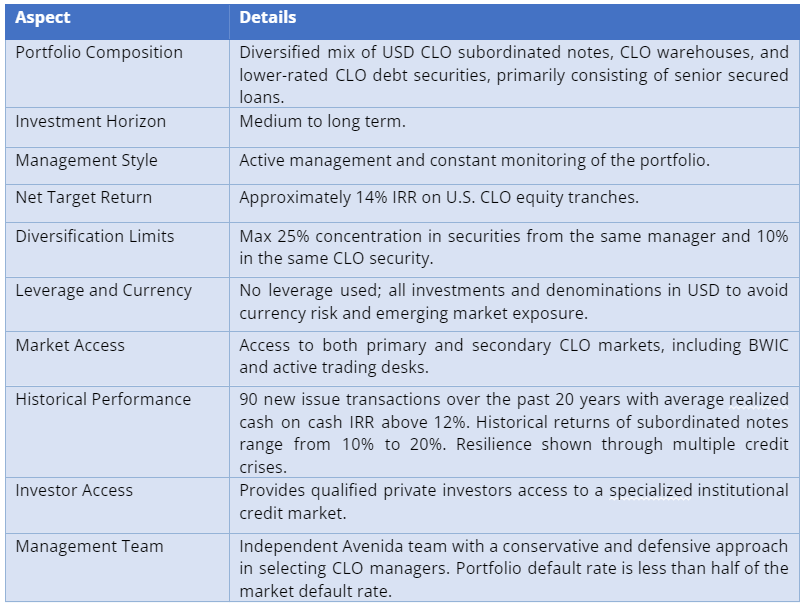

Avenida CLO Fund VCC

Avenida CLO Fund VCC: Primarily invests in subordinated notes and lower-rated tranches, typically targeting BB ratings, and CLO warehouses.

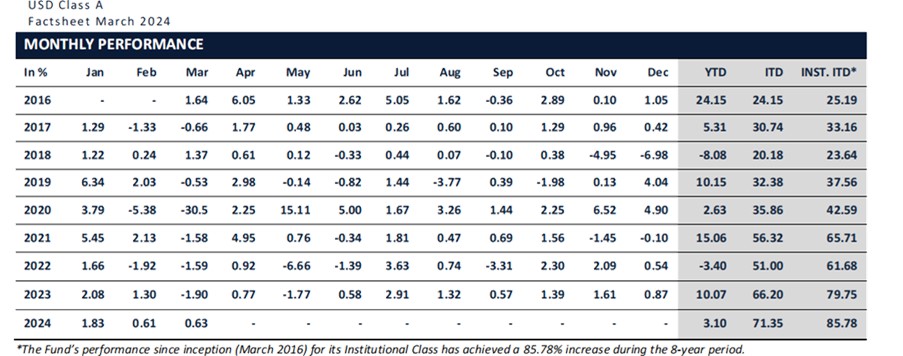

Avenida CLO Fund VCC Performance Summary

- YTD (2024): 3.10%

- ITD: 71.35% since inception

- Monthly Performance Highlights: The fund showed consistent positive returns in the first quarter of 2024, with 1.83% in January, 0.61% in February, and 0.63% in March.

- Historical Performance: The fund has demonstrated resilience and growth, particularly notable during the market recovery phases post-2020, achieving a cumulative increase of 85.78% over the 8-year period.

Fund Commentary

- The fund’s performance has been bolstered by strategic investments in CLO resets and refinancing opportunities, benefiting from tightened funding spreads, particularly for AAA to A CLO debt notes.

- The US loan market showed robust demand, supported by consumer resilience and a tight labour market. Despite inflation concerns, the loan market underperformed other fixed income assets in March, returning 0.85%, compared to higher returns in investment grade and high yield markets.

- The fund’s underlying portfolio, consisting of 98.59% senior secured loans and diversified across 1,279 obligors, mitigates risk while optimizing returns.

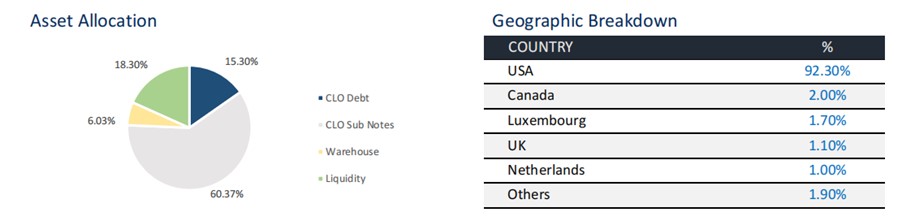

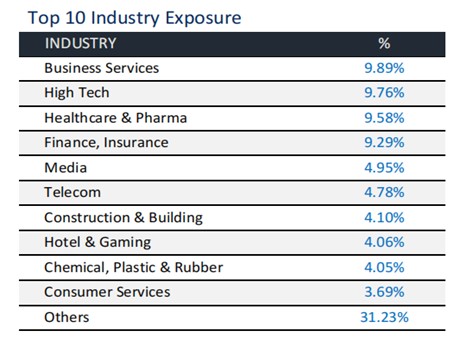

The fund’s allocation consists of 15.30% CLO debt, 60.37% CLO subordinated notes, 6.03% warehouse, and 18.30% liquidity. Geographically, the fund is predominantly exposed to the USA (92.30%), with minor exposures to Canada, Luxembourg, the UK, the Netherlands, and other regions. The fund is diversified across various sectors, including business services, high tech, healthcare & pharma, and others. The top 10 credit exposures sum up to 6.53% of the entire portfolio.

The fund’s performance is attributed to a multifaceted strategy, which includes:

- Strategic Fund Management: The Avenida CLO Fund VCC (Institutional) combines greater diversification with conservative portfolio management, mitigating market volatility while emphasizing stable, long-term investment returns.

- Selective Positioning and Warehouse Participation: The fund strategically positions itself in new issues while actively participating in warehouses, balancing potential risks and rewards effectively.

- Optimized Financial Strategies: The fund enhances its investment capacity by optimizing financial leverage through low-cost collateral loan markets or cost-effective CLO liabilities, coupled with dynamic tactical allocation that continuously adjusts between CLO equities, warehouses, and CLO BB debt notes to adeptly respond to changing market conditions.

- Proactive Refinancing and Resetting: Active management in refinancing and resetting of CLO sub-notes within the portfolio is a critical component, aimed at improving the fund’s interest rate profiles and reducing costs.

- Selection of Top-tier Managers: Lastly, the selection of best-in-class managers ensures expert handling of the fund’s strategies and operations, underpinning the overall success of the fund.

Avenida CLO Bond Fund

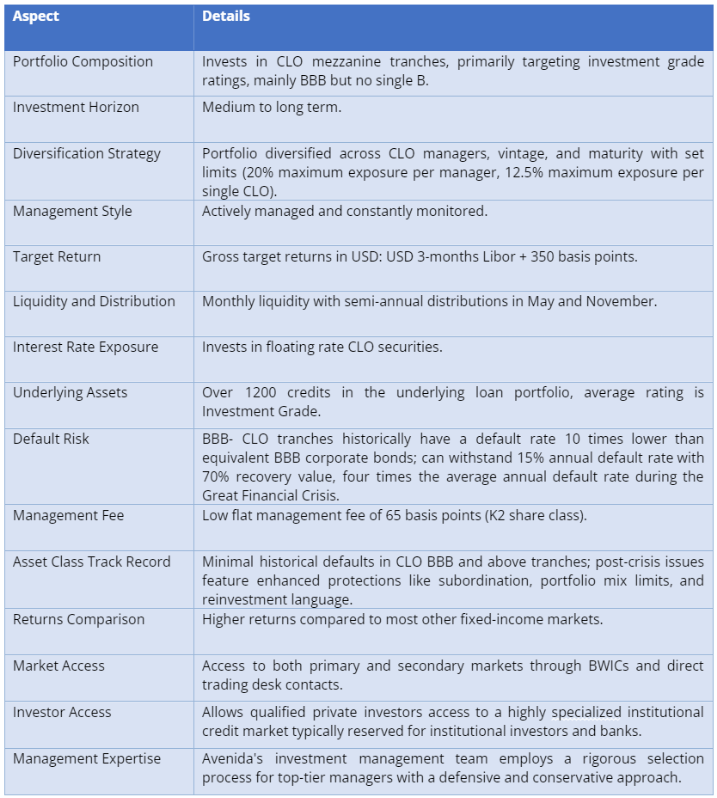

AOV Avenida CLO Bond Fund: Focuses on higher-rated CLO debt tranches, maintaining an investment-grade target, predominantly in the BBB category

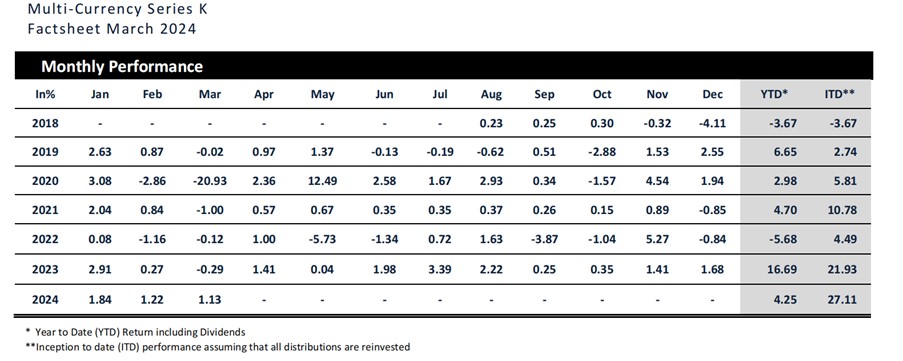

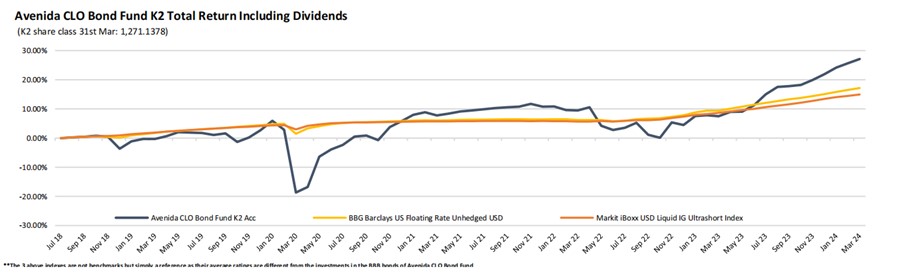

AOV Avenida CLO Bond Fund Performance Summary

- YTD (2024): 4.25% for K2 share class

- ITD: 27.11% for K2 share class since inception

- Monthly Performance Highlights: The fund posted positive returns in the first quarter of 2024, with January (1.84%), February (1.22%), and March (1.13%) contributing to the overall YTD performance.

- Historical Performance: Despite volatility in 2020, the fund rebounded strongly, with notable gains in 2021 and 2023, reflecting its robust investment strategy and market adaptability.

Fund commentary

- Following continued loan market appreciation, all but one CLO debt note increased by an average of 0.50% this month, contributing to positive performance. The weighted average price of BBB CLO notes in the portfolio rose to 97.11%, yielding 9.03%.

- Most BBB CLO notes are past their reinvestment period, allowing CLO managers to use loan repayments to pay down AAA notes first, which will improve the ratings of the remaining notes. As these CLO securities are trading below par, they are expected to rise towards par soon.

- In a higher interest rate environment, CLOs are expected to provide high returns and outperform other liquid credit products. The portfolio is well-diversified across 12 CLO debt notes managed by different managers, including 1,278 obligors. It has 98.98% exposure to senior secured loans and 1.02% to second lien loans, with the top 10 obligors representing 6.65% of the portfolio.

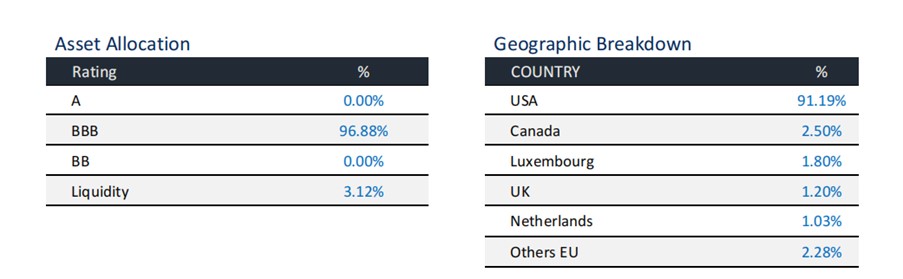

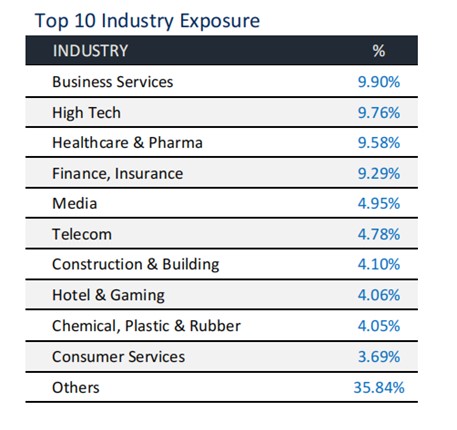

The fund’s allocation is predominantly in the USA (91.19%), with smaller exposures to Canada (2.50%), Luxembourg (1.80%), the UK (1.20%), the Netherlands (1.03%), and other EU countries (2.28%). The portfolio is heavily weighted towards BBB-rated securities (96.88%) and holds 3.12% in liquidity. The top industry exposures include business services (9.90%), high tech (9.76%), healthcare and pharma (9.58%), and finance and insurance (9.29%). Significant loan issuers in the portfolio are Liberty Global (1.26%), Altice NV (0.89%), Asurion (0.84%), Ineos (0.67%), and Virgin Media (0.58%).

CLICK HERE TO GET MORE INFORMATION

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.