Together with…

Introduction

Microcredit involves lending very small sums to individuals who lack access to traditional banking services to start or expand a small business. The loans are lent with customized repayment terms and no collateral requirements for borrower’s relief. It’s typically provided to poverty-stricken populations in developing countries, enabling them to become microentrepreneurs and ultimately fostering an environment of financial inclusion.

These loans are managed by microfinance institutions (MFIs), non-profit organizations (NGOs), banks and and community banks. By facilitating capital, these micro-aids result in a significant positive impact on economic empowerment and holistic growth of the country. However, financial institutions often face challenges in obtaining funding and managing the risks associated with the process. One solution is the issuance of bonds with collateral as the underlying asset.

Collateral-Backed Bonds

A bond is an interest-bearing instrument representing a loan from an investor to an issuer, who can use the funds for various purposes, including lending to others. Bonds can be issued by governments, municipalities, corporations, or other entities, and they usually pay regular interest and repay the principal at maturity. If the bonds have collateral, they are called secured bonds. Collateral, which can be any asset such as real estate, equipment or receivables, provides additional security to bondholders, ensuring repayment in the event of default.

CLICK HERE TO GET MORE INFORMATION

Important Aspects of Secured Bonds

Foundational Resources: A specific source of assets, such as debt (from credit card debt, mortgages, auto loans, or other loans), rent, or other assets, might support these bonds.

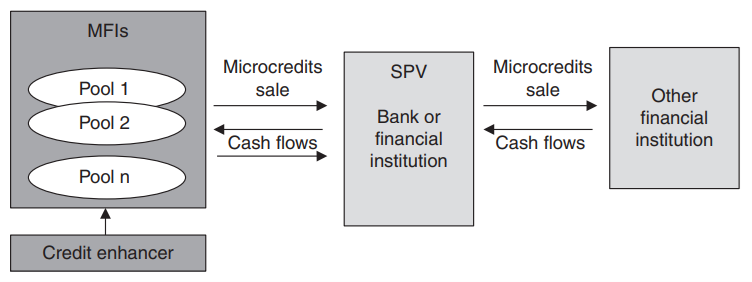

Structure: The ownership of the underlying asset is transferred to a special purpose vehicle (SPV) in order for the bond to be issued. To pay investors, the SPV takes advantage of the cash flow from the underlying assets.

Hedging: By combining a range of assets, secured bonds aim to lessen exposure to certain risks. For instance, the risk associated with mortgage-backed securities (MBS) is dispersed throughout several mortgages as opposed to being concentrated on a single loan.

Cash Flow Method: A secured bond is a debt instrument where investors provide capital to an issuer in exchange for periodic interest payments and the return of the principal at maturity. The bond’s repayment is secured by specific assets of the issuer. This structure can incorporate various bond and equity classes within a framework, offering different yield profiles and risk levels.

Credit Enhancement: In order to increase creditworthiness, covered bonds frequently go through processes like insurance, reserves, or consolidation, in which the value of the underlying assets exceeds the bond’s issued value.

Legal Framework: Each country has different requirements for surety bond compliance and regulatory control. Issuers have to abide by a number of guidelines and disclosures to guarantee transparency and investor protection.

The Evolution of the Microcredit Industry

Muhammad Yunus, a Nobel laureate, established the Grameen Bank in Bangladesh during the 1970s, and his efforts are credited with giving rise to the notion of microcredit. Yunus with his panoramic vision proved that giving little loans to the underprivileged might make a big difference in both economic growth and the reduction of poverty. Global microfinance growth has increased the demand for creative funding sources to sustain these organizations.

The increasing demand could not be met by traditional financing sources like grants and contributions. The notion of securitizing microloans and producing securities backed by microcredit surfaced as a key solution in this context.

BRAC in Bangladesh, one of the largest MFIs globally, is using this method to fund its activities effectively. In 2006, BRAC raised $180 million in the first microloan securitization in Bangladesh. The transaction involved combining a group of small loans and issuing bonds backed by them. The positive outcome not only gave BRAC essential funds but also showed other microfinance institutions the potential of microcredit-backed securities.

Another leading financial institution in India, SKS Microfinance, has utilized securitization to enhance its funding opportunities. By 2010, SKS had microloans worth more than $200 million. This allowed the organization to grow quickly and serve millions of borrowers throughout India. The securitization process additionally assisted SKS in broadening its funding sources and lowering its reliance on conventional bank loans and grants.

Structure and Mechanics of Microcredit-backed Securities

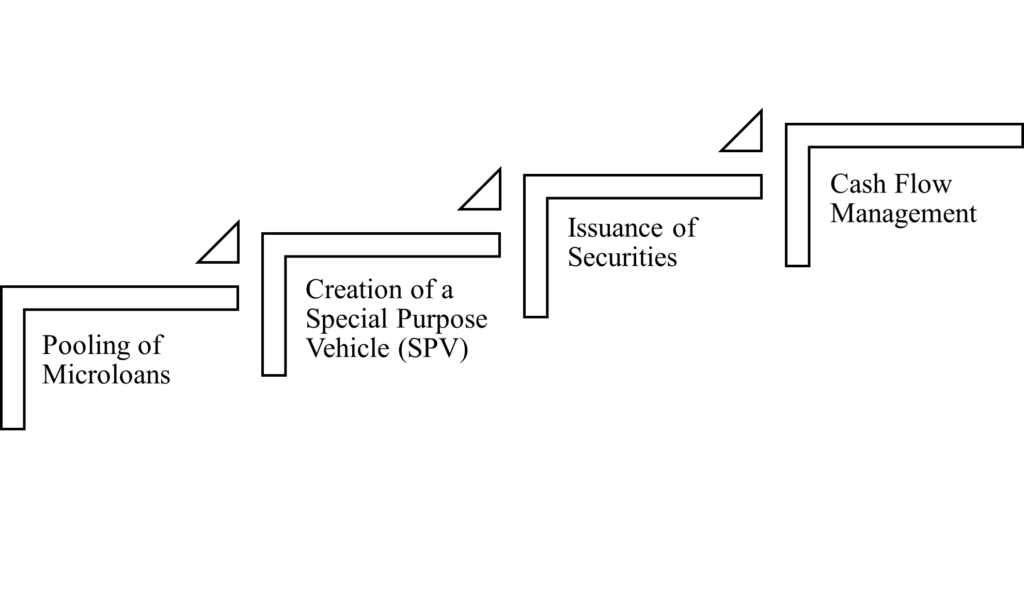

Microcredit-backed securities are built through a process called securitization; the steps are as follows:

- Pooling of Microloans – The MFI pools together a portfolio of diverse microloans across various sectors, and geographical regions to alleviate risk, which serves as the collateral for the securities. It’s generally provided to small businesses so flattening the risk factor is crucial in choosing the right set of microloans. Whether the pool of loans will be homogenous or heterogeneous depends on the MFI’s securitization. In the selection of the loan process, different factors are taken into consideration for a high probability of loan repayment, for example, history of payments, creditworthiness, etc.

- Creation of a Special Purpose Vehicle (SPV) – In this process establishment of an SPV takes place which is a separate legal entity from its MFI so that if any unfavourable financial condition occurs it doesn’t affect its MFI’s other operations and isolates the microloans. It provides a protective layer for the investors. By taking ownership, the SPV handles the cash flow of the loans, from timely repayments of the principal amount with the interest to the investors. This legal entity is responsible for issuing the securities and holding the collateral.

- Issuance of Securities – Securities are issued to investors through SPVs which are structured in different tranches that cater to different types of risk and return requirements of the investors. SPVs might also provide credit enhancements through different ways of collateralizing the microloans. In the process, MFIs employ different credit rating agencies to assess the creditworthiness of the SPV.

- Cash Flow Management – The SPVs manage the cash flows that are generated from the microloan repayments of principal and interest and then the distribution of funds takes place in a hierarchical manner from senior tranche holders to junior tranche holders. There is continuous monitoring and reporting of the performance of the SPV for a transparent flow of information to the investors for maintaining the goodwill and trust between the parties involved.

Conclusion

Microcredit-backed loans represent a new financial product that presents unique challenges and offers significant benefits. The creation of Microcredit-backed securities, which involves the consolidation of microfinance, the transfer to special purpose entities and the issuance of banks that guarantee these loans, provides a great diversification of income and risk for MFIs while attracting more investors. This infrastructure is reinforced by several entities, including administrators, investors, etc., ensuring that it is closely controlled and secure.

Microcredit-backed securities for MFIs are doors that open access to capital markets, reducing reliance on a traditional source of financing and enabling the expansion of financial services to underprivileged populations. For investors, Microcredit-backed securities offer socially responsible investment opportunities with attractive returns and diversified risk potential. It has a profound social impact and contributes to poverty reduction, economic empowerment and financial inclusion.

CLICK HERE TO GET MORE INFORMATION

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.