Together with…

Loan Market

The US economy continues to display resilience, buoyed by strong consumer demand and a tight labour market. However, inflation remains above (3.4%) the Federal Reserve’s target (2%), with public comments from the Fed indicating that rate cuts may be deferred further. In this economic landscape, the loan market has yet to catch up with other fixed-income asset classes, as investment grade and high-yield bond spreads reached new cycle lows amidst volatile treasury yields.

Market Activity

Leveraged loan demand has remained robust through during the entire first half of the year.

The primary market had in May its busiest month on record, as total deal activity was $180 billion. With the majority of loans trading above par, another wave of re-pricings ensued in the last month. Total monthly repricing volume reached a record of $119 billion, while the YTD volume is currently tracking a record high of $306 billion for the comparable period. Total institutional volume net of repricings increased to $47.4 billion from $34.1 billion in April, as acquisition-related deals began to re-emerge in the market

In March alone, 56 US CLOs priced at a total of $25.0 billion, with $10.7 billion excluding refinancing and $14.3 billion in refinancing. The primary market saw a surge in opportunistic deals, surpassing February levels as secondary prices rallied. Notably, refinancing transactions are now being executed for capital structures that were previously financed in private credit markets, reversing last year’s trend. Loans trading at par and above saw a significant increase from 21% in February to 60% before the end of June.

CLICK HERE TO GET MORE INFORMATION

Demand Dynamics

Retail loan funds’ inflows has picked up further in the last quarter, bringing the YTD tally to $7.4 billion. This is supported by demand under the “higher for longer” narrative. This inflow maintained secondary market strength, with a strong CLO bid for discounted paper facilitating new CLO creation and curing overcollateralization declines in existing portfolios. The percentage of CCC and distressed issuers has decreased from 10% to 8% since the start of the year, with 12% of the CCC being prepaid.

CLO Market Update – 2024

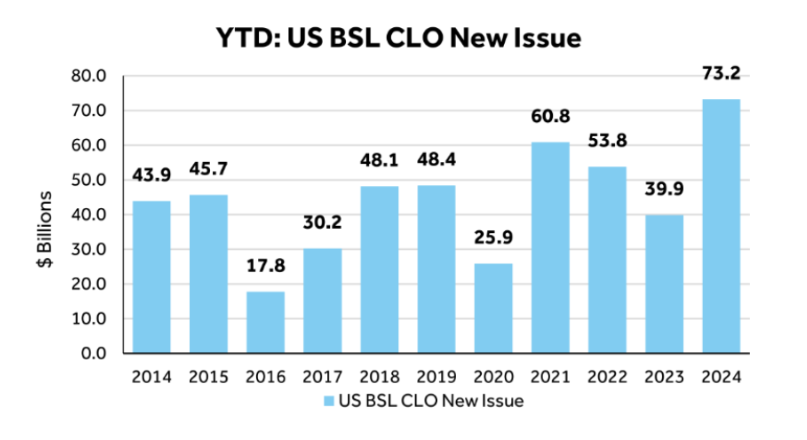

US BSL CLO new issuance has continued its record pace year-to-date as it shows the below graphs.

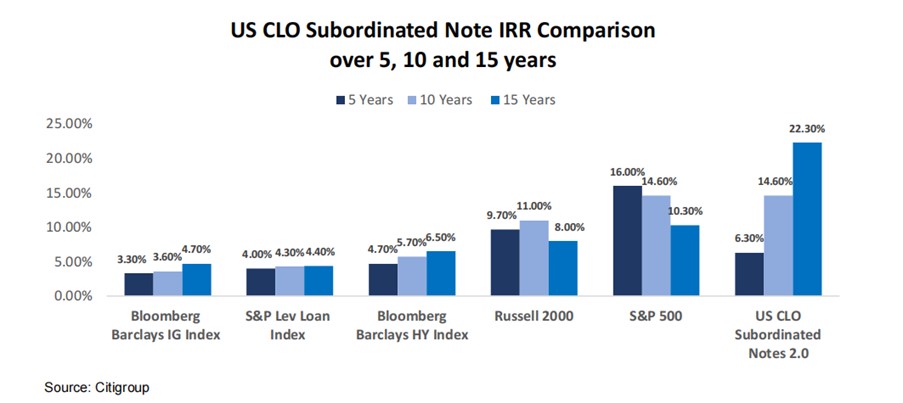

The Collateralized Loan Obligations market has demonstrated remarkable resilience and strong performance, especially when compared to other fixed-income and credit indices, as well as most stock markets. In this update, we will explore the factors contributing to this outperformance, highlight specific fund performances, and discuss future outlooks for the CLO market.

CLICK HERE TO GET MORE INFORMATION

2022-2023 Performance Review

2022: Resilience in Volatility

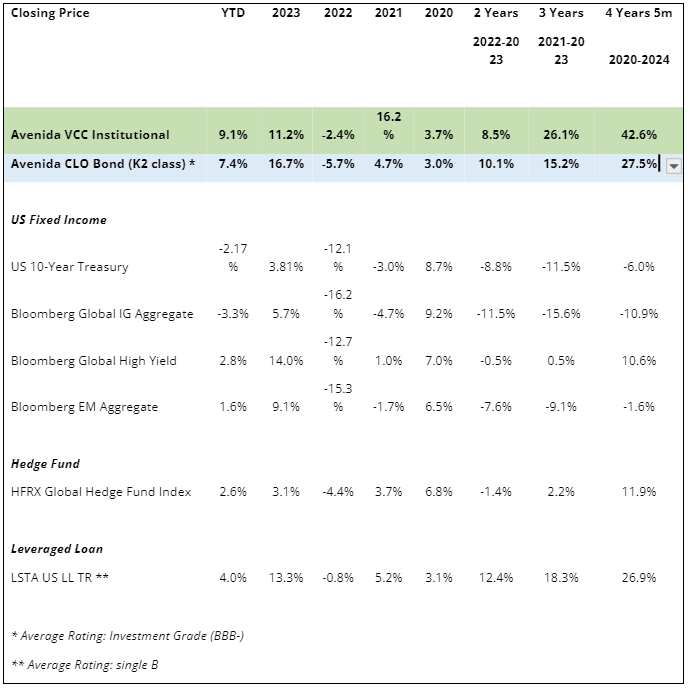

Despite the rise in interest rates and widening of credit spreads in 2022, CLOs outperformed the fixed-rate bond sector, including High Yield, Investment Grade, and Government bonds, by 10-14 percentage points. This performance was primarily due to their structure, which allows them to benefit from higher spreads even during periods of market volatility.

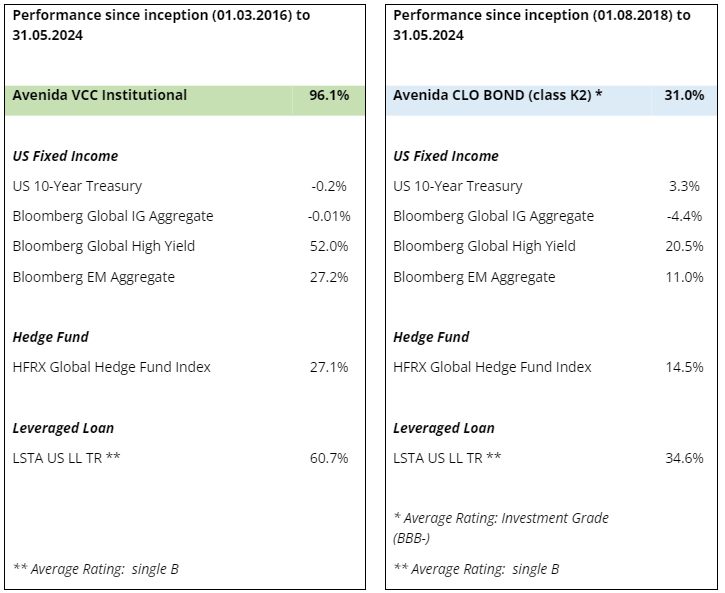

2023: Rapid Recovery

CLOs continued to prove their robustness in 2023. After initial corrections due to the credit spread widening, they recovered swiftly, leveraging the rising interest rates to their advantage. For instance, the Avenida CLO Bond Fund, which selects CLO BBB rated tranches, delivered a return of +16.7% in 2023 and an impressive 31% since the October 2022 correction. Similarly, the Avenida CLO VCC Fund, which invests in CLO Sub-notes, CLO BBs, and Warehouses, posted a return of 11.2% in 2023 and 29.2% since the July 2022 decline. This fund has achieved a cumulative return of +96.2% since its inception eight years ago. De facto, investing in CLO BBs alongside investments in CLO equity effectively synthetically creates a lower-leveraged loan exposure that offer better risk-adjusted returns if historical performance trends persist.

Factors Driving CLO Performance

Interest Rate Environment

CLOs are structured to benefit from rising interest rates due to their floating-rate nature. Even if interest rates were to decrease by 2-3 percentage points, CLO’s coupons would still offer higher yields than comparable bonds, making them an attractive investment.

Low Default Rates

Historically, the default rates for BB- or BBB-rated CLO tranches have been significantly lower, only 10-12% of comparable corporate bonds of equivalent ratings. This trend has been consistent over the past 20 years, providing a stable foundation for CLO investments.

Credit Risk and Market Outlook

While credit risk remains a consideration, current market prices have already discounted potential defaults. The anticipated economic slowdown has been long expected, allowing companies and CLO managers ample time to prepare. Companies have restructured and reviewed growth plans, reducing capex and non-strategic spending. CLO managers have proactively adjusted loan portfolios to mitigate risks associated with inflation, high interest rates, and economic slowdown.

CLICK HERE TO GET MORE INFORMATION

Conclusion and Future Expectations

Our specialists in the CLO market remains optimistic about the future performance of CLO investments, particularly in Junior notes, BBs, and BBBs. These investments are expected to continue outperforming other credit and fixed-income indices, as well as many equity indices.

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.