Together with…

Introduction

The market uncertainty surrounding rising interest rates presents a significant challenge for investors seeking to enhance portfolio resilience and maintain targeted returns. Collateralized Loan Obligations (CLOs) are a tool with potential for risk mitigation and strategic diversification within a fixed-income portfolio during market fluctuations. Conventional fixed-rate bonds, for instance, are susceptible to price depreciation when interest rates rise due to their inherent duration risk. This highlights the need for investment vehicles that exhibit lower sensitivity to interest rate fluctuations.

Interest Rate Duration Risk

Duration gauges a bond’s sensitivity to interest rate shifts. Contrary to conventional fixed-rate bonds, Collateralized Loan Obligations are frequently designed as floating-rate instruments. This implies that their interest payments adapt to prevailing market rates, in contrast to fixed-rate bonds with predetermined interest rates.

In times of rising market interest rates, fixed-rate bond prices typically decline due to decreased attractiveness compared to new bonds issued at higher rates—referred to as interest rate risk or duration risk. However, the impact is less pronounced for CLOs, given their floating-rate structure. As market rates increase, CLO interest payments rise proportionately, resulting in lower sensitivity to interest rate changes. Consequently, CLOs exhibit diminished interest rate and duration risk compared to their fixed-rate counterparts.

In a scenario characterized by heightened inflation and increasing interest rates, consider the performance of the BBB-rated corporate bond index, which incurred a substantial 17% loss year-to-date through November 18, 2022. In contrast, the BBB-rated CLO index faced a more moderate 5% loss during the same period. This serves as a demonstration of how the floating-rate characteristic inherent in CLOs acts to alleviate duration risk, providing a protective buffer for investors in environments where interest rates are on the upswing.

CLICK HERE TO GET MORE INFORMATION

Diversification in Bond and CLO Portfolios

Achieving diversification in a bond portfolio involves spreading investments across different bond types, issuers, maturities, and credit ratings. This approach is designed to minimize the impact of a single bond or issuer on the overall portfolio performance. Similarly, diversification is beneficial for Collateralized Loan Obligations portfolios. A typical CLO portfolio comprises a multitude of broadly syndicated loans (BSLs) from diverse industries and sectors, reducing the risk associated with individual loans or sectors.

Active management is a crucial element in both bond and CLO portfolio management, requiring vigilant monitoring of the market and timely adjustments to the portfolio. This proactive approach has the potential to generate higher returns and reduce risk compared to a passive strategy. Specifically, active management is vital for CLOs during periods of economic uncertainty. CLO managers proactively adjust their portfolio exposure to mitigate the risk of downgrades and defaults, reducing the risk of downgrades to the CLO tranches themselves.

Compared to a bond portfolio, a CLO portfolio provides enhanced diversification due to several factors:

- Industry Variety: CLOs are generally more diversified, backed by the debt of a wide range of industries, reducing dependence on the success of a single industry or sector.

- Collateralization: CLOs are collateralized by the assets of debt-issuing companies, offering an additional layer of security for investors.

- Senior Positions: CLOs often hold senior positions in corporate capital streams, positioning CLO investors among the first to be repaid in the event of a default.

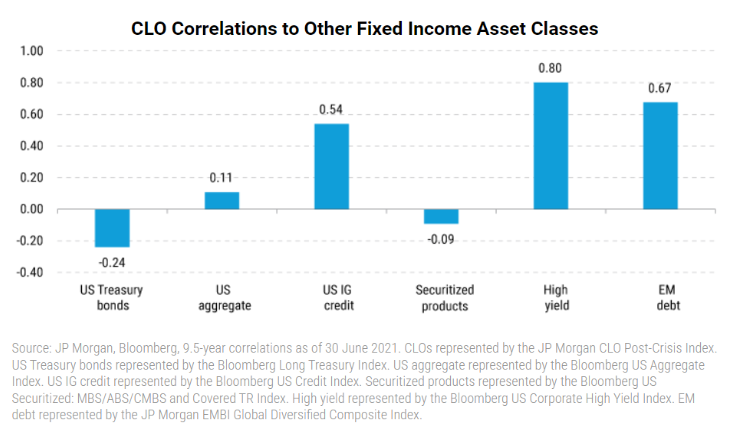

- Low Correlation: Historically, CLOs have demonstrated relatively low correlation with other fixed income categories, enhancing effective diversification in a broader portfolio.

- Large Number of Loans: A typical CLO portfolio includes numerous BSLs from various industries and sectors, further reducing the risk associated with any individual loan or sector.

- Active Management: CLO managers actively adjust their portfolio exposure to mitigate the risk of downgrades and defaults, minimizing the risk to CLO tranches.

Historical Defaults and Recovery Rates Comparison

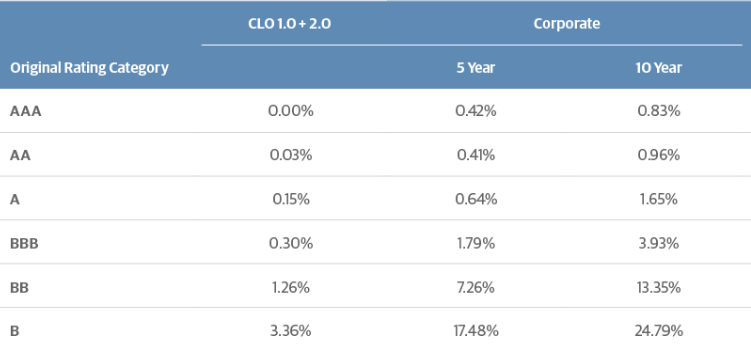

CLOs’ historically low default rate across the rating spectrum compares favourably to corporate debt.

*CLO 1.0s (CLOs that were issued before the GFC), CLO 2.0s (CLOs issued after the GFC)

In 2022, defaults and downgrades within Collateralized Loan Obligations were confined to U.S. tranches. The assets of these defaulting tranches had experienced a decline in quality both amid the COVID-19 pandemic and during the heightened defaults in 2016, sparked by volatility in oil and gas prices. Despite the defaults, the CLO default rate remained relatively low at 0.07%, and the downgrade rate decreased by half to 0.10%.

CLO tranche defaults typically occur after corporate defaults, partly due to the inherent structure of CLOs, allowing for the deferral of interest on junior tranches. While this feature enables CLOs to endure periods of credit stress, it may pose challenges for the deferring notes to fully repay during the amortization period. Nevertheless, over the past 25 years, CLO tranches have consistently demonstrated lower default rates compared to corporate entities.

The European Collateralized Loan Obligation (CLO) sector encountered its initial defaults in 2015, with the default rate swiftly rising to 0.81% in 2016. Subsequently, default rates have consistently decreased. In 2022, the credit ratings of European CLOs exhibited greater stability, experiencing fewer negative rating actions compared to U.S. CLOs. Remarkably, for the second consecutive year, there were no downgrades or defaults among European CLOs. In contrast to U.S. CLOs, European CLOs observed a one-percentage-point increase in their upgrade rate, reaching 1.74%, marking their highest upgrade rate since 2019.

CLICK HERE TO GET MORE INFORMATION

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.