Together with…

Introduction

Fixed-income investments, characterized by consistent interest payments and principal return upon maturity, constitute a crucial component of a well-diversified portfolio. Fixed-income investments include Treasury bonds, TIPS, Municipal bonds, corporate bonds and so on. In this domain, REITs ensure stability through real estate investments, Subordinated Bank Bonds offer distinctive risk positioning and Leveraged Loans present appealing yields. Analysing Collateralized Loan Obligations (CLOs), supported by corporate credit alongside traditional corporate bonds provides valuable insights into the nuanced world of fixed-income investments aiding decision-making.

Real Estate (REITs and Funds)

A Real Estate Investment Trust, or REIT, is an entity that possesses, manages or provides funding for properties that generate income. Like mutual funds, REITs aggregate the resources of multiple investors, enabling individuals to receive dividends from property investments without the need to purchase, oversee or finance any properties on their own.

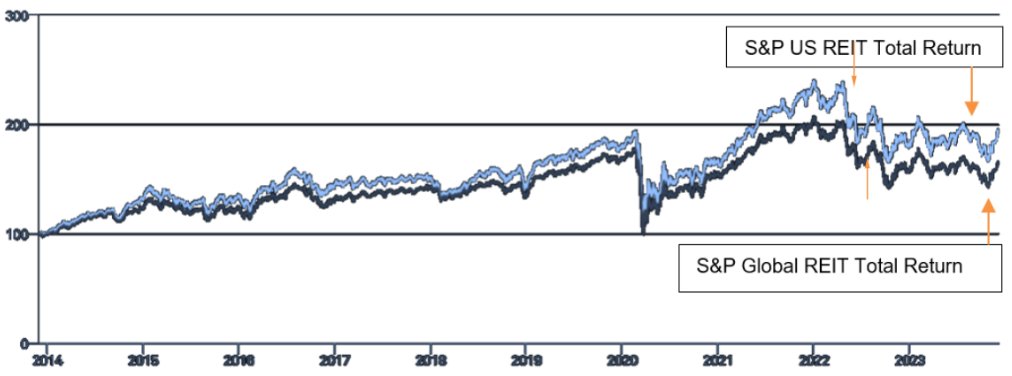

REITs provide a consistent revenue stream for investors, although they typically offer limited capital growth. Most REITs are publicly traded, akin to stocks, which grants them high liquidity, unlike tangible property investments. They invest in a wide range of property types, encompassing apartment complexes, cell towers, data centres, hotels, healthcare facilities, office buildings, retail centres and warehouses. The performance of REITs over the last 10 years has been quite robust with the S&P US REIT index delivering a 6.73% annualized total return and the S&P Global REIT index delivering a 5.16% annualized total return.

S&P Global Ratings predicts a substantial 10% to 24% decline in real estate valuations for rated European issuers from June 2022 to December 2024, influenced by rapidly rising interest rates impacting capitalization rates. Although rental growth is expected to partly offset the valuation decrease, challenges include logistics valuations falling significantly, with offices anticipated to face larger declines. Limited transactions, rising refinancing risks and discrepancies in reported yields contribute to repricing uncertainties. European REITs have not fully adjusted to the new interest rate reality, prompting expectations of further repricing, especially as the European Central Bank’s deposit rates have recently been reaching new highs.

According to NAREIT, REITs of all types collectively own more than $4 trillion in gross assets across the U.S., with public REITs owning approximately $2.5 trillion in assets. U.S.-listed REITs have an equity market capitalization of more than $1.3 trillion. U.S. public REITs own an estimated 575,000 properties and 15 million acres of timberland across the U.S.

CLICK HERE TO GET MORE INFORMATION

Subordinated Bank Bonds

Bank bonds are bonds issued by banks to meet their growth and working capital requirements. They offer an alternative way to achieve portfolio diversification. Subordinated bank bonds represent a category of bonds that are ranked lower than other senior loans or securities when it comes to claims on assets or earnings. These are riskier than senior debt since if the borrower defaults, the creditors who hold subordinated debt will only receive payment after the full payment of senior bondholders. However, holders of subordinated debt may benefit from a higher interest rate as a form of compensation for the potential risk of default.

In terms of interest rate risk, subordinated debt is exposed to the risk of value fluctuations due to changes in interest rates. This implies that when interest rates increase, bond prices decrease, and vice versa. This risk is especially relevant for subordinated bank bonds, as they are frequently issued with long-term maturities.

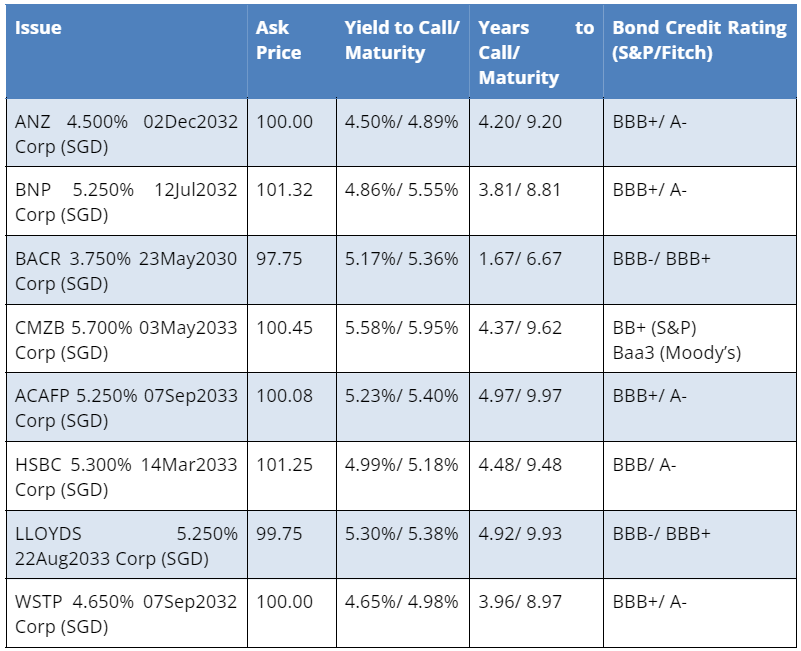

SGD-denominated bank bonds have been relatively popular in 2023 despite March’s banking crisis. Year-to-date, bonds issued from the financial sector represent the majority of the SGD issuances in 2023, at close to 74.4%, according to Bloomberg. This figure is also the highest we have seen in recent years, greatly exceeding 55.5% in 2020, 53.0% in 2021 and 45.9% in 2022. Likewise, the volume of issuances from the financial sector has been the highest seen in recent years.

Leveraged Loan

A leveraged loan, also known as a floating-rate or bank loan, is a form of financial assistance extended to entities with substantial debt or less-than-ideal credit standings. Given the elevated default risk associated with such borrowers, these loans entail increased costs and typically carry higher interest rates.

These financial arrangements are commonly structured, organised and overseen by one or more commercial or investment banks, often referred to as arrangers. To mitigate risk, these arrangers may engage in loan syndication, involving the sale of the loan to other banks or investors. Companies frequently utilize leveraged loans for diverse purposes, including financing mergers and acquisitions (M&A), recapitalizing balance sheets, refinancing debt or meeting general corporate needs.

S&P’s Leveraged Commentary & Data (LCD) categorizes a loan as leveraged if it carries a rating of BB- or lower. Alternatively, a nonrated loan or one rated BBB- or higher may be deemed leveraged if secured by a first or second lien. The heightened interest rates associated with leveraged loans can potentially yield increased returns for fund investors, rendering them an appealing investment for portfolio managers.

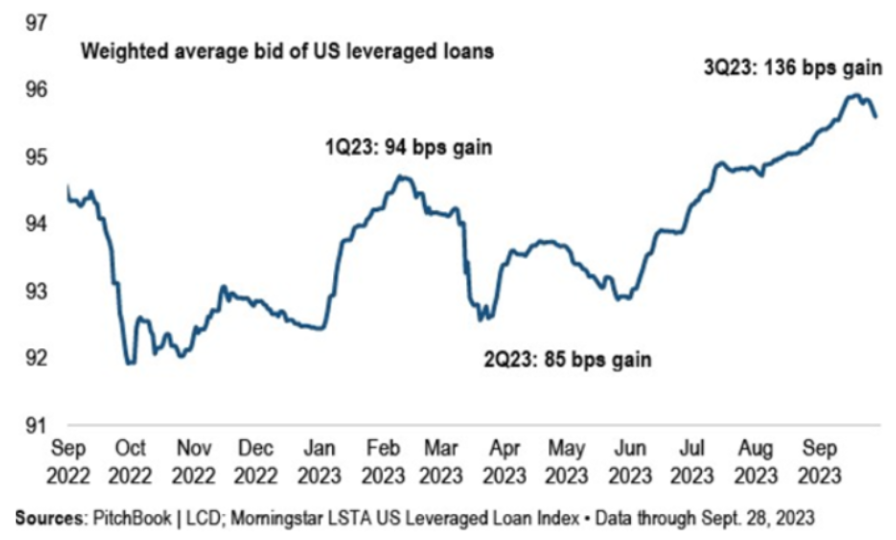

During the third quarter of 2023, there was a significant increase in the issuance of US leveraged loans, amounting to approximately $76 billion. This surge was the highest observed since the Federal Reserve began to aggressively raise interest rates, a move driven by escalating inflation and looming recession fears. Concurrently, the average bid on loan issues in the Morningstar LSTA US Leveraged Loan Index saw a steady rise over the third quarter. This upward trend resulted in a return of 3.46% for the asset class during this period, marking the highest return since Q4 2020.

However, it is important to note that the leveraged loan default rate is projected to increase from 1.42% in April 2023 to its long-term average of 2.5% by March 2024, due to ongoing credit challenges.

CLICK HERE TO GET MORE INFORMATION

Collateralized Loan Obligation

A Collateralized Loan Obligation (CLO) refers to a collection of predominantly leveraged loans bundled together, securitized, and overseen as a fund. A portfolio of loans acts as the collateral supporting a CLO. The primary assets are usually senior secured loans, enjoying priority repayment in case of insolvency compared to other creditors. Each CLO is organized into various tranches, consisting of interest-bearing bonds and a limited share of equity. CLOs are a $970 billion asset class within the broader $12 trillion structured credit fixed-income market, which also includes asset-backed securities (ABS).

Current Credit Spreads

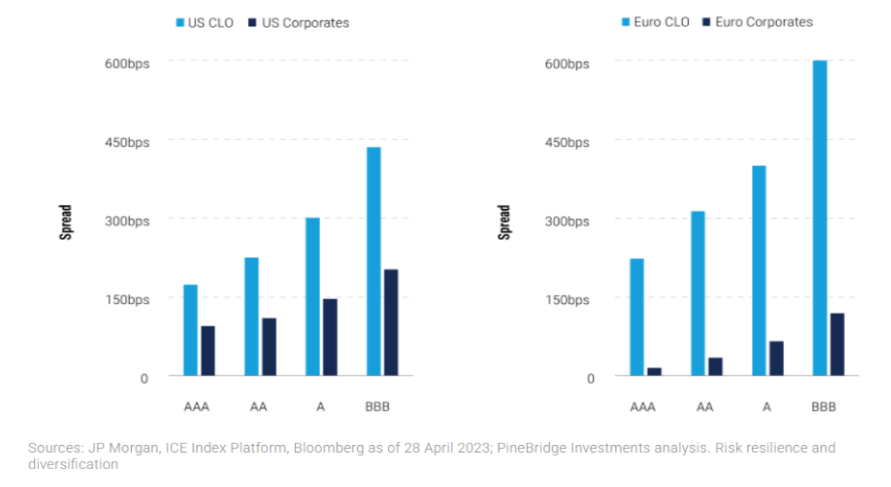

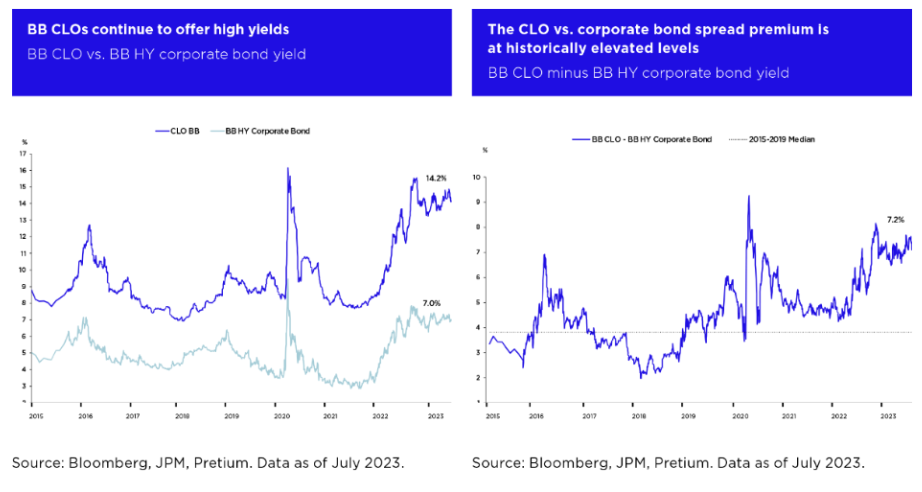

CLO spreads, wider than those of alternative debt instruments, result from the increased intricacy, diminished liquidity and regulatory demands associated with Collateralized Loan Obligations. When contrasted with investment-grade corporates and other high-yield debt sectors like high-yield and bank loans, CLO spreads present a particularly interesting proposition.

Current Yields

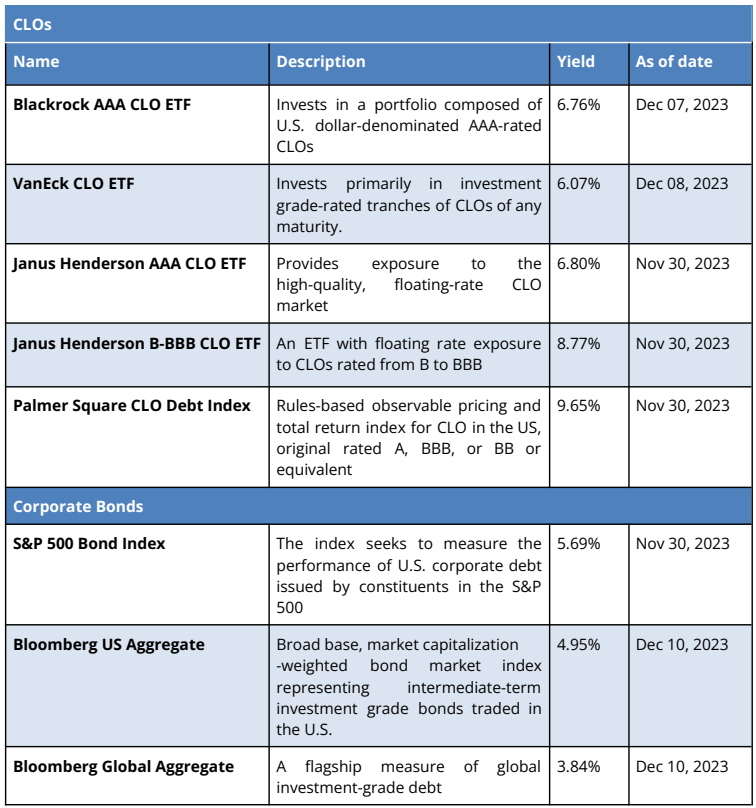

CLOs typically offer higher yields than other fixed-income investments such as investment-grade corporate bonds. The below table compares the yields offered by top CLO ETFs and indices with those of Corporate Bond and investment-grade bond indices.

CLICK HERE TO GET MORE INFORMATION

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.