“Allowing private companies to finance their projects through the issuance of alternative debt instruments. Ensuring innovative returns to qualified investors interested in financing the growth of the real economy.”

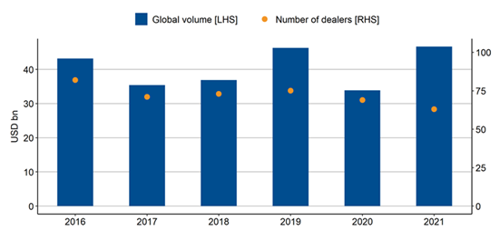

CLN Market Opportunity

The issuance of CLNs during year 2021 experienced a major increase, the total value of CLNs reached more than $46 billion globally. At the moment, there is no final data for the year 2022.

Tracing the trend of previous years, a global value of about $40 billion was recorded in 2016, and then declined slightly in the following two years. In 2019 there was an upturn until a record value was reached, about $45 billion, then passed in 2021, despite a complicated 2020 characterized by a lower global volume.

Since these are financial transactions agreed between two private and non-public market counterparties, access to historical information and data is often complicated by the nature of the transactions and the related market.

The increase in the volume of CLNs globally, has been mainly driven by increased use of these instruments in the Chinese market.

The difficulty of access by Western investors and numerous obstacles for Chinese companies to raise debt capital outside their borders through the domestic banking system has encouraged a rise in deals between qualified private counterparties.

German banks, historically very familiar with the use of structured financial products, in particular LBBW (Landesbank Baden-Württemberg), have also become among the leading players in this market, performing well in the CLN space.

Product Description

The main characteristics of Credit Linked Notes are:

- Credit Linked Notes are financial instruments, representing debt securities, through which a private company raises capital from qualified and/or institutional investors.

- They are financial products with an ISIN code, listed on regulated markets and listed on Bloomberg Terminal, the most widely used financial information platform in the world for qualified and institutional investors.

- The solidity of these products is linked to the creditworthiness of the target company to which investors lend money.

- The companies receiving the loan may decide to “collateralize” it with their own assets in order to make the repayment of the loaned capital more secure.

- Through ownership of the CLN, investors who lend money receive, in the form of a financial return, the interest paid by the target company on the line of credit received.

CLN As Company Funding Source

Example Scenario: a company is seeking financing (e.g., EUR 10 million) for a new business or development project. It decides to approach private/qualified investors (e.g. family offices, high net worth individuals, holding companies, private funds) for financing.

Traditionally available fundraising options may not be satisfactory for the following reasons;

- A conventional loan provided by banks may be too expensive or excessively burden the target company’s creditworthiness.

- The amount needed by the target company might be too low to justify a bond issue and the associated costs.

- Raising capital stock may not be acceptable to avoid further shareholder dilution.

One solution to these problems is the issuance of a CLN, aimed at raising the necessary capital for the firm from a network of private investors to whom it is intended to guarantee the proper execution of the deal through a regulated vehicle capable of complying with precise rules. These rules are defined by the financial supervisory authorities of the countries from which the CLN is issued, for the protection of the investor himself.

This approach is a flexible, time and cost effective solution from the perspective of the company receiving the financing. Given it is a regulated instrument, payment terms, duration, frequency and amount of coupons are defined in advance and are beneficial to investors

“It’s a WIN-WIN Solution:

the company receives the financing necessary to develop its business, investors get fixed returns, collateralized by the target company’s assets.”

What are the Goals

- Ability to securitize a loan guaranteed by assets of the target company.

- Accept debt capital from a multitude of qualified investors.

- Offer investors a return decorrelated to traditional bond yields, which are present in traditional financial markets.

- The CLN is a bankable instrument, so it can be purchased through any credit institution and held in the investor’s securities file.

- The financing transaction is subject to clear terms and to an official documentation called Term Sheet, delivered by the regulated entity issuing the financial instrument.

- Redemption options are allowed for investors before the maturity of the financing transaction defined with the target company.

- The total repayment of the invested capital will be made when the product reaches maturity.

Risks of the Deal

- The received coupons represent a premium for the risk undertaken by investors that varies depending on the condition of the financed/target company and the market in which it operates.

- The risk of CLNs is equal to the risk of default of the financed/target company.

- As an alternative financial product, the characteristics of the transaction are agreed between the parties involved and set out in a specific contractual documentation, the Term Sheet. Since this is an alternative investment, it is necessary to make one’s own personal assessment (defined as an assessment) of the transaction and the conditions set.

- NO issuer-related risks are present, as AMCs are segregated* financial products.

Focus on CLNs’ Segregation

- Every Credit Linked Note that is issued is segregated.

- Segregation is the process of separating the assets of the CLN from the assets of the issuer or product sponsor. The purpose of this segregation is to protect investors by ensuring that the assets held in the product are not mixed with the issuer’s assets and thus are not subject to the issuer’s financial risks or liabilities.

- In general, segregation is an important safeguard for investors in Credit Linked Notes and other investment products, as it ensures the rights of the product benefit the investors.

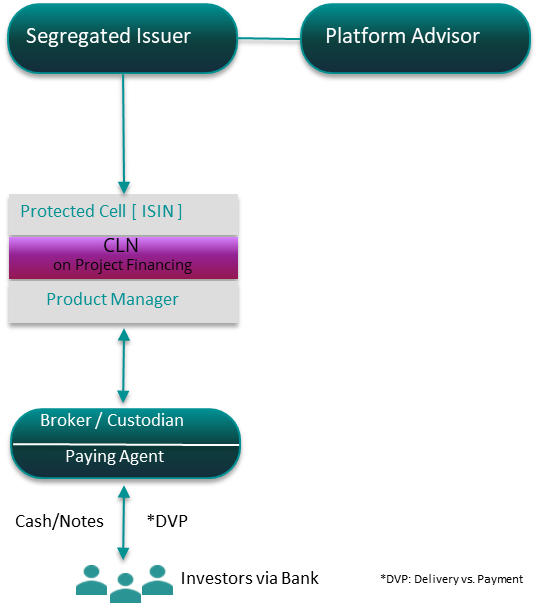

CLN Set-up and Core Figures

The Credit Linked Note as a regulated product provides for the following figures:

- The platform advisor manages and controls the participation on the underlying assets, as part of the investment committee.

- The securitization vehicle provider (segregated issuer) is the company in charge of the set-up of the securitisation vehicle from which the Tracker will be issued. The securitisation vehicle provider is a dedicated vehicle that meets the professional requirements under Guernsey or Luxembourg law, without issuer risk and fully segregated. The vehicle can issue CLNs, cross-asset / cross-custodians. The CLN is an independent cell, which is not only segregated from the issuer itself, but also from all other products of the same vehicle (if any).

- The reference assets (asset underlying), is the “company/project receiving financing”. It is represented by the company that receives the loan from qualified investors through investment in the CLN. The loan is used by “company/project receiving financing” for the development of its business in exchange for the payment of an annual pay-off typically linked to the company’s risk and market conditions. “company/project receiving financing” also represents the company that, at the maturity of the note, returns the borrowed money to the investors. Subsequently, “company/project receiving financing” can request the issuance of a new CLN.

Why invest in CLNs?