Together with…

Introduction

Microcredit is a crucial tool in the financial system, offering a pathway to prosperity for individuals often excluded from traditional banking. It offers those without access to conventional financial institutions assistance with small loans, enabling them to invest in their goals and stimulate their drive to succeed. It plays a vital role in economic inclusivity, enabling individuals to turn their ideas into thriving businesses.

Microcredit uplifts communities and promotes resiliency and determination by illuminating the relationship between small business financing and monetary exchange. Microcredit allows people to access financial resources and acquire tools to shape their futures, ultimately opening the door for a more inclusive and equitable global economy. Even the smallest loan has the power to catalyze tremendous change.

CLICK HERE TO GET MORE INFORMATION

How Microcredit Works?

Microcredit provides loans, which usually range from $10 and $2,000. Its foundation is based on the idea that entrepreneurial potential exists even in underdeveloped areas without access to traditional banking. Repayment starts right away and is sometimes done so without formal contracts, which promotes trustworthiness and permits additional borrowing. Interest rates may apply, and savings accounts may serve as collateral. This approach, exemplified by a Bangladeshi group borrowing $27 in 1976 to kickstart their businesses, illustrates how collective lending mitigates individual risk and fosters economic growth. Microcredit is a symbol of empowerment since it gives borrowers access to capital and helps them launch enterprises, which in turn helps impoverished communities grow economically and become more resilient.

Loan Process

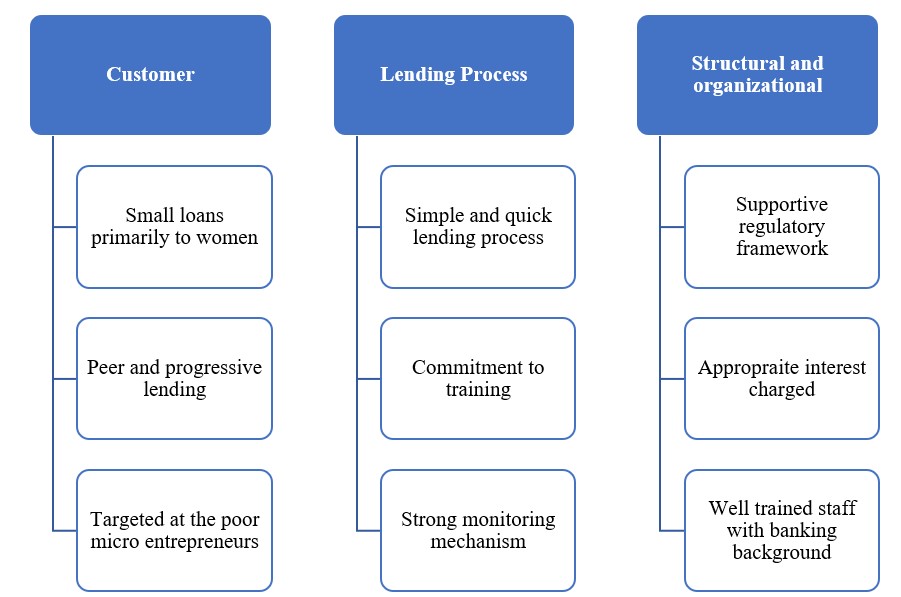

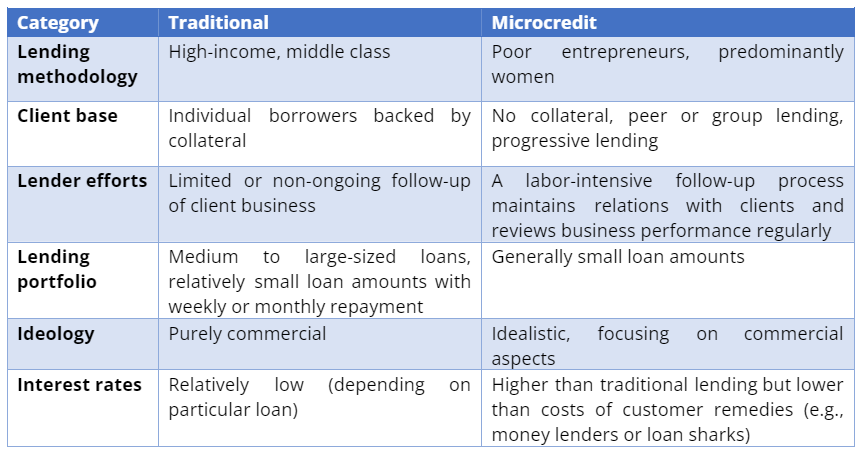

Microcredit loans typically have unique terms and conditions tailored to meet the needs of low-income borrowers. Here are some common loan terms associated with microcredit:

- Loan Amount: Microcredit loans often consist of a few hundred to a few thousand dollars, making them relatively small.

- Interest Rates: Compared to standard loans, microcredit loans may have higher interest rates. This can be attributed to the increased risk involved in making loans to those with low incomes and credit histories.

- Repayment Period: Microcredit loans usually have a shorter repayment period, ranging from a few months to a few years.

- Collateral: Microcredit loans are often issued without requiring collateral. This allows borrowers without valuable assets to access much-needed funds.

- Borrower Support: Microcredit institutions often provide additional support to borrowers, such as business training, mentorship, and assistance in creating a business plan.

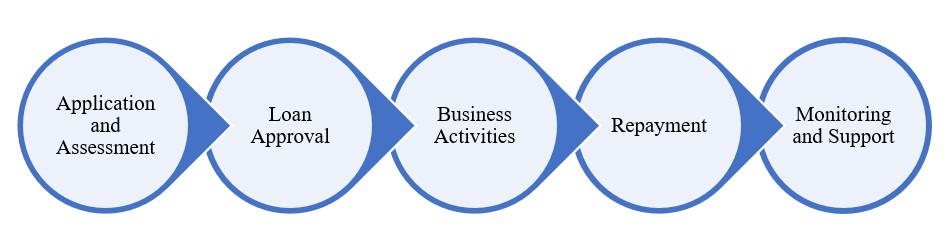

The microcredit loan issuance process involves several key stages aimed at empowering individuals to pursue entrepreneurial endeavors and improve their socioeconomic status.

- Application and Assessment: Microcredit applicants typically approach microfinance institutions (MFIs) seeking financial support for various endeavors, such as starting a small business or investing in education or skills training. The application process involves a thorough assessment of the borrower’s eligibility, focusing on factors like character, business potential, and community ties rather than traditional collateral requirements. MFIs often prioritize applicants who demonstrate a clear plan for utilizing the funds to generate income and contribute positively to their community.

- Loan Approval: Upon successful evaluation, borrowers are granted relatively small loan amounts tailored to their specific needs and financial capabilities. These loans, typically ranging from a few hundred to a few thousand dollars, are disbursed without the need for collateral, making them accessible to individuals who lack valuable assets. This approach fosters inclusivity and allows aspiring entrepreneurs from underserved communities to access vital financial resources.

- Business Activities: Recipients of microcredit loans utilize the funds to engage in income-generating activities, such as launching or expanding small businesses, purchasing equipment or inventory, or investing in vocational training or education. By empowering borrowers to pursue entrepreneurial ventures, microcredit initiatives stimulate economic growth at the grassroots level and contribute to poverty alleviation and job creation within communities.

- Repayment: Borrowers are required to repay the loan in fixed installments over a relatively short period, typically spanning from several months to a few years. Group lending models, where borrowers collectively guarantee each other’s loans, promote accountability and mutual support, reducing the risk of default and fostering a sense of community among participants.

- Monitoring and Support: Throughout the loan term, MFIs closely monitor borrowers’ progress and provide ongoing support and guidance as needed. By offering financial literacy training, mentorship, and access to additional resources, MFIs empower borrowers to effectively manage their businesses and financial obligations. Successful repayment not only enhances borrowers’ financial stability but also strengthens their creditworthiness, paving the way for future financial opportunities and socioeconomic advancement.

CLICK HERE TO GET MORE INFORMATION

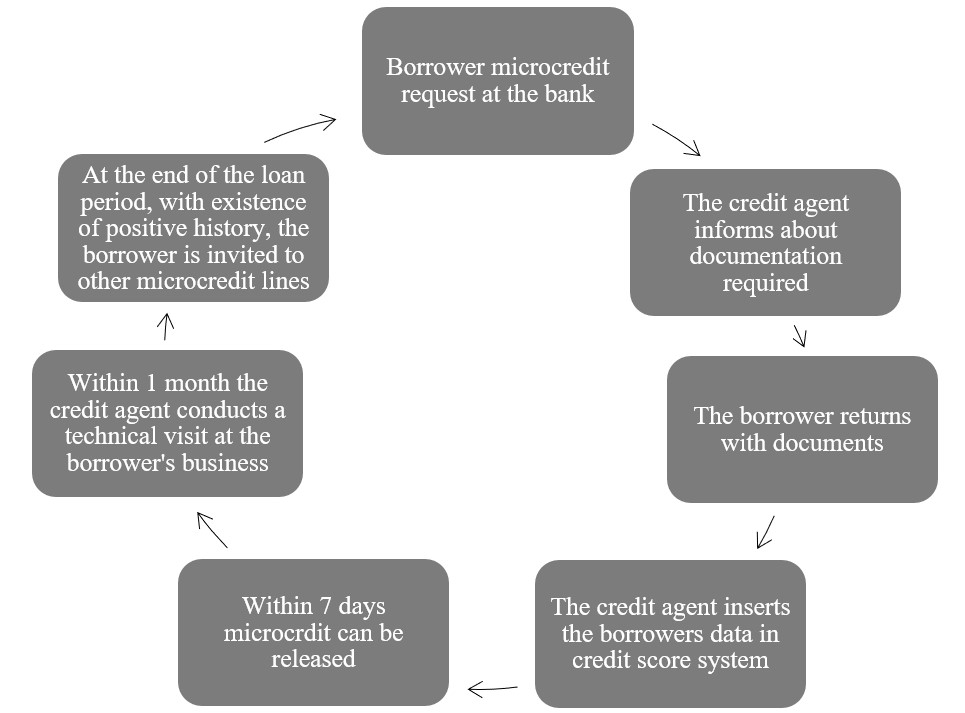

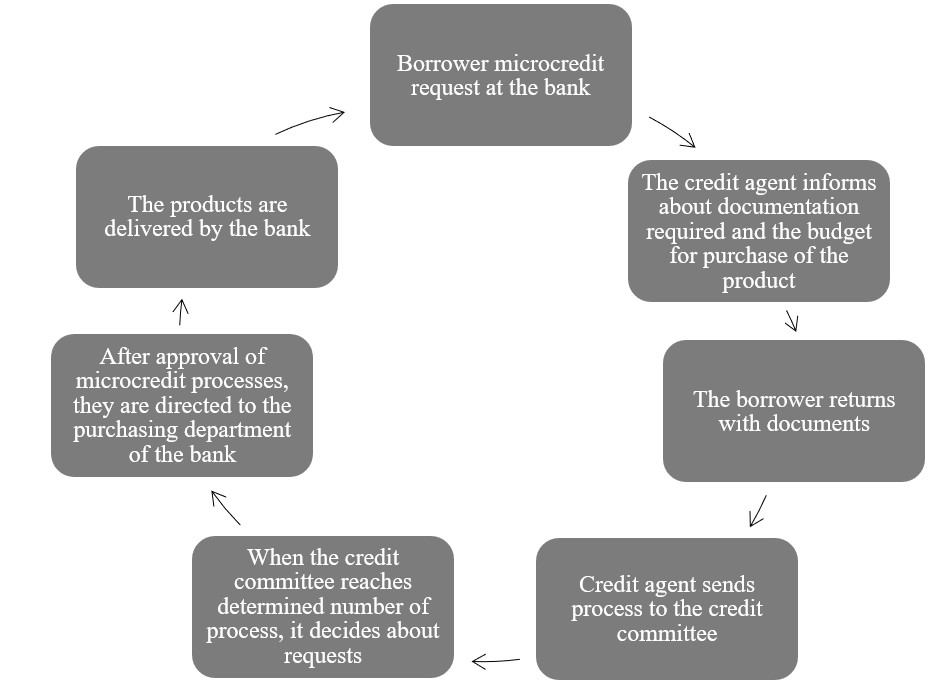

Microcredit Process Overview

- Representative organizations offer data on the availability of microcredit and the master model.

- The process is open, documented, and one-way.

- Analysis strictly follows parameters set by the Manual of Policies and Credit Rules.

- Additional documents may be requested during analysis.

- Borrower seeks businesses offering products or services that suit them.

- The borrower cannot have name restrictions.

- Agents notify the borrower of obstacles.

- The Credit Committee analyzes the process.

- The approved process requires original invoices and other documents.

Typical procedure for obtaining small loans from financial institutions, which is essential for individuals and small businesses seeking financial assistance from –

- Public Bank

- State Development Bank

Critiques of Microcredit

- Misuse and Mismanagement: In some instances, microcredit has been introduced in ways that led to funds being used for consumption rather than productive business ventures, particularly noted in South Africa’s poorest communities.

- Debt Burden: Borrowers may find themselves overwhelmed by debt, unable to repay even small-scale loans, often due to lack of steady income or unrealistic expectations about generating income from microcredit-funded ventures. This can lead to a cycle of borrowing to cover previous debts, exacerbating financial strain.

- High Interest Rates: Microcredit loans often come with high interest rates, sometimes exceeding 30%, which can contribute significantly to borrowers’ financial difficulties. Critics liken these rates to those of loan sharks, exploiting vulnerable individuals and exacerbating poverty.

- Negative Consequences: The pressure to repay loans, coupled with high interest rates, has been associated with negative outcomes, including high suicide rates among borrowers and severe debt levels, undermining the intended benefits of microcredit initiatives.

Conclusion

Microcredit serves as a beacon of hope for individuals marginalized by traditional banking systems, offering a pathway to economic empowerment and self-sufficiency.

The lending process follows particular steps that distinguish it from processes of other institutions. Most importantly, it maintains the support of small entities and poverty alleviation as its main objectives.

CLICK HERE TO GET MORE INFORMATION

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.