Together with…

Introduction

The shipping industry has long been an arena for remarkable investment stories, where strategic investors have leveraged market cycles, asset values, and capital allocation strategies to generate extraordinary financial gains. Over the past five years, insiders and institutional investors in the shipping sector have reaped massive returns by positioning themselves in key companies and asset classes. This research examines some of the most notable success stories in shipping investments and provides insights for potential investors considering investing in the sector.

The Rise of Strategic Shipping Investments

Shipping investments require a deep understanding of market cycles, asset valuations, and economic forces shaping global trade. The sector is known for its volatility, but that very volatility creates lucrative opportunities. Investors who can read the patterns—such as geopolitical trends, vessel supply-demand imbalances, and financial distress cycles—can secure high returns.

| Factor | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 (est.) |

|---|---|---|---|---|---|---|

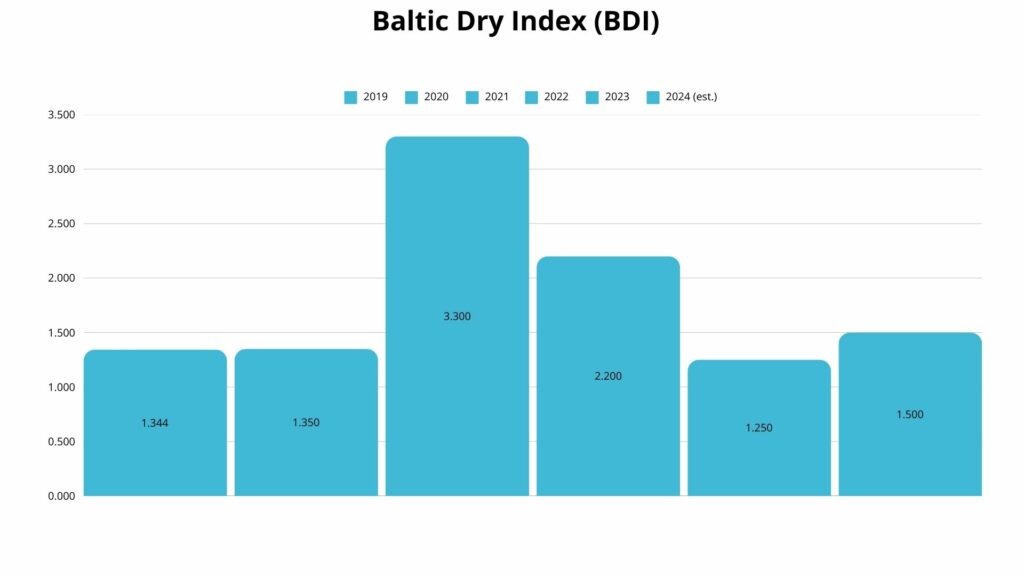

| Baltic Dry Index (BDI) | 1.344 | 1.350 | 3.300 | 2.200 | 1.250 | 1.500 |

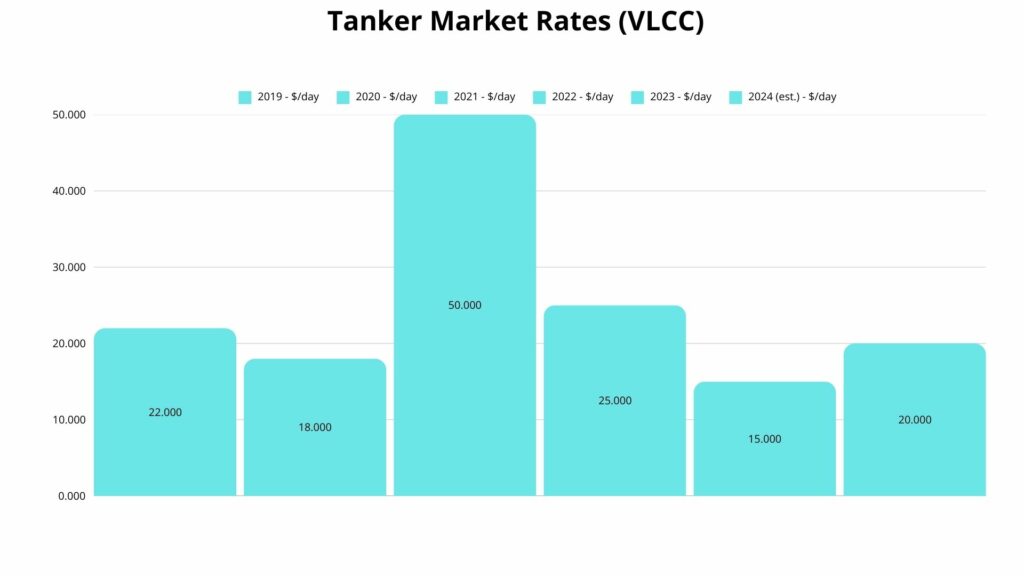

| Tanker Market Rates (VLCC) | $22K/day | $18K/day | $50K/day | $25K/day | $15K/day | $20K/day |

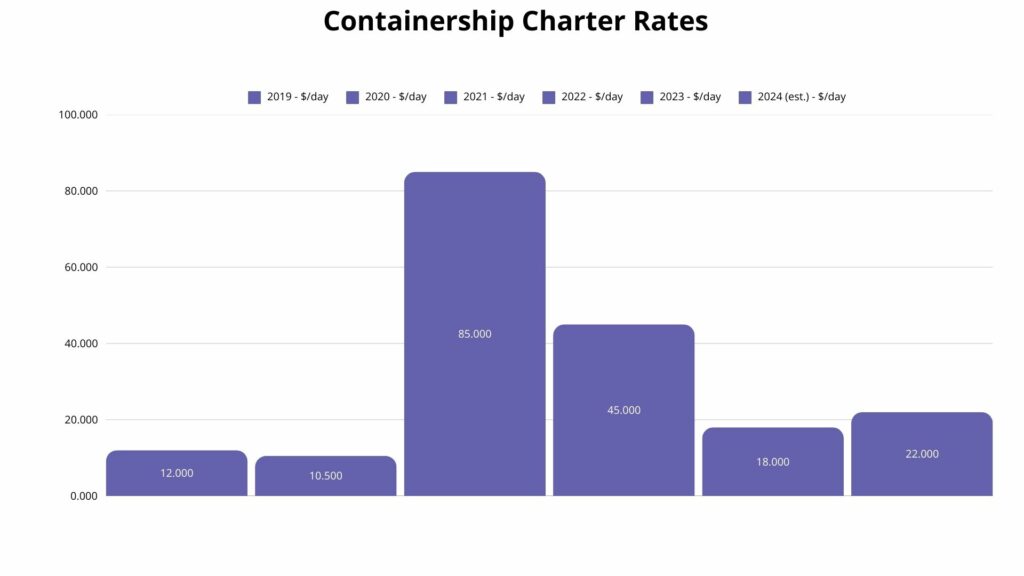

| Containership Charter Rates | $12K/day | $10.5K/day | $85K/day | $45K/day | $18K/day | $22K/day |

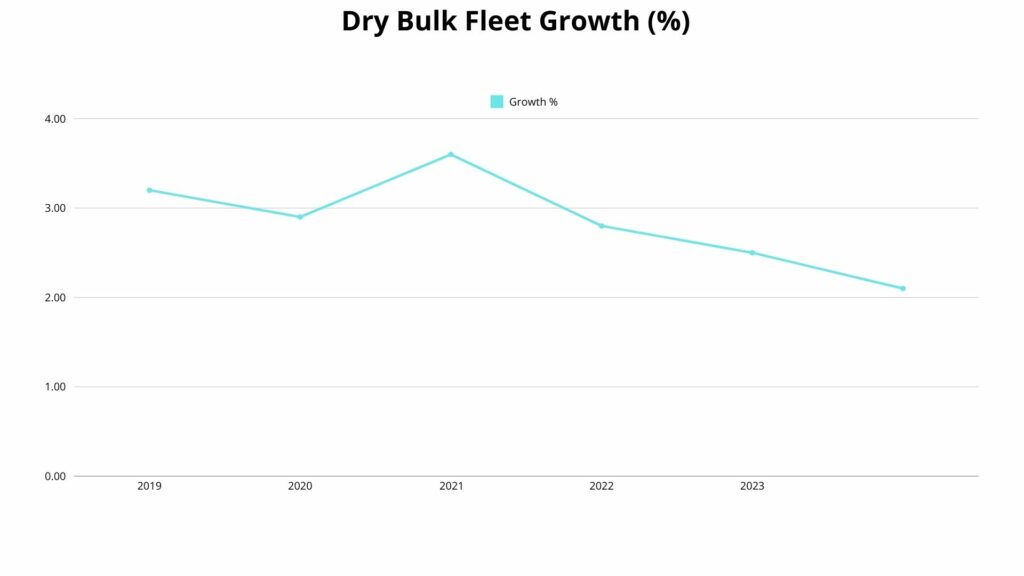

| Dry Bulk Fleet Growth (%) | +3.2% | +2.9% | +3.6% | +2.8% | +2.5% | +2.1% |

Note: The container shipping boom (2021-2022) was driven by supply chain disruptions, while dry bulk and tankers experienced mixed performance due to fluctuating demand.

Case Studies: High-Performing Shipping Investments

1. Oaktree’s Investment in Torm: A Fivefold Surge

Product Tanker Market Success

Oaktree Capital Management, a global alternative asset manager, made a strategic investment in Danish product tanker company Torm A/S. In 2019, Oaktree held 47.6 million shares of Torm, valued at approximately $372 million.

By 2024, its position had increased to 51 million shares, now worth $1.88 billion—a 5x increase in value.

What Drove This Growth?

- Surge in tanker rates due to geopolitical disruptions (e.g., Ukraine war).

- Increased demand for oil transport after COVID-19 downturn.

- Effective fleet modernization by Torm, increasing efficiency.

Lesson for Investors: Timing entry points during low-rate periods in the tanker market can yield massive gains when demand rebounds. Rates today are soft as a result of geopolitical uncertainty, and could take off again very soon as the geopolitical clouds recede. Is now a good time to consider entering the market?

2. John Fredriksen’s Frontline Holdings: A 3.5x Return

Crude Oil Tanker Giant’s Rebound

John Fredriksen, the legendary Norwegian shipping magnate, has built an empire by strategically entering and exiting shipping sectors.

In May 2019, Fredriksen owned 79.1 million shares of Frontline Ltd., a major crude tanker operator, valued at $602 million. By 2024, those same shares were worth $2.09 billion, marking a 3.5x return.

Key Success Factors

- Market Cycles: Tanker rates spiked in 2020 and 2022 due to oil supply chain disruptions.

- Asset Play: Frontline’s strategy of acquiring secondhand vessels at low prices paid off.

- Geopolitical Leverage: Sanctions on Russian oil shifted crude flows, boosting tanker demand.

Lesson for Investors: Tankers benefit from oil price shocks and geopolitical instability—patience in downturns pays off in upcycles.

We are once again in a geo-politically charged environment. Should investors be once again taking advantage?

3. Golden Ocean: Fredriksen’s 4.6x Bulk Carrier Bet

Dry Bulk Shipping Revival

Beyond crude tankers, Fredriksen also made a massive play in dry bulk. In 2019, he held 50.6 million shares in Golden Ocean Group Ltd., valued at $257 million. By 2024, he expanded his stake to 79.1 million shares, now worth $1.18 billion, a 4.6x increase.

Growth Catalysts:

Iron Ore & Coal Demand: China and India’s industrial growth kept bulk demand strong.

Fleet Renewal Strategy: Golden Ocean replaced aging vessels with fuel-efficient models.

Cyclical Rebound: Dry bulk benefited from post-pandemic trade recovery.

Lesson for Investors: Dry bulk shipping is highly cyclical—investing at fleet valuation lows can generate huge returns in an upswing.

Freight rate and asset valuations are once again at a soft point in the cycle. Could the time be right for an investment in the right shipping venture?

4. Danaos Corporation: A 14x Gain for the Coustas Family

The Containership Boom

Perhaps the most astonishing shipping investment story belongs to the Coustas family and their stake in Danaos Corporation, a leading containership lessor.

Performance Breakdown

| Metric | 2019 | 2024 | Increase |

|---|---|---|---|

| Shares Held | 4.9 million | 9.2 million | +88% |

| Charter Rates | $12,000/day | $85,000/day (2021) | 7x Increase |

| Market Value | $53 million | $765 million | +1,343% (14x) |

What Happened?

- Pandemic-driven Surge: E-commerce demand exploded, causing a container shipping crunch.

- Charter Rate Boom: Long-term contracts locked in record-high profits.

- Fleet Optimization: Danaos capitalized on high valuations by refinancing assets

Lesson for Investors: As with other shipping sectors, the containership market can deliver extreme windfalls during global trade shocks—owning assets during a cyclical upturn is key.

The prospect of US tariffs on trading partners has driven down asset values. Is now the time to take a position in shipping assets?

Key Investment Strategies in Shipping

| Strategy | Application | Example |

|---|---|---|

| Timing Market Cycles | Buying assets during downturns for long-term appreciation | Fredriksen’s Frontline investment |

Leverage & Capital | Using financing for fleet expansion at low costs | Danaos’ use of charter revenues |

| Diversification | Investing across tankers, bulk, and containers | Fredriksen’s multi-sector strategy |

| Strategic Asset Play | Acquiring modern, fuel-efficient ships for better earnings | Torm’s fleet renewal program |

Conclusion

The past five years have demonstrated the enormous potential for wealth creation in shipping investments. Whether through strategic equity stakes, market timing, or asset diversification, investors like Oaktree, John Fredriksen, and the Coustas family have turned maritime holdings into multi-billion-dollar fortunes.

For investors exploring opportunities to diversify into shipping, these case studies provide a roadmap for navigating and capitalizing the current investment environment, which, if we take on board the lessons of recent notable investment stories, are back at extremely favourable entry conditions.

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.