Together with…

The Microcredit Market

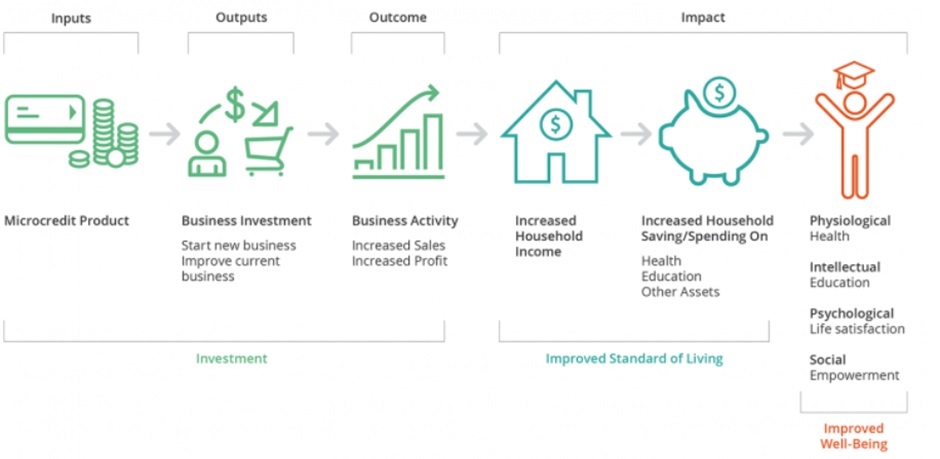

Microcredit has emerged as a powerful tool for poverty alleviation and economic empowerment. While the debate on its effectiveness continues, there’s compelling evidence of its positive impact on individuals, families, and communities worldwide.

Entrepreneurship and Investment:

- High-Potential Borrowers Thrive: Research shows that microcredit can be highly beneficial for a subset of borrowers with strong entrepreneurial potential. These individuals can leverage the loan to invest in high-return opportunities, leading to increased income and improved livelihoods.

- Product Innovation Matters: Tailoring microcredit products to specific needs is crucial. Flexible repayment options and targeting high-potential entrepreneurs show promise in maximizing the program’s effectiveness. Additionally, innovations like disbursing loans directly to business owners can significantly increase their control over the capital.

- Beyond the Borrower: The benefits of microcredit extend beyond direct borrowers. Studies suggest that access to credit in a community can stimulate the local economy, even for those who haven’t received loans themselves. This can create a ripple effect of growth and development.

Transformative Case Studies:

- Women’s Empowerment: Microcredit has been instrumental in empowering women, particularly in developing countries. MFIs in Bangladesh provide women with the financial resources to start businesses and gain financial independence. This economic empowerment translates to a stronger voice within their communities and improved social standing.

- Poverty Alleviation: By providing access to capital for those excluded from traditional financial systems, microcredit offers a powerful tool for poverty alleviation. In India, MFIs empower individuals living below the poverty line to pursue income-generating activities, allowing them to break the cycle of poverty and invest in a better future.

- Education and Healthcare: The impact of microcredit extends beyond just income generation. Microfinance institutions in Kenya provide loans to families struggling to afford education, ensuring children receive an education and a chance to break the cycle of poverty. Similarly, microloans can support the establishment of healthcare clinics in underserved areas, improving access to essential medical services.

- Climate Change Resilience: Microcredit is being used to build resilience against climate change. In Nepal, MFIs offer loans for installing solar panels in remote villages. This not only reduces reliance on fossil fuels but also empowers communities by providing them with reliable energy for income-generating activities.

- Entrepreneurship and Innovation: Microcredit fosters a spirit of entrepreneurship and innovation, particularly among young people. Organizations in Ghana support young entrepreneurs by providing microloans to start their own businesses. This not only creates employment opportunities but also contributes to the economic growth of the region.

Microcredit is not a silver bullet, but it is a powerful tool with the potential to transform lives. By focusing on responsible lending practices, targeting high-potential borrowers, and promoting financial literacy and business skills development, microcredit programs can continue to empower individuals, strengthen communities, and contribute to a more inclusive and prosperous world. The ongoing research and innovation in microcredit products and delivery mechanisms hold immense promise for maximizing its positive impact in the years to come.

Understanding the Financial Returns of Microcredit Investments

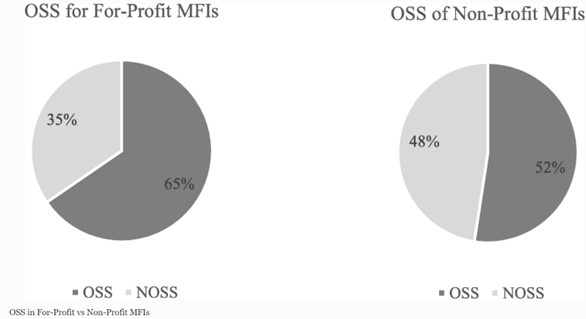

In microfinance, ensuring the financial health of institutions that serve low-income communities is critical. The Operational Self-Sufficiency (OSS) is a key metric to assess this: it is an indicator of the financial performance of an MFI and measures its ability to cover its costs through operating income. The formula is:

OSS = (Financial Revenue) / (Financial Expense + Net impairment + Operating expenses)

where financial expense is the expense on funding liabilities and net impairment is the loss on gross loan portfolio. This ratio assesses a Microfinance Institution’s (MFI’s) ability to cover its operational costs using its own income generation, essentially measuring its financial sustainability.

According to a study by Laxmi Remer & Hanna Kattilakoski, a relatively higher percentage, i.e. 65% of for-profit MFIs show operational self-sufficiency (OSS) whilst 52% of the non-profit MFIs show OSS. This is in line with the theory that non-profit MFIs, which are either credit unions/co-operatives or NGOs and are heavily subsidized, are more focused on other aspects of microfinance than OSS.

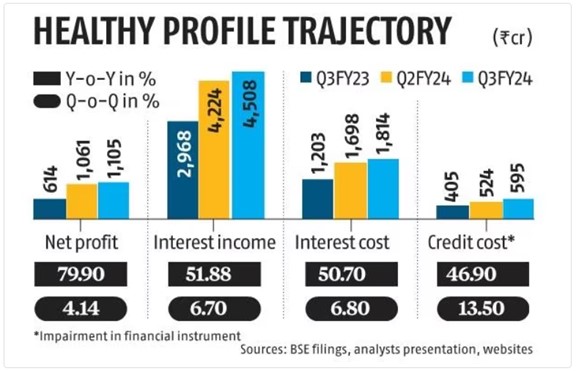

In India, the listed MFIs and MFI subsidiaries of the listed finance companies posted 80% year-over-year growth in net profit at Rs 1,105 crore ($132.6 mn) in the December quarter of the current financial year (FY24).

The financial returns of investing in microcredits can vary depending on several factors, including the specific microfinance institution, the geographic region, the types of financial products offered, and the overall economic environment. Here are some key points to consider regarding the financial returns of investing in microcredits.

- Interest Income: Microcredit investors typically earn returns in the form of interest income generated from the loans extended to micro-entrepreneurs and borrowers. The interest rates charged on microcredit loans are often higher than those of traditional banking products to compensate for the higher risk associated with lending to low-income individuals without collateral.

- Portfolio Yield: The portfolio yield, which represents the average interest rate earned on the entire loan portfolio, is a key metric used to assess the financial performance of microfinance institutions. Higher portfolio yields generally translate to higher returns for investors.

- Portfolio Quality: The quality of the loan portfolio, including factors such as loan repayment rates, delinquency rates, and loan loss provisions, directly impacts the financial returns of microcredit investments. Microfinance institutions with strong credit risk management practices and low levels of loan defaults tend to generate more consistent and sustainable returns for investors.

- Operational Efficiency: Efficient operations and low overhead costs contribute to higher profitability for microfinance institutions, ultimately benefiting investors. Microfinance institutions that can achieve economies of scale, streamline processes, and leverage technology to reduce costs are better positioned to deliver attractive financial returns.

- Diversification: Investing in a diversified portfolio of microcredits across different regions, sectors, and borrower profiles can help mitigate risk and enhance overall financial returns. Diversification allows investors to spread their risk exposure and capture opportunities in various microfinance markets.

- Social Impact: While financial returns are an important consideration, many investors in microcredits also prioritize social impact. Investing in microfinance offers the dual benefit of generating financial returns while contributing to poverty alleviation, women’s empowerment, and economic development.

Overall, investing in microcredits can offer attractive financial returns, particularly for investors seeking to achieve a balance between financial profitability and social impact. However, it’s essential for investors to conduct thorough due diligence, assess the risk-return profile of microcredit investments, and align their investment objectives with their financial and social goals.

CLICK HERE TO GET MORE INFORMATION

The Microfinance Industry: A Growing Force with Untapped Potential

Microfinance has emerged as a powerful tool for financial inclusion and poverty alleviation. Here are the latest trends in the microfinance industry from CGAP (CGAP is a global partnership of more than 30 leading development organizations that works to advance the lives of people living in poverty, especially women, through financial inclusion):

- International funders committed US$74 billion for financial inclusion in 2022. This represents an 8% increase since 2021, with both private and public funders showing steady growth following two years of fluctuations caused by the COVID-19 pandemic. When talking about international funders, we refer to organizations that provide financial resources for projects and initiatives happening outside their own borders. These organizations can be either public funders (including government agencies, development banks, and multilateral organizations like the World Bank or the United Nations) or private funders (meaning charitable foundations, corporations with philanthropic arms, and impact investors).

- Development finance institutions showed the strongest growth and continue to dominate the public funding landscape.

- While Sub-Saharan Africa continues to receive more funding than any other region, funding to Latin America and the Caribbean has grown substantially, by 49% over 2021.

- Funders are increasingly interested in supporting climate objectives through their financial inclusion programming, with 14% of financial inclusion projects tagged to a green/climate thematic objective.

- For the first time, more than a third of projects have been tagged to women’s financial inclusion.

The industry has witnessed significant growth and boasts impressive statistics that highlight its reach and impact.

- Widespread Reach: An estimated 500 million individuals worldwide have benefitted from microfinance services (data as of 2022). Over 10,000 microfinance institutions operate globally, serving more than 70 million borrowers and an equal number of savers. The total loan portfolio managed by these institutions is estimated at a staggering $40 billion.

- Transforming Lives: Since its inception in the early 2000s, the microfinance industry has demonstrably improved the lives of over 130 million people. By providing access to financial services like loans and savings accounts, individuals are empowered to start or grow businesses, invest in education and healthcare, and build a more secure future for themselves and their families.

- Untapped Potential: Despite its impressive reach, the microfinance industry is estimated to have only served around 20% of its potential market. With over 3 billion people worldwide classified as poor, and more than 200 million small businesses lacking access to proper financing, there’s immense potential for further growth and impact.

- Growth Trajectory: The microfinance industry has experienced remarkable growth in recent years. The annual growth rate has consistently hovered between 20%-30% since 2008. Loan disbursements have grown at a Compound Annual Growth Rate (CAGR) of 34%, while outstanding loans within the sector have seen a CAGR of 15%. This steady growth reflects the increasing demand for microfinance services and their effectiveness in empowering individuals and fostering economic development.

- Interest Rate Considerations: The average global interest rate for microcredit currently stands at 35%. While this may seem high, it’s important to understand the context. MFIs often rely on commercial sources to raise funds, which typically come with interest rates ranging from 8%-12%. While NGOs might transfer funds to MFIs as interest-free capital, the operational costs of running these institutions necessitate higher interest rates on microloans.

- Looking Ahead: The future of the microfinance industry appears bright. Allied Market Research predicts the global microfinance market to reach $496.9 billion by 2030, reflecting a healthy CAGR of 10.8%. However, challenges remain. An estimated 400 million people who qualify for microcredit lack access due to infrastructure limitations, particularly in remote areas. Additionally, there are potentially 2.4 billion people who could benefit from microfinance services but haven’t been reached yet.

Conclusion

Looking ahead, the potential for microcredit to continue empowering individuals and strengthening communities remains immense. By promoting innovative financial products, tailoring programs to specific needs, and leveraging technological advancements, the microcredit industry can continue to unlock economic opportunities and contribute to a more inclusive and prosperous future.

The ongoing commitment to responsible lending and borrower well-being will ensure that microcredit remains a powerful force for positive change.

CLICK HERE TO GET MORE INFORMATION

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.