Executive Summary

- Tracker Certificates are investment products designed to provide investors with exposure to an underlying thematic or sector index, consisting of a basket of securities or to track foreign funds and make it much accessible in many different jurisdictions.

- The product allows investors to diversify their portfolio through a single transaction while monitoring the value of their investment in real time.

- The purpose of Tracker Certificates is to provide investors with a linear replication of the performance of the underlying without any leverage effect.

- They are classified as capital-unprotected instruments, which means that they offer no downside protection.

Product Description

The technical characteristics of Tracker Certificates in brief:

- No intermediate premium: Tracker Certificates pay no intermediate premium – the return is derived solely from the increase in the price of the Certificate.

- No cap (limit): There is no limit to the positive returns that can be achieved by the Certificate.

- No leverage: The purpose of Tracker Certificates is to provide investors with a linear replication of the performance of the underlying index without any leverage effect.

- No barrier protection: Tracker Certificates are classified as capital-unprotected instruments, which means that they do not offer any barrier protection against downturns.

- Intellectual property rights: Tracker certificates are investment products that may have intellectual property rights associated with the underlying theme or sector index.

CLICK HERE TO GET MORE INFORMATION

Why investing in a Tracker of a CLO Fund

Collateral Loans Obligations (CLO securities) have continued to outperform other credit and real estate investments over the last 25 years.

A tracker of a CLO Fund is an efficient way to:

- Diversify away from traditional non secured corporate bond investments.

- Reduce credit concentration because of the selection of a highly diversified portfolio of each CLO security.

- Mitigate corporate credit risk through the active loan portfolio management in CLOs by established credit managers such as Blackstone, Apollo, Prudential, Neuberger, Carlyle, KKR, ARES, CSAM.

- Avoid interest rates risk of fixed rate investments; all CLOs are FRN instruments.

- Take advantage of market dislocation and volatility.

- Choose the range of return and risk: from investment grade rated securities to subordinated notes

Main features of a Collateral Loan Obligation

Higher return than most fixed income instruments with equivalent rating and risk profile; the expected return for CLO subordinates securities is around 10% which is also the annual target return for Avenida CLO VCC Fund that is diversified in subordinated and rated CLO securities.

Investments in Senior Secured Loans which are senior to bonds as they are collateralised by the company’s assets.

Highly diversified portfolio because the average exposure to each senior secured corporate loans is around 0.40% and the largest single asset is less than 1.5%.

- No Emerging markets exposure and no Currency risks.

- Higher credit protection than equivalent rated corporate bonds.

- Large and mature sector with many institutional players and same liquidity as the credit bonds market.

Avenida CLO Fund Team

- Experienced Team: the key professionals of the Avenida CLO Fund Team have each more than 20 years’ experience on the asset class and they work together as a CLO Fund management group since 2016.

- Team’s track record of +13% IRR in selecting CLOs subordinated notes dates back to 2001.

- CLO focus only: Avenida funds invest exclusively in CLOs products with no use of leverage.

- Outperformance: Avenida CLO Funds provide a professional access to invest in the asset class and have been outperforming their peers’ groups since inception of the funds in 2016 and 2018.

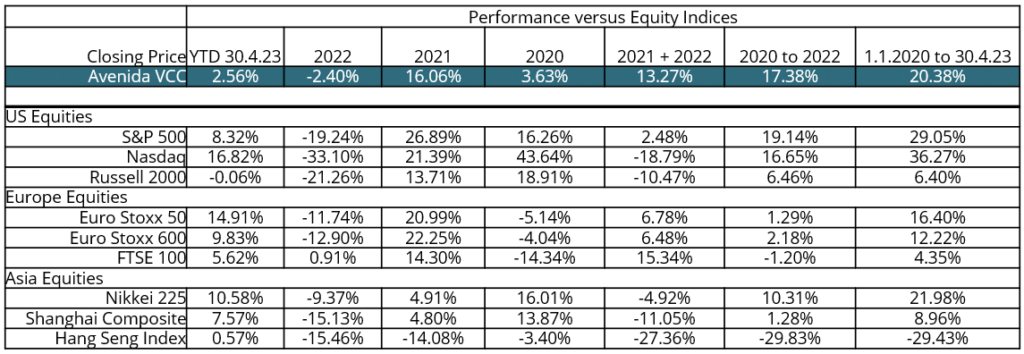

- Strong belief that CLOs debt and subordinated notes will continue to provide a better medium-long term performance than other credit indices and equity markets, respectively.

CLICK HERE TO MEET THE FUND MANAGER

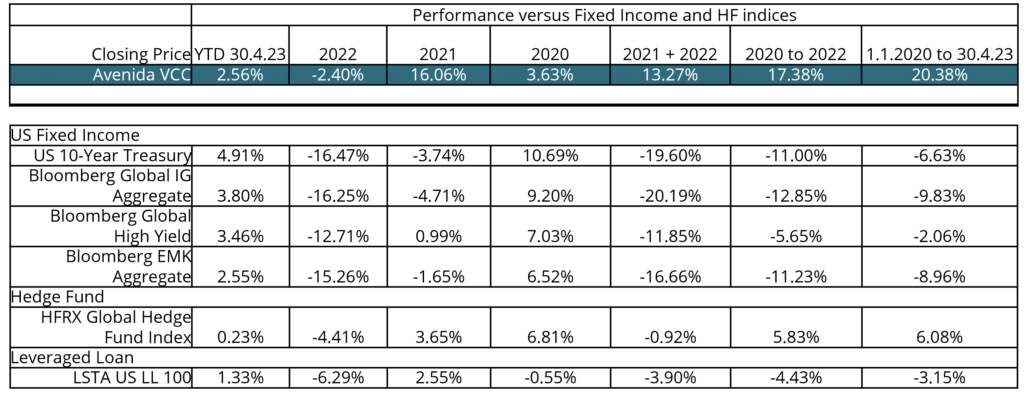

Avenida CLO VCC Track Record

Avenida VCC CLO Pandemic Years’ Performance

Product Advisor

The advisor manages and controls the participation on the underlying assets, as part of the investment committee.

Avenida CLO Tracker’s advisor is Virgil Alternative Investments UK Ltd.

Securitisation Vehicle Provider

The securitisation vehicle provider is the company in charge of the set-up of the securitisation vehicle from which the Tracker will be issued.

The securitisation vehicle provider is a dedicated vehicle that meets the professional requirements under Switzerland law, without issuer risk and fully segregated.

The vehicle can issue Trackers, cross-asset / cross-custodians.

The Tracker is an independent cell, which is not only segregated from the issuer itself, but also from all other products of the same vehicle (if any).

Importance of Product Segregation

- Every Tracker Certificate that is issued is segregated. Segregation is the process of separating the assets of an investment product from the assets of the issuer or product sponsor. The purpose of this segregation is to protect investors by ensuring that the assets held in the product are not mixed with the issuer’s assets and are therefore not subject to the issuer’s financial risks or liabilities of the latter.

- In the context of a Tracker Certificate, segregation typically consists of holding the underlying assets of the certificate in a separate and distinct account or trust from the assets of the issuer. This segregation helps to ensure that the assets of the certificate are managed and invested exclusively for the benefit of the certificate’s investors.

- In general, segregation is an important safeguard for investors in Tracker Certificate and other products, as it helps protect their investments from the risks and financial liabilities of the issuer or product sponsor.

CLICK HERE TO GET MORE INFORMATION

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.