Executive Summary

- Tracker Certificates are investment products designed to provide investors with exposure to an underlying thematic or sector index, consisting of a basket of securities or to track foreign funds or shares of public/private company and make it much accessible and bankable in many different jurisdictions.

- The product allows investors to diversify their portfolio through a single transaction while monitoring the value of their investment in real time.

- The purpose of Tracker Certificates is to provide investors with a linear replication of the performance of the underlying without any leverage effect.

- They are classified as capital-unprotected instruments, which means that they offer no downside protection.

Product Description

The technical characteristics of Tracker Certificates in brief:

- No intermediate premium: Tracker Certificates pay no intermediate premium – the return is derived solely from the increase in the price of the Certificate.

- No cap (limit): There is no limit to the positive returns that can be achieved by the Certificate.

- No leverage: The purpose of Tracker Certificates is to provide investors with a linear replication of the performance of the underlying index without any leverage effect.

- No barrier protection: Tracker Certificates are classified as capital-unprotected instruments, which means that they do not offer any barrier protection against downturns.

- Intellectual property rights: Tracker certificates are investment products that may have intellectual property rights associated with the underlying theme or sector index.

Why invest using a Tracker Certificate

- Simplified investment procedure to reference assets

- The Tracker is compliance with current EU regulations

- Ability to invest in the Tracker from any bank

- Further review by the Investment Committee

- No cost to access the fund

- Faithful replica of the reference assets performances

- Segregation of the Tracker in any situations

Focus on Trackers’ Segregation

- Every Tracker Certificate that is issued is segregated.

- Segregation is the process of separating the assets of the Tracker from the assets of the issuer or product sponsor. The purpose of this segregation is to protect investors by ensuring that the assets held in the product are not mixed with the issuer’s assets and thus are not subject to the issuer’s financial risks or liabilities.

- In general, segregation is an important safeguard for investors in Tracker certificates and other investment products, as it ensures the rights of the product benefit the investors.

Tracker Set-up and Core Figures

The Tracker Certificate as a regulated product provides for the following figures:

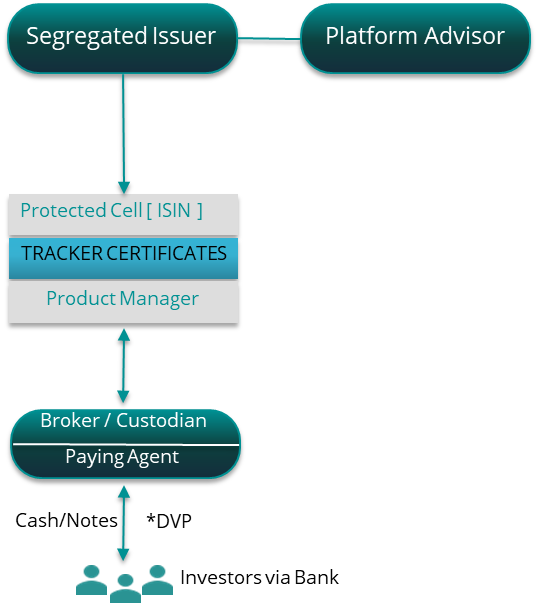

- The platform advisor manages and controls the participation on the underlying assets, as part of the investment committee.

- The securitization vehicle provider (segregated issuer) is the company in charge of the set-up of the securitisation vehicle from which the Tracker will be issued. The securitisation vehicle provider is a dedicated vehicle that meets the professional requirements under Guernsey or Luxembourg law, without issuer risk and fully segregated. The vehicle can issue Trackers, cross-asset / cross-custodians. The Tracker certificate is an independent cell, which is not only segregated from the issuer itself, but also from all other products of the same vehicle (if any).

- The reference assets (asset underlying), are “a Basket fo Securities, Funds or Public/Private Company Shares”. These represent the reference assets where qualified investors take exposure. It consisting of a basket of securities, funds or shares of public/private company accessible and bankable in many different jurisdictions. These assets are responsible for the performance of the Tracker Certificates as it exactly replicates the underlying.