Together with…

What are CLOs?

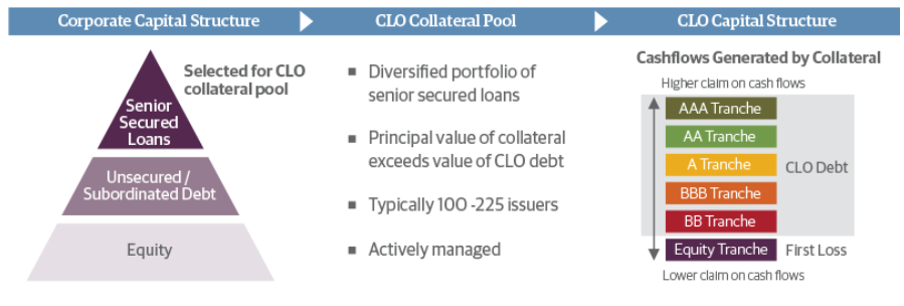

A Collateralized Loan Obligation (CLO) is a funding vehicle that buys leveraged loans as assets and issues rated debt tranches and an unrated subordinated tranche (the latter is also called equity or junior tranche). Therefore CLO tranches are bond securities backed by a pool of corporate loans with BB and B credit ratings; some of these loans are taken out by private equity firms to conduct leveraged buyouts. The process of pooling these assets into a marketable security is known as securitization. In a CLO, the investor receives the scheduled debt payments from the underlying loans. The risk of non-performing loans diminishes the Excess Spread paid to the subordinated tranche. The Excess Spread, often referred at the CLO Arbitrage, is the difference between the interests derived from the loans and the coupon payments of all the CLO debt tranches. CLOs tranches offer investors higher-than-average returns and diversification benefits, but their complexity is higher than traditional bonds.

A CLO is an actively managed instrument, equivalent to a fund, where the managers continuously buy and sell individual loans in the underlying collateral pool to score gains and minimize losses.

How CLOs Work

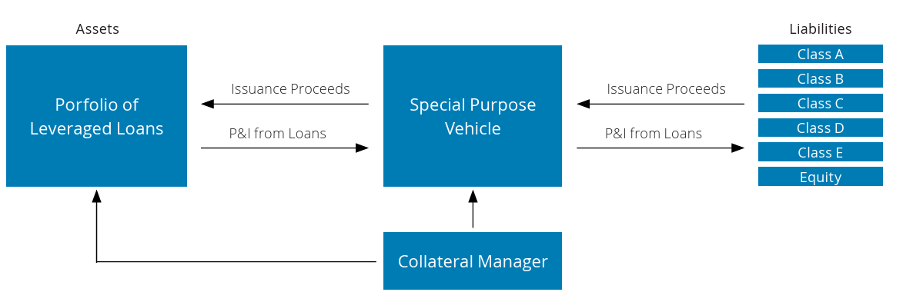

CLOs are a portfolio of leveraged loans that generate proceeds from interests and principal repayments. These loans are held in a Special Purpose Vehicle (SPV), which is managed by a collateral manager, the CLO Manager.

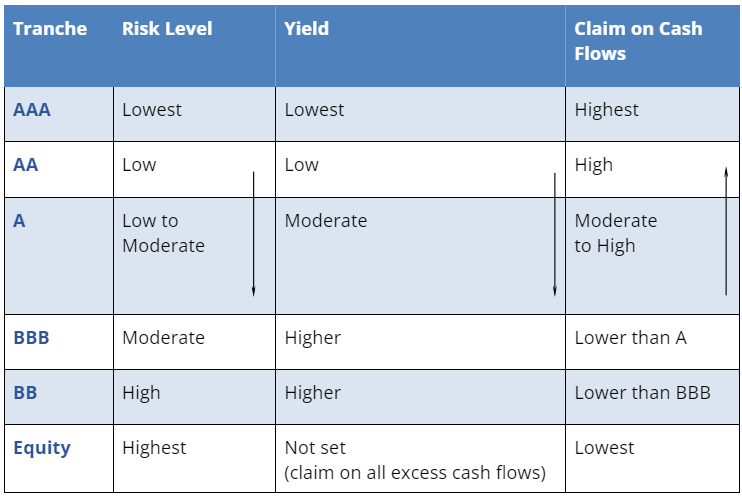

On the liabilities side, all proceeds from loans are distributed among different tranches purchased by CLO investors (typically Class A to E or F) with varying degrees of risk and return profiles. Class A represents the safest tranche with the lowest yields, while the subordinated tranche, absorbs the first losses but offers higher potential returns. This structured finance mechanism enables diversification of risk and caters to varied investors’ risk appetites.

CLOs gather funds through issuing debt and equity to build a varied portfolio primarily comprising senior secured bank loans. These debt securities are divided in tranches, each offering distinct risk and return profiles based on their priority in claiming the cash flows generated by the underlying pool of loans. The process involves bundling senior secured bank loans from various borrowers into the CLO, which is then actively managed by a designated CLO manager. Economically, CLO subordinated-note investors own the pool of loans managed within the CLO, while CLO debt investors provide the financial backing for this pool.

CLICK HERE TO GET MORE INFORMATION

CLO Life Cycle

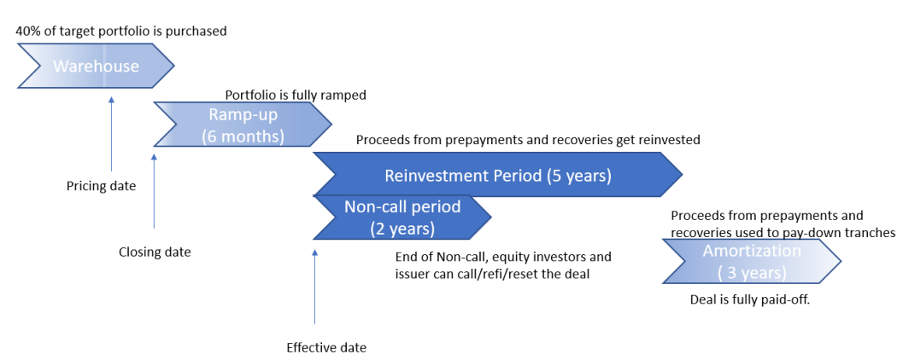

CLOs have many stages in their life cycles with the unique feature of a reinvestment period, followed by amortization. These stages are discussed below:

Stage 1: Warehousing Period

The warehousing phase commences upon the CLO manager’s acquisition of loans designated as the underlying collateral for the transaction. To finance these acquisitions, the CLO manager uses a credit line provided by the CLO arranger, typically a major investment bank. The structuring bank may reduce its capital requirement for this financing exposure by buying protection through a Warehouse arrangement, typically with the investors that will buy the subordinated-notes when the CLO is issued. These investors de facto fund the loans portfolio during the rump-up period before the CLO is brought to the market. The warehousing phase generally spans from 3 to 12 months as it necessitates time for the CLO manager to ensure the inclusion of a diverse array of assets in the CLO, aligning with its requirements and investment strategy.

Stage 2: Ramp-Up Period

A CLO may not always finalize with a full complement of loans, resulting in the total loan value at closing (the date when the tranches are paid by the CLO investors) potentially falling short of the targeted par value envisioned for the transaction. This ramp-up phase can extend for a few months following the closing date. Upon reaching the targeted loan portfolio value, the transaction is considered “fully ramped,” and at that juncture, it “goes effective.”

Stage 3: Reinvestment Period

After the transaction becomes effective, it enters the reinvestment period—which typically lasts up to five years after closing date. During the reinvestment period, the CLO manager actively buys and sells the assets to rebalance the portfolio according to the CLO investment strategy and reinvests any principal proceeds from the underlying collateral to purchase additional assets. Among other things, the CLO manager works to maintain credit quality, par value, and portfolio diversity, and must also adhere to the various credit quality and concentration limits outlined in the transaction documents.

Stage 4: Amortization Period

The amortization period runs from the End of the Reinvestment Period (EoRP) until the transaction matures. During this period, the CLO manager uses principal and interest received from the underlying collateral to pay interest accruals and pay down the outstanding balances of the notes in accordance with the waterfall priorities. This period typically ends before the legal maturity date of the CLO notes since the underlying CLO assets tend to have a shorter lifespan. To the extent there are any funds remaining after paying down the balances of the notes, the equity holders receive the remaining proceeds.

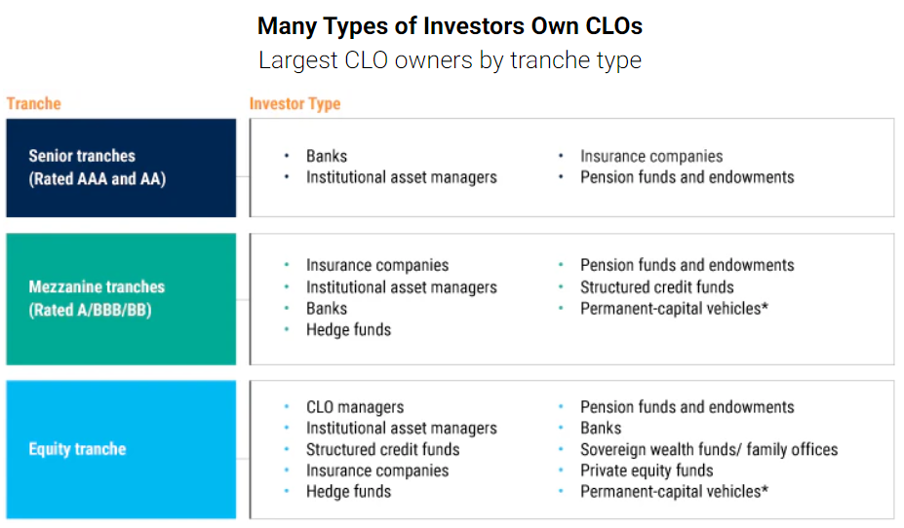

Investor Types in CLOs

Due to the inherent structure of CLOs, they appeal to and are owned by a diverse group of investors. Banks and institutional asset managers predominantly hold senior tranches rated AAA and AA. Mezzanine tranches, rated A/BBB/BB, attract insurance companies, institutional asset managers, banks (smaller portion than senior tranches), and hedge funds. Subordinated / equity tranches are the most diversified, with CLO managers, institutional asset managers, structured credit funds, insurance companies, and hedge funds involved.

Also Sovereign wealth funds/family offices and private equity funds are notably invested in subordinated tranches. There is an obvious overlap across categories as there are different risk characteristics each organization is looking for, be it banks, insurance companies, or pension funds.

CLICK HERE TO GET MORE INFORMATION

Advantages and Disadvantages

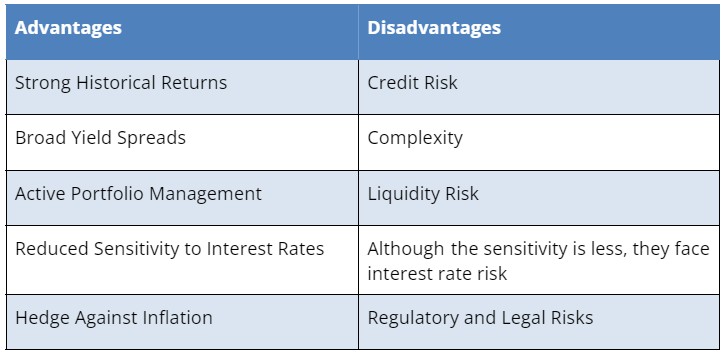

Pros:

- Strong Historical Returns: Over time, CLOs have consistently shown strong returns when compared to other fixed-income strategies. In comparison to corporate debt categories, such as bank loans, high-yield bonds, and investment-grade bonds, especially at lower rating tiers CLOs have performed exceedingly well.

- Broad Yield Spreads: The yield spreads of CLOs are generally wider than those of other debt instruments. This can be attributed to lower liquidity, higher complexity, and regulatory requirements. When compared to investment-grade corporates and other high-yield debt sectors like high-yield and bank loans, CLO spreads are particularly attractive.

- Active Portfolio Management: CLOs are actively managed by the appointed CLO manager. The active trading of the loans in a CLO portfolio reduces the risk of non performing loans and can also create profits contributing to the express spread for the subordinated tranche.

- Reduced Sensitivity to Interest Rates: Leveraged loans and their CLO tranches are floating-rate instruments, priced at a spread above a benchmark rate: SOFR or EURIBOR). As interest rates fluctuate, CLOs’ coupons adjust accordingly. At times of interest rates movements, the prices of CLOs tranches are less volatile than those of fixed-rate instruments, which can be beneficial for investors with fixed-income assets.

- Hedge Against Inflation: As CLOs pay a floating-rate interest, they can be a better hedge against inflation.

- CLOs’ benefit from credit market volatility: CLO Managers can take advantage of loan market volatility without being a forced seller, because the debt notes do not have a fixed maturity and even their legal maturity can be extended under certain circumstances.

Cons:

- Credit Risk: If a borrower in CLO defaults and fails to make its debt payments, the investors at the bottom of the tranche are the first to incur losses. However, this risk is mitigated through performance tests, credit enhancement, and active portfolio management.

- Complexity: CLOs are complex investments. Understanding their structure and the nature of the underlying loans requires a deep knowledge of credit markets and risk assessment. This complexity can deter some investors.

- Liquidity Risk: Due to their complexity and the specific nature of the underlying loans, CLOs are perceived to be less liquid than some debt instruments. During periods of market stress, they had a reduced liquidity like other High Yield and Investment Grade corporate bonds.

- Regulatory and Legal Risks: Changes in regulations or legal frameworks governing CLOs could affect their structuring, performance, and attractiveness to investors.

Conclusion

This research note demystifies the world of Collateralized Loan Obligations, exploring their underlying mechanics, the nuances of distinct tranches, and the crucial role of active portfolio management. We have seen how a pool of leveraged loans is securitized and segmented into risk-graded tranches, catering to a range of investor appetites. CLOs are a major financing source in the leveraged loan market: in the US and Europe around 60% to 70% of Broadley Syndicated Loans are held in CLO structures. By investing in CLOs, investors get access to a diversified non-investment grade corporate credit portfolio. While CLOs are not part of major fixed-income indexes, the market has grown to be a key and unique securitized product asset class with strong historical performance and much improved market liquidity. In particular, CLO floating rate notes appear to be very well positioned for a rising rate environment. CLOs have proved to be resilient through economic downturns due to the fundamental strength of collateralized leveraged loans, robust structural protection with credit enhancement and performance tests, and active management by CLO managers to mitigate portfolio risk.

While the intricacies of CLOs demand meticulous due diligence, their potential cannot be ignored. The combination of a diversified, securitized structure and active management expertise makes them a compelling investment avenue for sophisticated investors seeking high-yield returns within a managed risk framework. As the market continues to evolve, understanding the nuances of CLOs and the value proposition of active management will remain an essential skill for navigating the complex world of credit investing.

CLICK HERE TO GET MORE INFORMATION

Disclaimer

Index:

Data Room AccessData room access is available only for accredited and institutional investors due to FCA permissions.

To gain access, click and fill out the following form. Our compliance team will grant you access within 24 hours.