Introduction

The exacerbation of the Israel Palestine conflict can have disastrous effects on the global economy. As noted by Ajay Banga, president of the World Bank, “it’s a humanitarian tragedy and it’s an economic shock we don’t need”. Hamas attacks and Israel’s fierce counterattacks not only represent a worrying escalation in the ongoing conflict, but also raise significant concerns for the stability of the global economy. These events have the potential to disrupt key economic factors and aggravate the existing economic challenges created by the war in Ukraine.

The concurrent occurrence of multiple geopolitical crises, each with its economic consequences, places added stress on international financial markets, trade relationships, and supply chains. Global leaders and organizations, including the World Bank, are closely monitoring these situations, as mitigating these economic shocks and addressing humanitarian crises becomes paramount for the stability and resilience of the global economy.

Global Energy markets, the threat of high inflation

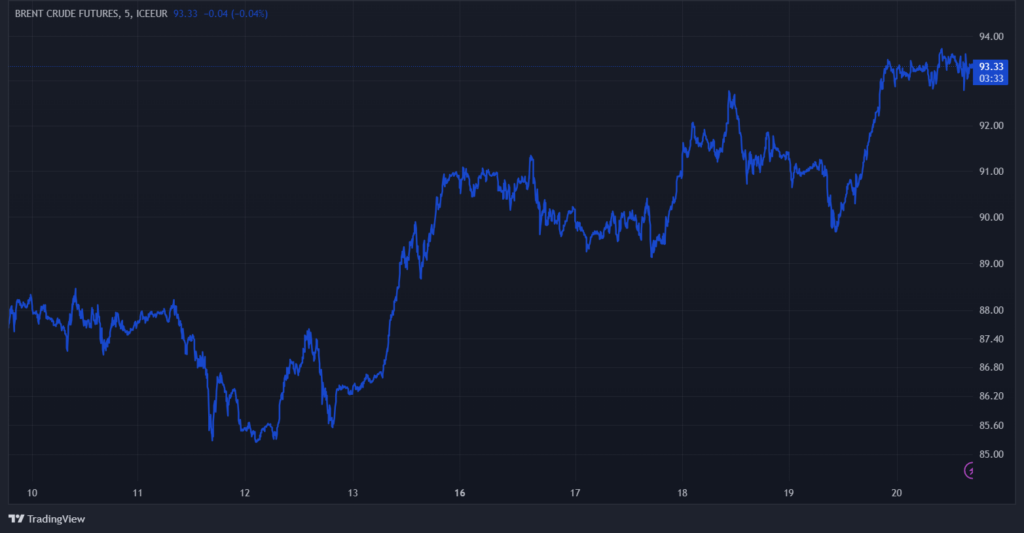

The flare-up of the conflict is having a significant impact on the global energy markets, which is exemplified by the rise of crude oil price index (and futures on crude oil). The Middle East is a major hub for oil production, and any escalation in conflict in the region raises concerns about potential disruptions to the supply of oil and gas. This leads to uncertainty in the energy markets, prompting traders and investors to anticipate potential supply disruptions, which can result in higher oil prices.

Moreover, the fact that Iran is warning that the war could expand, contributes to creating more economic and political insecurity. Iran is a significant player in the Middle East and shares a complex relationship with both Israel and the United States. Such warnings can increase apprehension in the global community and heighten concerns about potential regional instability, which in turn can affect energy markets and geopolitical dynamics.

Furthermore, as previously noted, the fact that western economies are still fully adapting to the challenges posed by other geopolitical scenarios, notably the War in Ukraine, adds an added layer of complexity in their ability to effectively respond to and navigate the economic repercussions of the escalating conflict in Israel and Palestine. Higher oil prices could lead to higher inflation which, in turn, would lead to higher interest rates and increased cost of borrowing for businesses and consumers, potentially leading to reduced spending and investment.

As noted by Bloomberg, the economic impact is difficult to predict and largely depends on how the conflict evolves and if it spills over to other countries in the Middle East, such as Lebanon, Syria and Iran. Were the war to expand to these countries, it could lead to a global recession.

Safe Haven assets

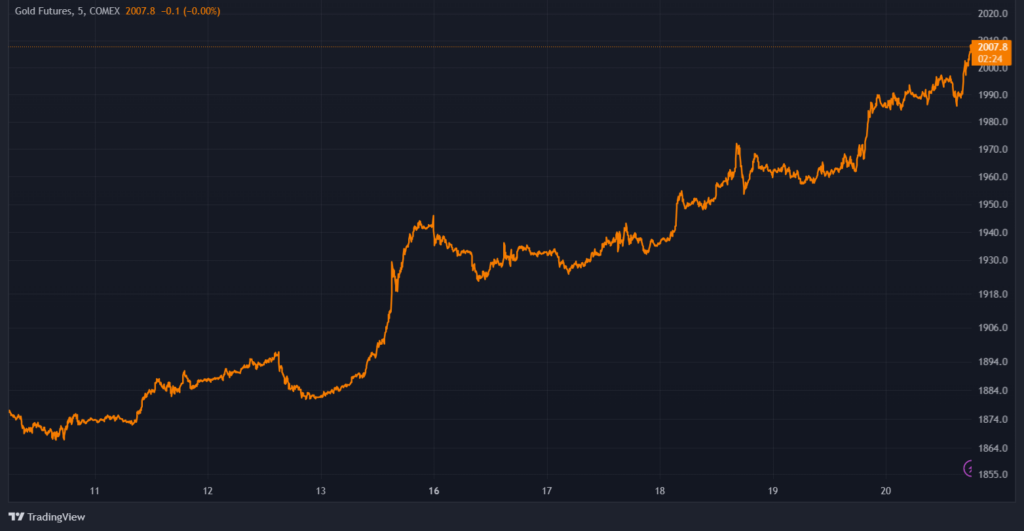

The financial turmoil caused by Hamas’ terrorist attack, has led to an increase in safe haven investments. During times of economic uncertainty, when fear drives investment choices and market sentiment, investors often seek refuge in “safe haven” assets, which are considered more stable and less prone to significant price fluctuations. These assets are perceived as a store of value and are typically favored for their ability to provide a degree of protection during turbulent financial periods. The rise in gold futures prices, as shown in the graph below, exemplifies this trend: investors often turn to gold as a store of value and a hedge against inflation and currency devaluation; gold prices can rise if the perception of risk in the financial markets increases.

Similarly, as noted by CNN Business, “Utilities, energy and real estate stocks have also outperformed the broader S&P 500 index’s roughly 1% gain this week. Those sectors are considered defensive since consumers tend to prioritize spending on necessities like electricity and shelter over discretionary purchases during periods of economic hardship”.

In the specific context of the Israel-Palestine conflict, the defensive nature of these sectors can provide a level of comfort to investors who are concerned about the economic repercussions of the conflict spreading to other parts of the Middle East or impacting global markets. Whether this shift in investment choices will be justified largely depends on future developments in the geopolitical landscape of the Middle East.

What is certain is that, as of now, investors are not excluding the idea that this conflict could escalate quickly, expand to other countries, and have a global negative economic impact.

World Bank and IMF’s outlook

The eruption of fighting between Israel and Hamas, has led the International Monetary Fund and the World Bank to revise their forecasts about global economic indicators for current and next year. The conflict has cast a shadow that complicates the job of policymakers that are now faced with a new crisis that worsens the already complicated global economic landscape. Indeed, if, so far, the impact of the exacerbation of the conflict on the global economy is more limited than that of the Ukraine war, World Bank’s president Banga noticed how a further escalation could lead to a crisis of unimaginable proportions.

This pessimism has been translated into numbers by the IMF that reduced its expectations on global economic growth to 3.0% (from 3.5%) and that revised its forecast on global expected inflation, which is set to remain at troubling levels for the whole 2024.

As global leaders and organizations work to navigate this intricate economic terrain, they emphasize the importance of diplomatic efforts to address the conflict’s root causes and achieve a sustainable and peaceful resolution. The evolving situation in the Middle East has become a significant factor in the trajectory of the world economy, making international cooperation and risk management critical components of the path forward.

Conclusion

In conclusion, the ongoing Israel-Palestine conflict has far-reaching economic implications that reverberate across the global landscape. As we’ve explored, the exacerbation of this conflict raises economic concerns that are compounded by the concurrent occurrence of multiple geopolitical crises, adding stress to international financial markets and supply chains. As global leaders and organizations, including the IMF and the World Bank, work to navigate this challenging economic and humanitarian scenario, they emphasize the importance of diplomatic efforts and international cooperation to achieve a sustainable and peaceful resolution and to avoid catastrophic global economic consequences.

Join ThePlatform to have full access to all analysis and content: https://www.theplatform.finance/registration/

Disclaimer: https://www.theplatform.finance/website-disclaimer/